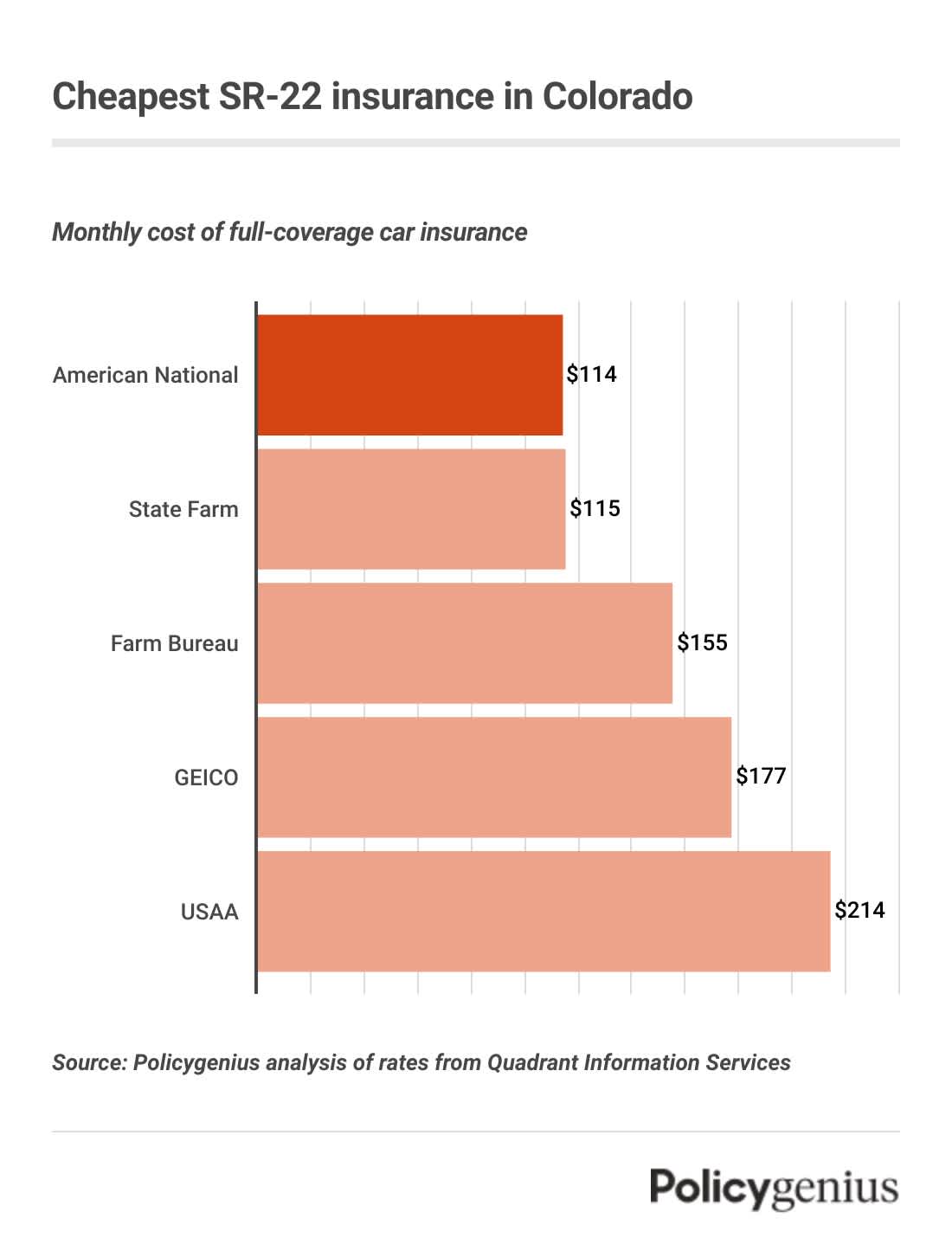

Cheapest SR-22 insurance in Colorado

American National has the cheapest SR-22 insurance in Colorado, with an average monthly rate of $114. That’s $1,374 per year, or 56% cheaper than the statewide average of $3,092 a year.

You can also get cheap SR-22 insurance in Colorado from State Farm and Colorado Farm Bureau. Insurance costs can vary a lot depending on the company, so it’s a good idea to compare rates before getting covered.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

American National | $114 | $1,374 |

State Farm | $115 | $1,384 |

Colorado Farm Bureau | $155 | $1,854 |

GEICO | $177 | $2,127 |

USAA | $214 | $2,572 |

Progressive | $229 | $2,746 |

Allstate | $232 | $2,787 |

American Family | $236 | $2,833 |

What is SR-22 insurance in Colorado?

SR-22 insurance isn’t actually a type of coverage. Instead, an SR-22 is a form that your insurance company files for you proving you have insurance. You’re typically required to have an SR-22 after your license is suspended or after a serious driving violation, like a DUI. [1]

In Colorado, your SR-22 must show that you have at least:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $15,000

Drivers in Colorado typically need SR-22 insurance for three years, but the length depends on your violation. If you don’t keep your coverage for the whole time, your license may be suspended again (and you may face more fines).

How to get SR-22 insurance in Colorado

Getting SR-22 insurance in Colorado isn’t impossible, but it could take some time. To get SR-22 coverage, you should:

Find a company that offers SR-22 insurance: Not every company in Colorado offers SR-22 insurance to high-risk drivers, and your current car insurance company may not be able to add an SR-22 to your policy. This means it could take longer for some people to find coverage.

Wait for your SR-22 to process: It shouldn’t take very long for your SR-22 to process, but don’t wait too long to to get coverage and miss a deadline.

Pay your license reinstatement fees: Once you have proof of insurance, send a check or money order of $95 to Colorado’s DMV, plus extra fees depending on why you had to get an SR-22, so you can receive a Letter of Clearance and start driving.

Colorado suggests that drivers give at least 36 days for their SR-22 and license reinstatement to process, and asks that you not contact the state’s DMV about your license’s status until after at least 20 business days have passed.

Non-owner SR-22 insurance in Colorado

If you’re licensed but don’t own a car, you may still need an SR-22 after a license suspension or a serious violation. But without a car of your own, you may need to look into something called non-owner SR-22 insurance.

Non-owner insurance provides drivers who don’t own their own cars enough insurance to meet the state requirements, but doesn’t come with comprehensive or collision coverage. Just like with regular car insurance, you can have your non-owner car insurance company file an SR-22 on your behalf.

Since it’s a special type of policy with limited coverage, non-owner SR-22 insurance is cheaper than a regular policy. But because it’s a little more specialized, you may have a harder time finding coverage.