Cheapest SR-22 insurance in Missouri

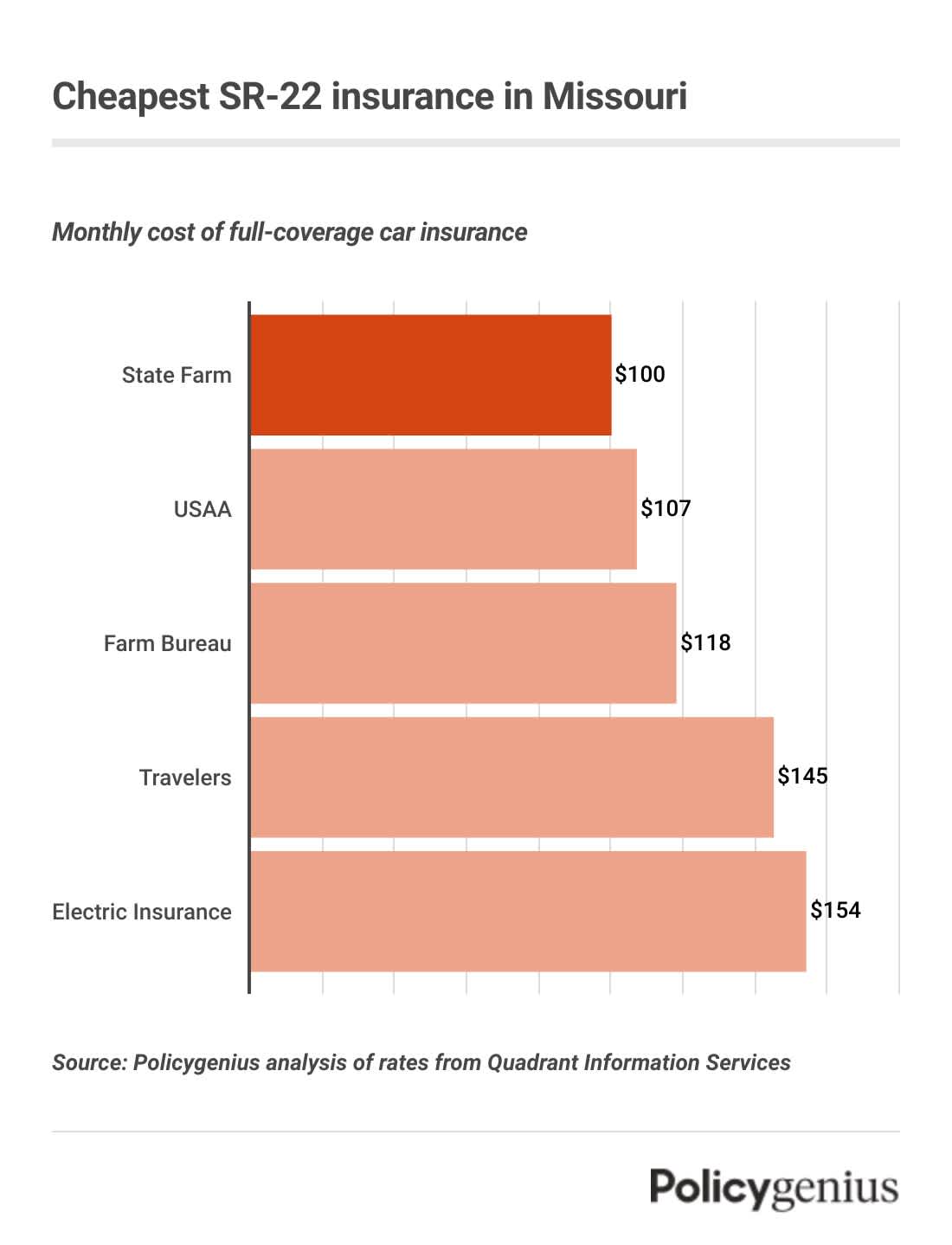

We found that State Farm has the cheapest SR-22 insurance in Missouri. On average, a policy with an SR-22 from State Farm costs $100 per month or $1,200 a year. That’s 54% cheaper than the statewide average in Missouri.

USAA, Farm Bureau, and Travelers also have cheaper-than-average rates for SR-22 car insurance in Missouri. Since rates vary so much by driver and company, it’s a good idea to compare quotes before you buy coverage to be sure you get the best deal on SR-22 insurance.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

State Farm | $100 | $1,200 |

USAA | $107 | $1,281 |

Farm Bureau | $118 | $1,419 |

Travelers | $145 | $1,742 |

Electric Insurance | $154 | $1,849 |

Allstate | $198 | $2,377 |

Progressive | $201 | $2,414 |

American Family | $203 | $2,435 |

What is SR-22 insurance in Missouri

SR-22 insurance isn’t a type of car insurance. Instead, an SR-22 is a form that your insurance company files for you proving you have insurance coverage. In Missouri, you must carry at least the following amount of insurance:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $25,000 per accident for property

Uninsured motorist bodily injury (UIMBI): $25,000 per person, $50,000 per accident

You might have to get an SR-22 in Missouri if you’re caught driving without insurance, if you’re found guilty for failing to pay for the damages from an accident, for driving while intoxicated, or if you get too many points on your license. [1]

Most of the time you’ll have to keep your SR-22 on file for two years after your violation or the date when your license is reinstated. For failing to provide proof of insurance or giving fake proof of insurance, an SR-22 is required for three years.

How to get SR-22 insurance in Missouri

You can follow these steps to find SR-22 insurance in Missouri:

Find a company that offers coverage: Not all companies in Missouri offer car insurance to high-risk drivers who need an SR-22. You might have to shop around for a while before you find coverage.

Pay all of your fees and any judgments: If you need SR-22 insurance for more than one reason, like a DUI and a failure to stay insured, you’ll have to pay separate fees in addition to the cost of filing your SR-22 form.

Keep your SR-22 for enough time: Depending on your violation, you’ll have to keep an SR-22 on file for two or three years. If you let it lapse, you’ll have to pay a fine and keep your SR-22 for even longer.

Non-owner SR-22 insurance in Missouri

Even if you don’t own a car, you may still have to get SR-22 insurance after violation or license suspension. In that case, you might need what’s called non-owner SR-22 insurance.

Non-owner SR-22 insurance is a special kind of limited coverage that lets people who don’t own a car fulfill their SR-22 requirement in Missouri. A non-owner car insurance policy comes with bodily injury liability, property damage liability, and uninsured motorist coverage — but not comprehensive or collision (since there’s no car to protect).

Since non-owners insurance comes with less protection than a standard policy, it tends to be cheaper. But it’s also harder to find a company that will file an SR-22 with a non-owner policy. You may have to call a few companies or work with an agent to find coverage.