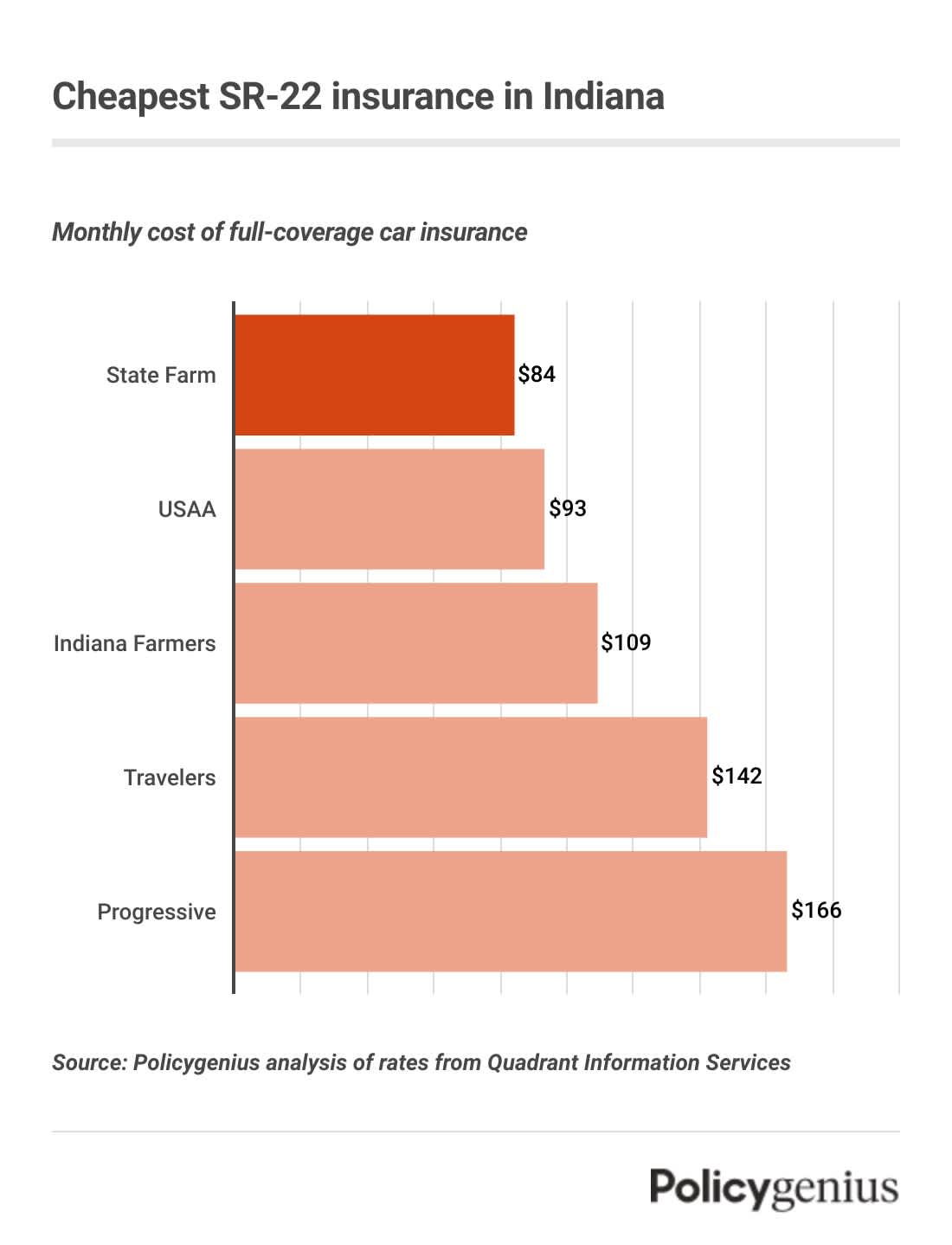

Cheapest SR-22 insurance in Indiana

After analyzing car insurance rate data, we found that State Farm has the cheapest SR-22 insurance in Indiana. On average, State Farm offers SR-22 coverage for $84 per month or $1,011 a year. That’s $1,129 cheaper than the average for SR-22 car insurance in Indiana.

USAA and Indiana Farmers also offer cheaper-than-average SR-22 insurance in Indiana. But different drivers will see very different rates, so it’s a good idea to compare quotes to be sure you’ve found the best company for you.

Company | Average monthly cost of SR-22 insurance | Average annual cost of SR-22 insurance |

|---|---|---|

State Farm | $84 | $1,011 |

USAA | $93 | $1,116 |

Indiana Farmers | $109 | $1,312 |

Travelers | $142 | $1,709 |

Progressive | $166 | $1,992 |

Grange Mutual | $178 | $2,132 |

What is SR-22 insurance in Indiana?

An SR-22 actually isn’t a type of car insurance. It’s a form that your insurance company files on your behalf with Indiana’s Bureau of Motor Vehicles that proves to the state that you have car insurance coverage. When you request an SR-22, you also pay a small filing fee.

In Indiana, you may need an SR-22 insurance in order to reinstate a suspended license or after you’re caught driving without insurance, driving under the influence, failing to appear in court, or missing child support payments. An SR-22 proves you have at least:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $25,000 per accident

Uninsured motorist bodily Injury (UIMBIL): $25,000 per person, $50,000 per accident

If you’re caught driving without insurance, you have to carry SR-22 insurance for 180 consecutive days — and the requirements may be longer for other violations. Your license reinstatement fees also change depending on the violation.

How to get SR-22 insurance in Indiana

Follow these steps to find your best options for SR-22 car insurance in Indiana:

Shop around for car insurance: Your current car insurance company may be able to add an SR-22 to your policy, but you may have to check with a few companies before you can get SR-22 coverage, since not all companies in Indiana offer coverage to high-risk drivers.

Make sure your SR-22 doesn’t lapse: If you try to drop your insurance or let it lapse before your SR-22 period ends, you’ll face more fines and another license suspension.

You don’t have to worry about filing the SR-22 yourself, your car insurance company will do it for you. If you’re not sure whether the state has received your SR-22, you can check with Indiana’s Bureau of Motor Vehicles.

Non-owner SR-22 insurance in Indiana

If you commit a serious driving violation and lose your license but don’t own a car, you may still have to get SR-22 insurance. That’s where non-owner car insurance comes in.

A non-owners policy is limited coverage for drivers who don’t own a car, but just like with regular coverage, you can request an SR-22 form to show proof to the state that you have car insurance.

But not every car insurance company offers non-owners SR-22 insurance, and you won’t be able to get non-owners quotes online. One benefit of non-owners SR-22 insurance is that it’s cheaper than a regular high-risk policy because it offers less protection than a standard car insurance policy.