The cheapest car insurance company in Tennessee is USAA, at an average of $68 a month or $820 a year. But USAA is only available to drivers affiliated with the military, so State Farm, Auto-Owners, GEICO, and Travelers are the cheapest car insurance companies in Tennessee for most drivers.

Average cost per month | ||

|---|---|---|

USAA | $68 | |

State Farm | $71 | |

Auto-Owners | $81 | |

GEICO | $90 | |

Travelers | $100 |

Cheapest car insurance companies in Tennessee

Best car insurance companies in Tennessee

The best car insurance company in Tennessee is USAA, which scored the highest on the 2023 J.D. Power Auto Insurance Study. [1] This study measures how drivers in the region feel about their insurance company’s service, billing, claims service, and price.

If you’re not in the military or in a military family, Tennessee Farm Bureau is the best-rated car insurance company.

Company | Score | |

|---|---|---|

1 | USAA | 876 |

2 | Tennessee Farm Bureau | 866 |

3 | Erie | 859 |

4 | Kentucky Farm Bureau | 857 |

5 | Alfa | 851 |

Cheapest car insurance companies by age in Tennessee

Car insurance for teens is typically much more expensive than insurance for adults, sometimes by several thousand dollars each year. This is because young drivers are statistically more likely to be in an accident or file a claim than older drivers.

Most teens see their insurance costs go down as they get into their early twenties, but that is only if they have a clean driving record.

The table below shows the companies with the lowest rates by age in Tennessee:

Age | Cheapest company | Average cost |

|---|---|---|

18 | GEICO | $2,225 |

21 | USAA | $1,256 |

35 | USAA | $823 |

45 | USAA | $773 |

55 | USAA | $726 |

60 | USAA | $723 |

65 | USAA | $745 |

70 | USAA | $791 |

16 | State Farm | $2,997 |

25 | State Farm | $1,008 |

30 | State Farm | $863 |

Choosing the right car insurance company in Tennessee

Choosing the best car insurance company for you doesn’t have to be an overwhelming experience. There are several factors to consider, including:

Cost: The best way to keep insurance costs low is to get quotes from multiple companies to make sure you are getting the lowest possible rate.

Coverage: If you don’t have enough liability coverage you will still be held accountable for damage that goes beyond your coverage levels, so having the highest levels of liability coverage you can afford is an important consideration when choosing an insurance policy.

Customer service: The odds are good that you will only contact your insurance company if you are filing a claim. Given how stressful it can be to deal with the aftermath of an accident, choosing a company with stellar customer service can go a long way toward making a difficult situation better.

Policygenius can help you compare quotes and choose the right policy for your needs.

