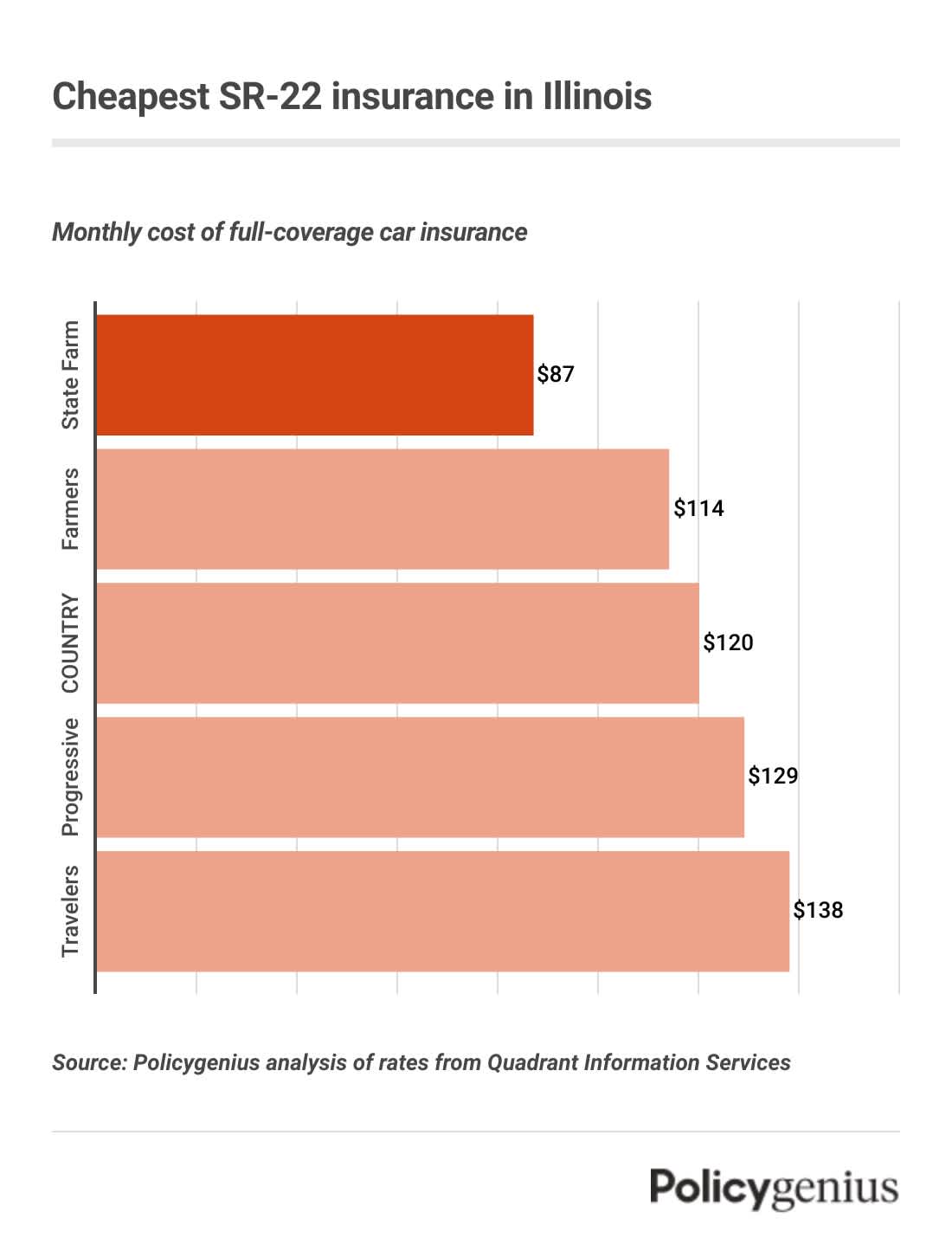

Cheapest SR-22 insurance in Illinois

State Farm has the cheapest SR-22 insurance in Illinois, with an average monthly cost of $87. That’s $1,039 a year, which is 59% less than the average for SR-22 insurance in Illinois.

Drivers can also get cheap SR-22 coverage from Farmers or COUNTRY, but it’s a good idea to compare rates to be sure you get the best price. This is even more important if you live in a big city (like Chicago), where SR-22 costs are even higher.

Company | Average monthly cost of SR-22 insurance | Average annual cost of SR-22 insurance |

|---|---|---|

State Farm | $87 | $1,039 |

Farmers | $114 | $1,367 |

COUNTRY | $120 | $1,441 |

Progressive | $129 | $1,548 |

Travelers | $138 | $1,654 |

What is SR-22 insurance in Illinois?

An SR-22 is a form that your insurance company files for you, not a type of car insurance. In Illinois, your car insurance company files an SR-22 with the Secretary of State after your license is suspended. The SR-22 acts as proof that you have car insurance with at least the following amounts of coverage:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $20,000 per accident

There are a range of reasons you may have to get SR-22 insurance in Illinois, like if your license was suspended after a DUI or another violation, if you missed a court date, or if you failed to make child support payments.

By Illinois law, you must have SR-22 insurance for at least three years. Alternatively, you can deposit at least $70,000 with the state and file for a bond that proves you’d be covered in the event of a crash.

→ Read about SR-22 insurance in Chicago

How to get SR-22 insurance in Illinois

It’s not hard to find SR-22 insurance in Illinois after your license is suspended. Follow these steps to get the SR-22 coverage you need:

Find an insurance company that offers coverage: Not all insurance companies in Illinois offer coverage to high-risk drivers, so you’ll have to let any company know about what you need while you shop.

Wait for your SR-22 to process: It can take up to 30 days for your SR-22 to process, but you’ll receive a confirmation from both your insurance company and the Illinois Secretary of State when it does.

Renew your SR-22 on time: You have to renew your SR-22 every year, and Illinois requires that you renew your SR-22 a minimum of 45 days in advance.

Non-owner SR-22 insurance in Illinois

Sometimes, drivers who don’t have their own cars are required by the state to get an SR-22, which means they may need non-owner insurance. A non-owner SR-22 works just like a regular car insurance policy, except it usually has lower limits and no comprehensive or collision coverage (because there’s no vehicle to protect).

Not many companies offer non-owner SR-22 insurance, so if you’re a high-risk driver without a car, you may have to check around to see what your options are. But the good news is that since non-owner

SR-22 insurance has lower limits than a regular policy, it will probably be cheaper than a regular SR-22 policy.