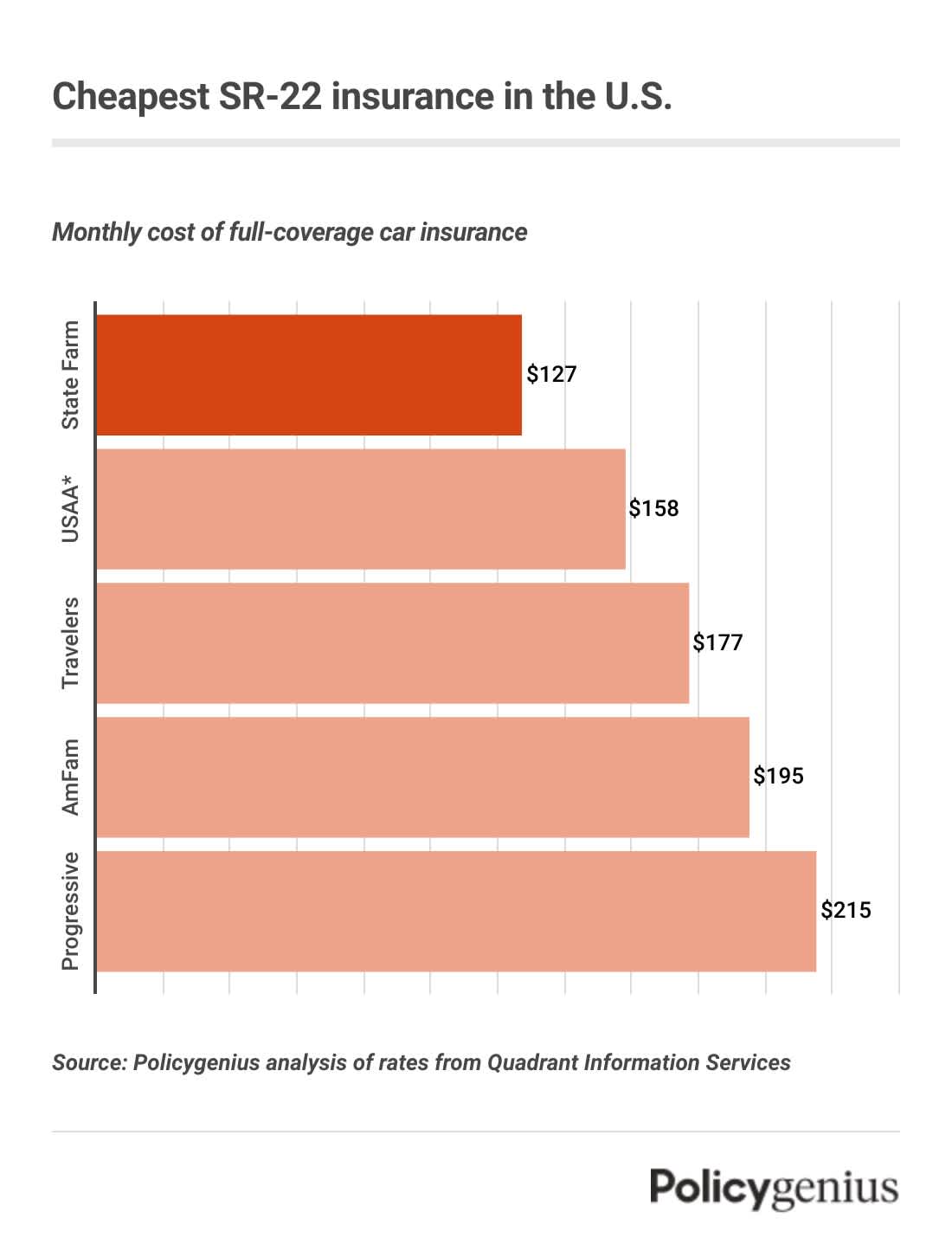

Who has the cheapest SR-22 insurance?

According to our analysis, State Farm has the cheapest car insurance for drivers who need an SR-22. On average, State Farm is $127 per month or $1,519 a year, for car insurance with an SR-22. That’s 51% cheaper than the national average for SR-22 insurance.

USAA, Travelers, American Family, Progressive may also offer cheap car insurance for drivers who need an SR-22.

State Farm has the cheapest SR-22 car insurance for drivers with citations on their records for driving with a suspended license, a DUI, or reckless driving.

Since your car insurance rates depend on where you live and other personal details, you should still compare quotes from a few companies to be sure you find the best rates for you, regardless of your driving record.

Company | Driving with a suspended license | DUI | Reckless driving |

|---|---|---|---|

$1,485 | $1,588 | $1,485 | |

USAA* | $1,972 | $2,110 | $1,616 |

$2,144 | $2,122 | $2,108 | |

$2,439 | $2,149 | $2,439 | |

$2,723 | $2,318 | $2,701 | |

$2,224 | $3,047 | $2,645 | |

$3,278 | $2,873 | $3,288 | |

$3,230 | $3,306 | $3,196 | |

$3,320 | $3,416 | $3,251 | |

$3,826 | $3,907 | $3,907 |

Average yearly cost of SR-22 insurance

Cheapest SR-22 insurance by state

We found that State Farm has the cheapest SR-22 insurance in 32 states. American National, GEICO, Progressive, USAA, and Wawanesa also have cheap rates in a handful of states.

Since car insurance with an SR-22 can be 50% more expensive (or more) than the cheapest options for drivers with a clean record, it’s all the more important to shop around and get multiple quotes before choosing a policy.

