Cheapest SR-22 insurance in Texas

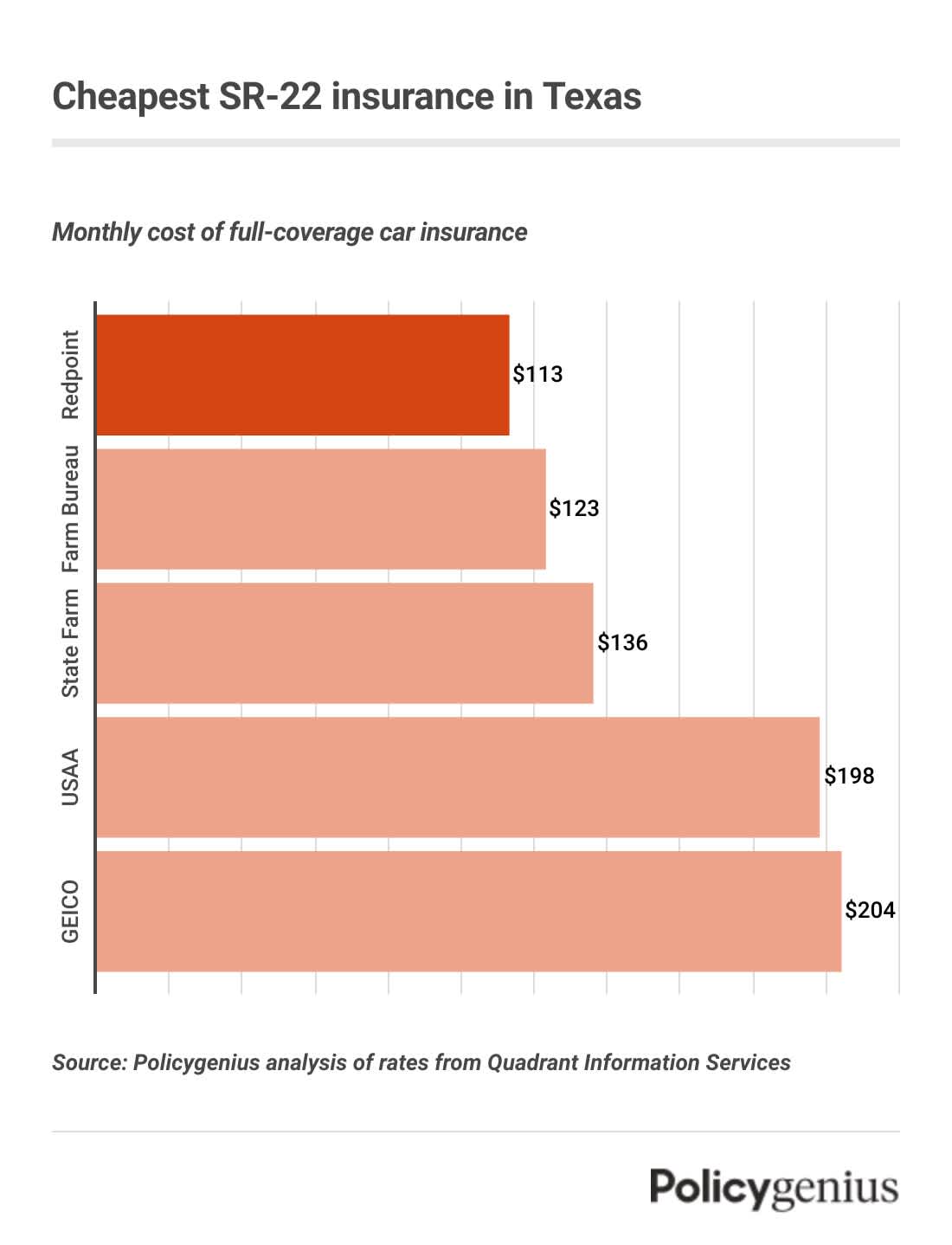

We found that Redpoint County Mutual has the cheapest SR-22 insurance in Texas. On average, SR-22 insurance from Redpoint costs $113 per month or $1,356 a year. That’s 52% cheaper than the statewide average in Texas.

A few other companies offer cheaper-than-average SR-22 for Texans. Texas Farm Bureau and State Farm are the cheapest alternatives, but you should compare rates before buying since costs can vary so much from person to person, especially when it comes to SR-22 insurance.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

Redpoint | $113 | $1,356 |

Texas Farm Bureau | $123 | $1,476 |

State Farm | $136 | $1,627 |

USAA | $198 | $2,378 |

GEICO | $204 | $2,451 |

AAA | $218 | $2,614 |

What is SR-22 insurance in Texas?

An SR-22 isn’t a type of car insurance. An SR-22 is actually a form that your insurance company files for you as proof you’re covered.

You may be required to get an SR-22 after a serious violation, like racing, getting a DUI, driving without insurance or a license, and buying alcohol for minors.

In Texas, your SR-22 must show you have a policy with the following amounts of car insurance:

Bodily injury liability (BIL): $30,000 per person, $60,000 per accident

Property damage liability (PDL): $25,000 per accident

The length of time you need to maintain SR-22 car insurance in Texas varies. If you’re caught driving without insurance, your license will be suspended until you get SR-22 insurance and you’ll have to keep it on your policy for two years.

For other violations, you’ll still have to have an SR-22 but your license may be suspended for longer (sometimes more than a year).

How to get SR-22 insurance in Texas

It’s not hard to find SR-22 insurance in Texas if you know where to look. Once you know that you need to get an SR-22, follow these steps:

Find a company that offers SR-22 insurance: Not all companies in Texas cover high-risk drivers, and that may include your current insurance company. You should plan ahead and shop around so you’re not scrambling to find an SR-22 ahead of a deadline.

Pay your reinstatement fee: Once you have SR-22 insurance, you still won’t be able to drive before you pay your reinstatement fee (and any other fines).

Don’t let your SR-22 lapse: Drivers in Texas must carry an SR-22 for at least two years. If you let your coverage lapse, you’ll have to pay the $100 reinstatement fee again and file another SR-22.

Non-owner SR-22 insurance in Texas

If you’re licensed but don’t have your own car, you may still have to find SR-22 insurance after a violation or license suspension. In this case, you may need something called non-owner SR-22 insurance.

Non-owner car insurance is just car insurance for people who don’t own a car. Like a regular car insurance regular policy, non-owners insurance includes bodily injury and property damage liability coverage (that’s what’s required by the state). And like with a regular policy, your non-owner car insurance company can file an SR-22 on your behalf.

Since there’s no car to cover, non-owner car insurance doesn’t come with comprehensive or collision coverage, which makes it cheaper than normal SR-22 insurance.

While it’s cheaper, non-owner SR-22 insurance is also harder to find than a regular policy. You’ll have to call a few companies or work with an independent agent to find one that will add an SR-22 to a non-owners policy for you.