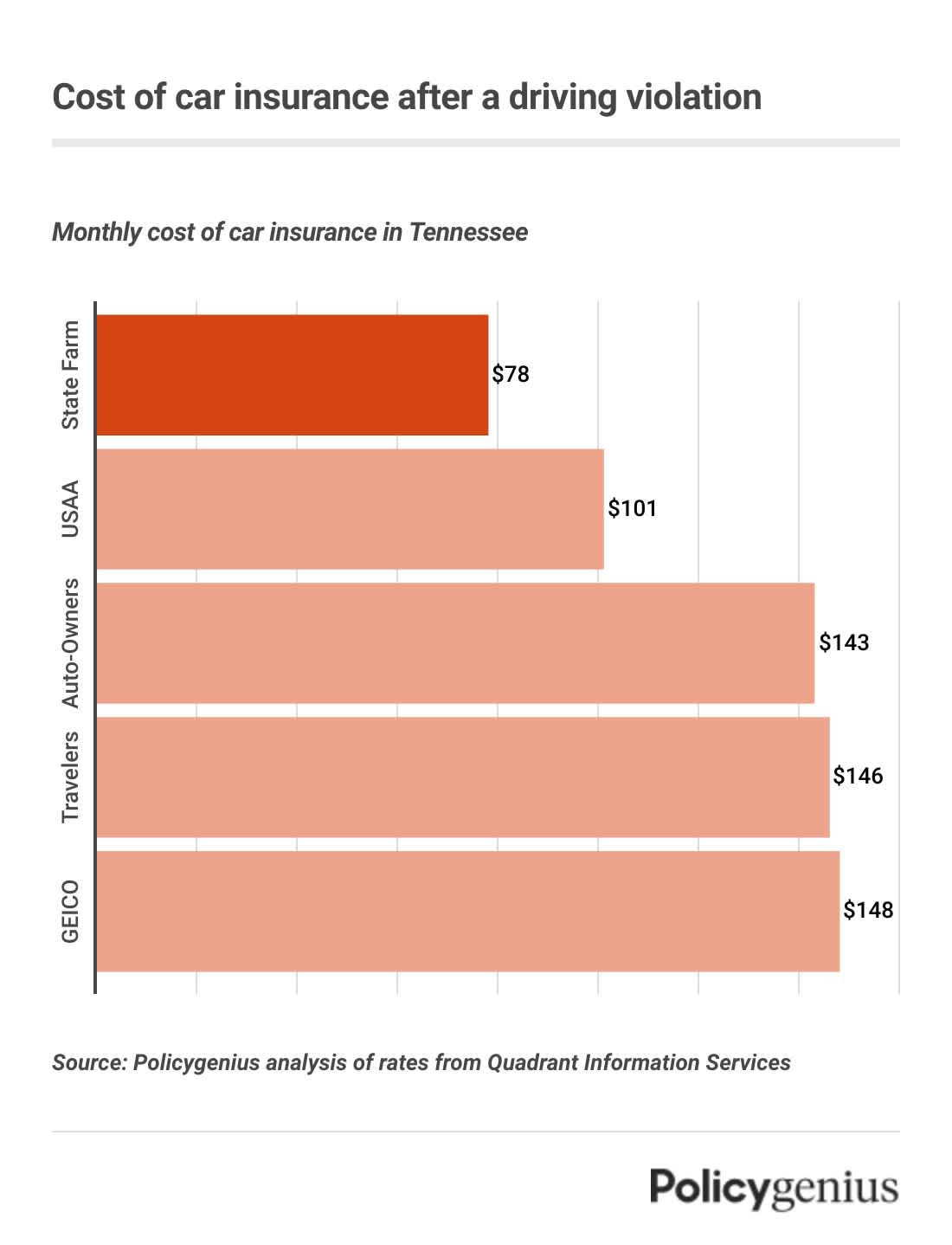

Car insurance rates for drivers with driving violations in Tennessee

Your driving history is one of the biggest factors insurance companies use to help determine your rates, meaning a single accident or a traffic ticket could have a significant impact on your insurance costs.

The cheapest car insurance in Tennessee if you have an accident or driving violation on your record is State Farm.

USAA | State Farm | Auto-Owners Insurance | GEICO | Travelers | |

|---|---|---|---|---|---|

At-fault accident | $1,249 | $1,010 | $1,720 | $1,914 | $1,747 |

Suspended license | $1,593 | $936 | $2,384 | $2,795 | $1,902 |

Open container | $1,162 | $936 | $1,292 | $1,993 | $1,660 |

Expired registration | $1,039 | $936 | $1,005 | $1,256 | $1,660 |

Driving without lights | $1,039 | $936 | $1,005 | $1,299 | $1,660 |

Running a red light | $1,039 | $936 | $1,005 | $1,299 | $1,683 |

Following too closely | $1,039 | $936 | $1,005 | $1,299 | $1,660 |

Hit and run | $1,712 | $936 | $2,384 | $2,302 | $1,902 |

Not-at-fault accident | $875 | $863 | $1,005 | $1,075 | $1,299 |

Passing a school bus | $1,162 | $936 | $1,423 | $1,299 | $1,902 |

Reckless driving | $1,162 | $936 | $2,384 | $2,302 | $1,902 |

Cheapest car insurance after an accident in Tennessee

The cheapest car insurance company in Tennessee after an at-fault accident is State Farm. On average, car insurance from State Farm costs $84 a month, or $1,010 a year with a single at-fault accident on your record.

Rates for drivers with an at-fault accident | |

|---|---|

State Farm | $1,010 |

USAA | $1,249 |

Auto-Owners | $1,720 |

Travelers | $1,747 |

GEICO | $1,914 |

Cheapest car insurance for drivers with a DUI in Tennessee

The cheapest car insurance company in Tennessee if you have a DUI on your record is State Farm. The average cost of car insurance from State Farm is $78 a month or $936 a month with a DUI.

Rates for drivers with DUIs | |

|---|---|

State Farm | $936 |

USAA | $1,651 |

Travelers | $1,902 |

GEICO | $1,993 |

Auto-Owners Insurance | $2,384 |

Cheapest car insurance for drivers with a speeding ticket in Tennessee

The cheapest car insurance after a speeding ticket in Tennessee comes from State Farm. On average, coverage from State Farm after a speeding ticket costs for $78 a month or $936 a year.

Rates for drivers with speeding tickets | |

|---|---|

State Farm | $936 |

USAA | $1,039 |

Travelers | $1,902 |

GEICO | $2,302 |

Auto-Owners Insurance | $3,258 |

→ Learn about how to find the cheapest SR-22 insurance in Tennessee

Cheapest car insurance for drivers with bad credit in Tennessee

Insurance companies in Tennessee can use your credit score to help determine your rates, or even decide whether or not to sell you insurance based on your credit. Drivers with poor credit histories and low credit scores can expect to pay more for their insurance than drivers with high credit scores.

Because of this, working to improve your credit score can save you money on car insurance. The chart below shows the car insurance companies with the lowest average rates for drivers with low credit:

Rates for drivers with bad credit | |

|---|---|

USAA | $1,544 |

GEICO | $1,644 |

Tennessee Farmers Mutual Insurance | $1,763 |

Grange Insurance | $1,879 |

Nationwide | $1,939 |

Cheapest car insurance in Tennessee by city

Your insurance rates will depend on local crime, population density, and traffic accidents and congestion near where you live.

Here are the cheapest car insurance companies in the 10 most populated cities in Tennessee.

Largest cities | Cheapest company | Average yearly rate for the cheapest company | Overall citywide average |

|---|---|---|---|

Nashville | USAA | $812 | $1,370 |

Memphis | USAA | $924 | $1,700 |

Knoxville | USAA | $831 | $1,283 |

Chattanooga | State Farm | $842 | $1,290 |

Clarksville | USAA | $759 | $1,318 |

Murfreesboro | USAA | $803 | $1,284 |

Franklin | USAA | $771 | $1,225 |

Johnson City | State Farm | $722 | $1,123 |

Jackson | USAA | $823 | $1,359 |

Hendersonville | USAA | $820 | $1,256 |

Buying car insurance in Tennessee

If your vehicle is registered in Tennessee, state law says drivers must meet the following minimum liability insurance requirements or have other proof of financial responsibility:

$25,000 for each injury or death per accident

$50,000 for total injuries or deaths per accident

$25,000 for property damage per accident

These are just the basic required minimum amounts. However, these limits are relatively low. If you are in an accident that causes more damage than your liability limits will cover, you will be held personally responsible for any costs above and beyond your liability insurance coverage. If you have a car loan or lease a vehicle, you’ll need to have comprehensive and collision insurance as well.

Tennessee is an at fault state, which means that if you cause an accident, you must fully compensate the other driver for any damages to their property or bodily injuries sustained in an accident. Your liability insurance covers the cost of car repairs, other property damage, and medical expenses for the other driver if you are found at fault, but only up to your policy limits. If you don’t have enough liability insurance to cover those damages, expect to pay those additional costs out-of-pocket.

How to get cheap car insurance in Tennessee

Most insurance companies offer Tennessee drivers plenty of ways to save money on your car insurance. These are some of the discounts available from most companies:

Good student discount: Students who maintain a B average or higher can earn up to 15% off of their car insurance.

Bundling discount: Insurance companies typically offer a substantial discount to customers who combine multiple insurance policies (home, auto, renters, etc.) through the same company.

Safe driver discount: Taking a safe driver course can sometimes earn drivers a discount on their insurance, but some companies offer discounts for drivers who maintain a clean driving record for three years or more.

Group discount: Insurance discounts are often available based on profession. For example, teachers are often given a discount on their car insurance. Some insurance companies also partner with larger employers and offer discounts as part of an employee benefits package.

Low mileage discount: Insurance companies often charge lower rates for drivers who have short commutes.

Military discount: Many insurance companies offer a discount to active military members and their families.

Not everyone will qualify for these discounts, but there are other ways to save money on your car insurance. Keeping your driving record clean is the best way to keep your insurance costs low, while improving your credit rating can help save you a significant amount of money on your insurance.

Comparing quotes from multiple insurance companies is another excellent way to make sure you are getting the most affordable policy available.

Find car insurance in your city: