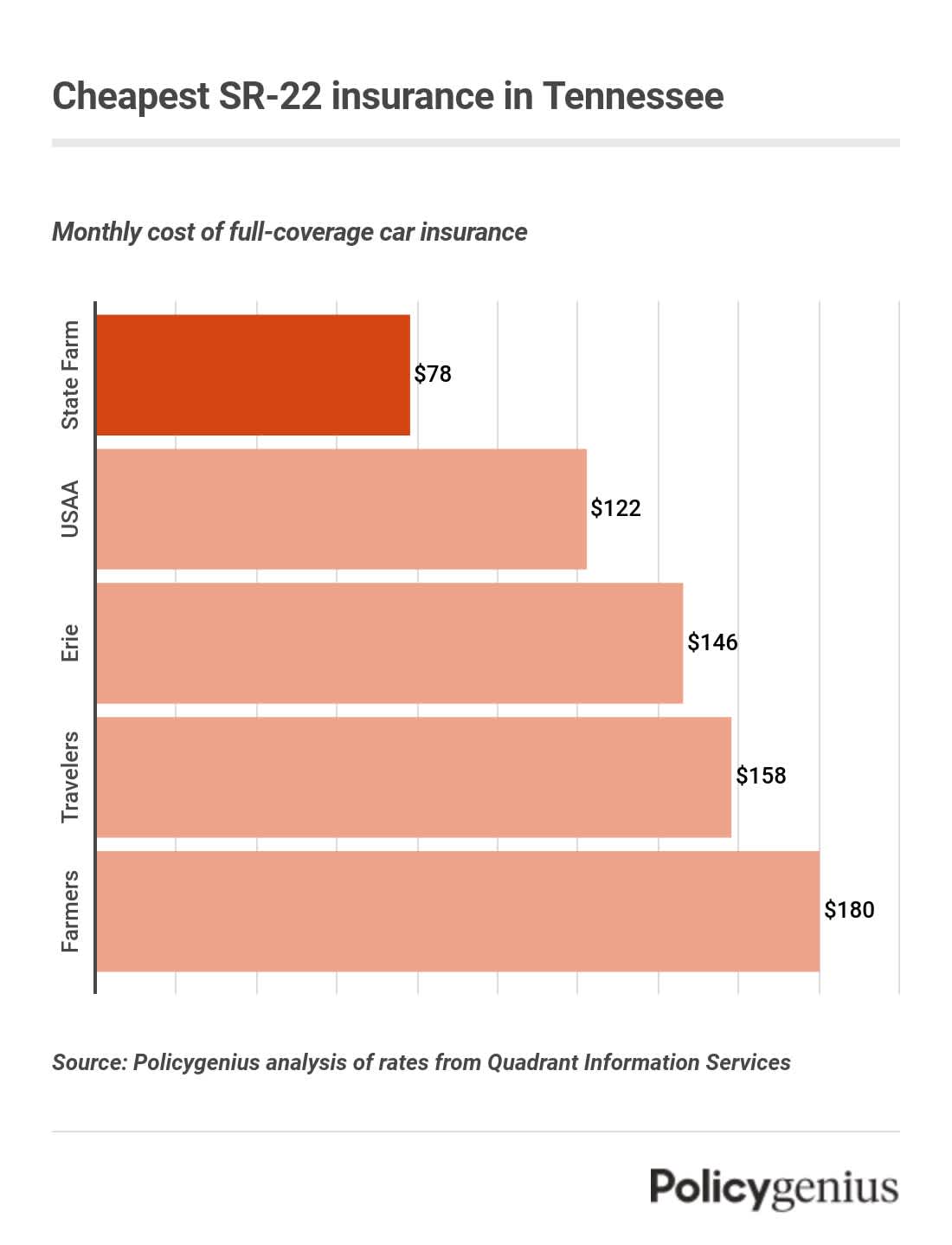

Cheapest SR-22 insurance in Tennessee

We found that State Farm has the cheapest SR-22 insurance in Tennessee. On average, coverage from State Farm costs $78 per month or $936 a year. That’s $1,637 cheaper per year than the statewide average in Tennessee.

You can find cheap SR-22 insurance from other companies, too, including USAA, Erie, and others. Since the cost of car insurance depends so much on the driver, it’s a good idea to compare quotes from different companies before you buy.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

State Farm | $78 | $936 |

USAA | $122 | $1,469 |

Erie | $146 | $1,750 |

Travelers | $158 | $1,902 |

Farmers | $180 | $2,160 |

GEICO | $197 | $2,363 |

Auto-Owners | $199 | $2,384 |

Progressive | $200 | $2,399 |

Grange Mutual | $204 | $2,451 |

An SR-22 is not actually a type of insurance. Instead, it’s a form that your insurance company files for you to show that you’re insured. Tennessee requires drivers have at least:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $15,000 per accident

In Tennessee, you’ll have to get an SR-22 after a suspended license or a serious driving violation, like driving under the influence or getting too many points on your license.

You must have an SR-22 for three to five years in Tennessee. You can avoid getting an SR-22 if you wait five years before reinstating your suspended license. You wouldn’t be able to legally drive during that time, though.

How to get SR-22 insurance in Tennessee

You can follow these steps to get an SR-22 in Tennessee:

Find a company that offers coverage: Not all companies will file an SR-22 for high-risk drivers, so plan on spending more time looking for coverage.

Pay your fines: Besides getting SR-22 insurance, you may have to pay a fine, take a driving or alcohol abuse class, or appear for a hearing before you’re able to drive again.

Don’t let your SR-22 lapse — or be sure to renew it quickly: In Tennessee, you must have an SR-22 for three to five years. If your policy lapses before that time, you can renew it within 20 days and avoid a second suspension.

Non-owner SR-22 insurance in Tennessee

If you have a license but don’t own a car, you’ll still have to get SR-22 insurance after a driving violation or when your license is suspended. In this case, the best way to get your license back is a non-owners SR-22 instead of a standard policy.

Non-owners insurance is a type of policy that comes with basic liability insurance. You can’t add comprehensive or collision coverage to non-owners policy, so it’s usually cheaper than a standard policy.

As with a regular policy, when you get non-owners coverage your insurance company files the SR-22 for you. At the same time, non-owners insurance isn’t offered as commonly as a regular policy, so plan to spend more time searching for coverage.