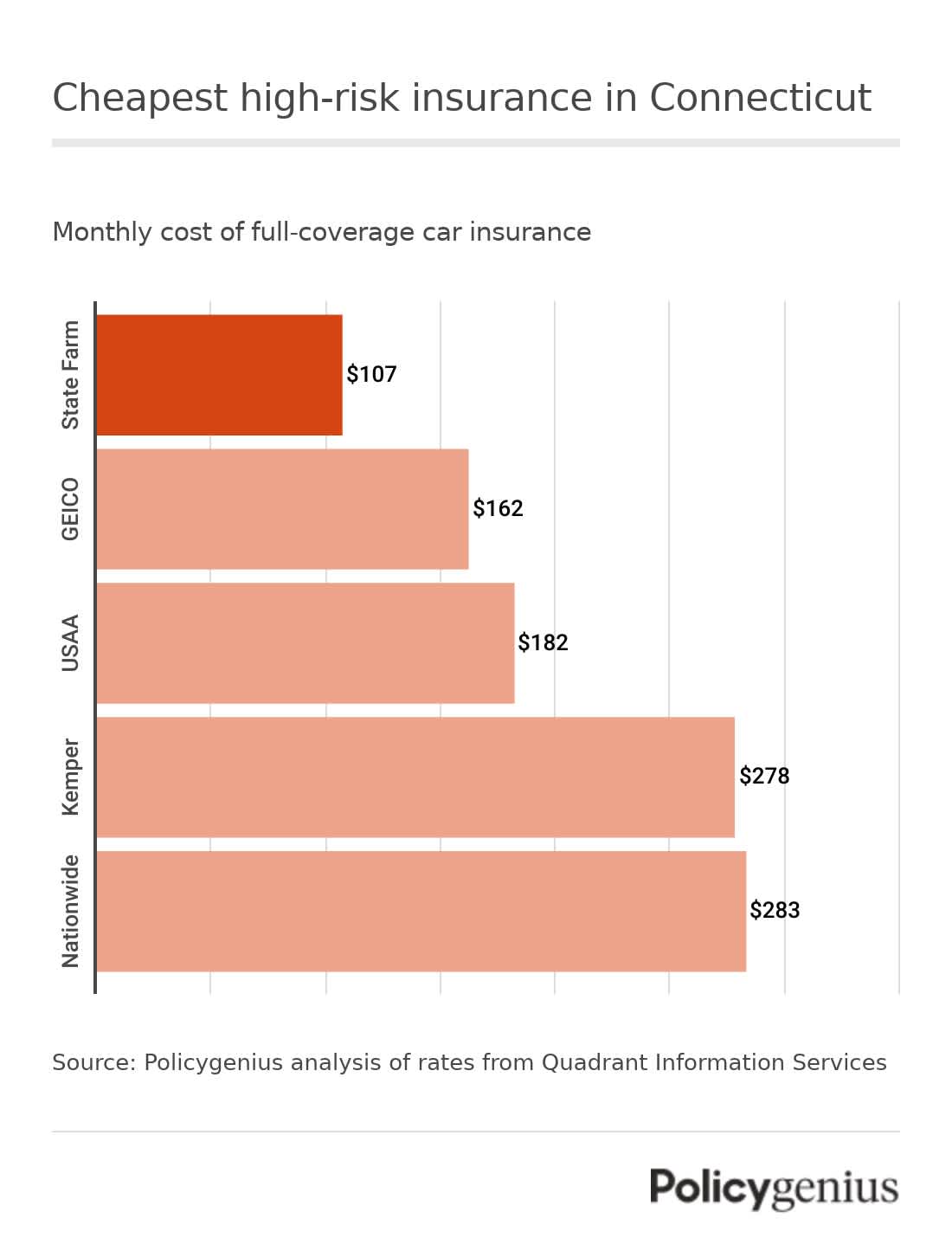

Cheapest high-risk insurance in Connecticut

Connecticut doesn’t require SR-22 insurance, but drivers still need to be insured. We found that State Farm has the cheapest average car insurance rates for those high-risk drivers in Connecticut who would need an SR-22 in other states.

GEICO and USAA also have cheap car insurance for Connecticut’s high-risk drivers. Since the cost of car insurance varies so much by the driver, it’s a good idea to compare rates before you buy.

Company | Average monthly cost of high-risk insurance | Average yearly cost of high-risk insurance |

|---|---|---|

State Farm | $107 | $1,290 |

GEICO | $162 | $1,950 |

USAA | $182 | $2,186 |

Kemper | $278 | $3,333 |

Nationwide | $283 | $3,399 |

Allstate | $302 | $3,623 |

Progressive | $302 | $3,627 |

Is SR-22 insurance required in Connecticut?

Connecticut doesn’t have an SR-22 insurance requirement. In other states, you’d need an SR-22 (a form that your insurer files to prove you’re insured) after being caught without insurance or after a driving violation, like a DUI.

Instead, Connecticut requires drivers who let their insurance lapse have to file an SR-37, or the Insurance Compliance Consent agreement. [1] Once your policy lapses or you cancel it, you have 14 days to get covered, pay the $200 fine, and file an SR-37.

If you were caught driving without insurance, your license and registration will be suspended for one to six months depending on how many previous offenses you have. You’ll also face a fine of $100 to $1,000 and an additional $175 reinstatement fee.

After other violations, your license will be suspended for a set number of days. The length of time depends on your history. You’ll also face other fines and penalties, like an ignition interlock (a breathalyzer in your car), that depend on the violation.

How to file an SR-37 in Connecticut

In Connecticut, your insurance company will alert the state once your insurance coverage lapses or you cancel your policy. You’ll get a Warning Notice and you’ll have to prove you’re insured. At this point, you should:

Try to get covered as soon as possible: When your coverage has lapsed for more than 14 days, Connecticut will send you a suspension notice and you’ll face more fines to reinstate your registration.

Look for a company that offers coverage: Not all companies will cover high-risk drivers with a history of serious violations or insurance lapses on their record, so plan to spend more time shopping for coverage.

Pay a fine and send in the SR-37: Send in the SR-37 form to the state’s DMV, along with the $200 civil fine and proof of your insurance and avoid more serious punishments, like a driving suspension.