State | Cheapest SR-22 insurance | Average monthly cost of SR-22 insurance | Difference from average |

|---|---|---|---|

State Farm | $116 | -54% | |

Wawanesa | $136 | -67% | |

American National | $114 | -56% | |

State Farm | $107 | -67% | |

State Farm | $146 | -57% | |

State Farm | $123 | -51% | |

State Farm | $52 | -67% | |

State Farm | $87 | -59% | |

State Farm | $84 | -53% | |

State Farm | $64 | -61% | |

Progressive | $162 | -58% | |

State Farm | $100 | -54% | |

State Farm | $67 | -59% | |

American National | $93 | -64% | |

State Farm | $78 | -64% | |

Redpoint | $113 | -52% | |

State Farm | $75 | -59% |

Average monthly cost of SR-22 insurance

What is SR-22 insurance?

SR-22 insurance isn’t actually a type of car insurance. An SR-22 is a form that your insurance company files for you to prove to the state that you have an active car insurance policy.

The rules are different in each state, but an SR-22 may be a requirement for you if:

Your have a suspended license

You were caught driving without car insurance

You let your car insurance lapse

You forged car insurance documents

You have a DUI, DWI, or OWI

You got too many points on your license

You got into an accident without insurance

You committed a felony while driving

Needing an SR-22 means that you’re considered a high-risk driver — basically, car insurance companies see you as more likely to file a claim. That’s why insurance with an SR-22 is more expensive than coverage for drivers with a clean record.

Non-owner SR-22 insurance

Non-owners car insurance is basic coverage for people who don’t own their own car. If your license is suspended and you need an SR-22 to show proof of insurance but you don’t own a car, getting non-owners insurance may be the cheapest way to meet your state’s requirements.

Since non-owner insurance only comes with limited liability coverage and no comprehensive or collision coverage, it’s cheaper than a regular car insurance policy. But fewer companies offer non-owner insurance (especially if you need an SR-22), so you may have to call a few companies or work with a broker to find coverage.

→ Read more about non-owner SR-22 insurance

Out-of-state SR-22 insurance

If your license is suspended or you commit a driving violation in a state you don’t live in, you may still have to get an SR-22.

You may have to find an insurance company in your state that will file your SR-22 with the state where you received the citation. This means finding a company that works in both your home state and the place where your license was suspended or where you committed the violation.

Sometimes you can apply for an SR-22 waiver instead. For example, Tennessee lets out-of-state residents apply for a waiver through their home state’s DMV or equivalent agency. [1] If your waiver is accepted, you don’t have to get a Tennessee SR-22 while living in another state.

SR-22 insurance vs. other forms

These forms are also related to proof of insurance, but they aren’t the same as an SR-22:

FR-44: Drivers in Florida and Virginia who commit drinking and driving violations have to carry FR-44 insurance instead of an SR-22.

SR-22A: In Georgia, an SR-22A shows that you’re insured after you’re caught without car insurance more than once.

SR-26: Your insurance company files an SR-26 with your state when you no longer have an SR-22. This is how your state knows if you canceled your policy or let it lapse while you were still supposed to have an SR-22.

SR-37: In Connecticut, an SR-37 is a form that you file to show you’re insured after the state asks for proof. An SR-37 also includes a $200 fine.

How long do you need SR-22 insurance?

In most states, you need to have SR-22 insurance for three years, but it can depend. In Tennessee, for example, you typically have to carry an SR-22 for up to five years after your suspension or driving violation.

During the SR-22 period, it’s essential to keep paying your premiums to avoid a lapse in car insurance coverage. If your SR-22 insurance lapses, your license will be suspended all over again and you’d need to keep your SR-22 on file for even longer.

States where you don’t need SR-22 insurance

There are 12 states that don’t require SR-22 forms (although you may still faces fines or license suspension):

Delaware

Kentucky

Maryland

Minnesota

New Jersey

New Mexico

New York

North Carolina

Oklahoma

Pennsylvania

Rhode Island

West Virginia

In other states, things can get a little more complicated. For example, in Connecticut you won’t need an SR-22, but you still have to file proof of insurance and pay a fine after a violation. [2]

You may also be able to send money to the state instead of showing proof of insurance through an SR-22. Illinois lets drivers deposit $70,000 with the State Treasurer in lieu of proof of insurance. [3]

How much is SR-22 insurance?

We found that car insurance for drivers who need an SR-22 costs an average of $256 per month, or $3,078 a year. But there are other costs to keep in mind if you need an SR-22.

In most states, your insurance company files your SR-22 for you. You should expect your insurance company to charge you a filing fee of about $25 on top of your higher premiums.

And, while this isn’t directly related to your insurance rates, you should expect to pay other fines before your license is reinstated. These fines depend on where you live, your violation, and your driving history.

If you let your coverage lapse, you may even have to pay the fines a second time.

Which insurance companies offer SR-22 insurance?

Not all insurance companies will file an SR-22 for you, but many will. A few of the large companies where you can get SR-22 insurance are:

State Farm

GEICO

Progressive

USAA

American Family

Travelers

Nationwide

Liberty Mutual

You can also get high-risk coverage from smaller providers like Auto-Owners, AAA affiliates, Mercury, and Kemper. If you’re not sure where to start, speak with an independent broker like the ones at Policygenius.

Non-standard insurance companies

Non-standard insurance companies offer coverage to high-risk drivers. If you’re having trouble finding SR-22 insurance, it may be easier to get coverage from a non-standard company.

Popular non-standard car insurance companies include National General (now affiliated with Allstate), Freeway Insurance, Oxford, The General, and United Automobile Insurance Company.

How to get SR-22 insurance

You’ll find out that you need an SR-22 through the mail or, if you have to get an SR-22 because of a court ruling, a judge will tell you. Once you know that you need to get SR-22 insurance, follow these steps: