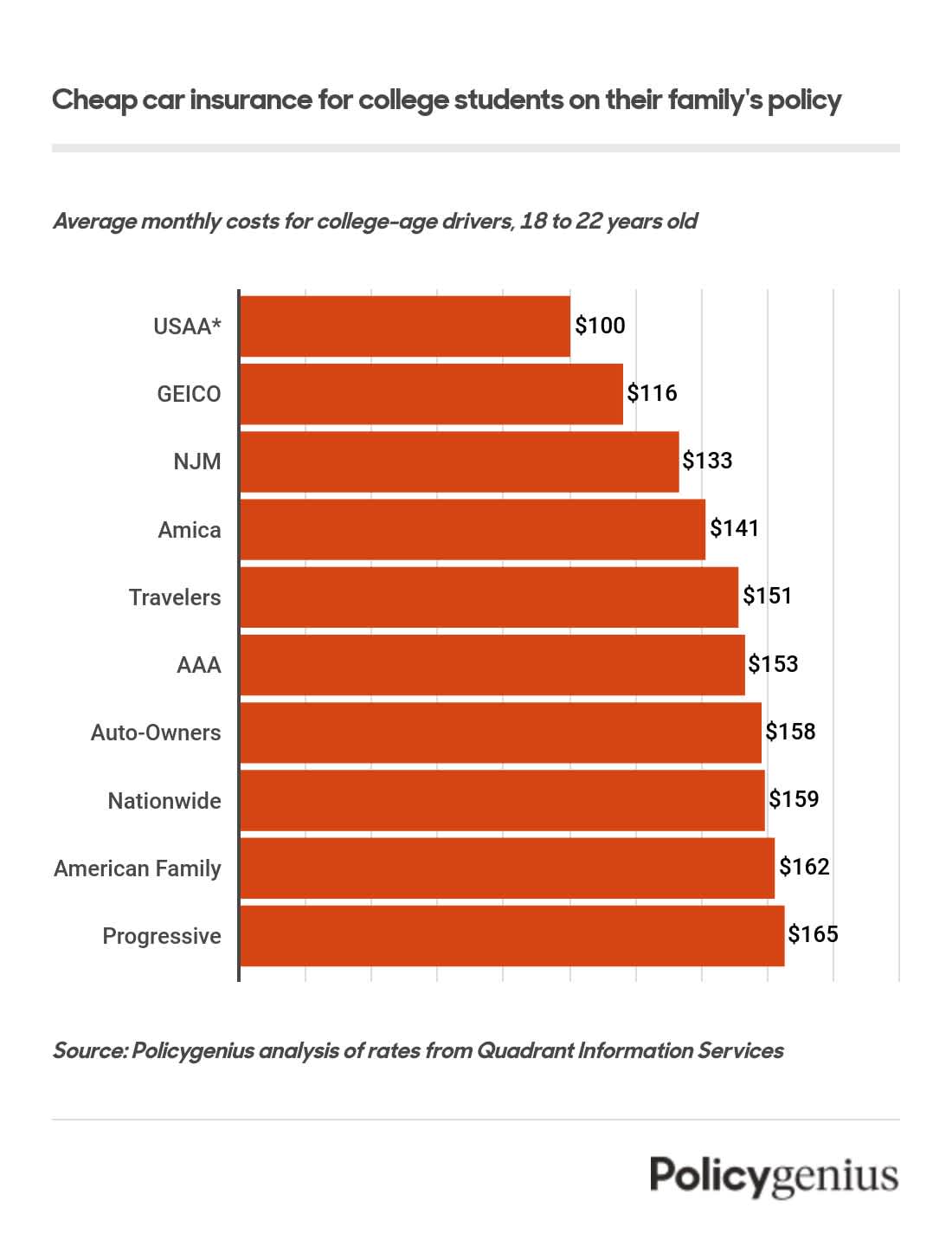

Our cost analysis found that GEICO is the cheapest car insurance company for most college students who are added to their family’s policy. COUNTRY Financial has the cheapest car insurance for college students who get their own coverage.

The younger you are, the more your auto insurance will cost. That’s why it’s important for college students to compare car insurance quotes as they shop for coverage. Otherwise you could pay hundreds of dollars more each month for car insurance than you need to.

Do college students need their own car insurance?

College students can get their own car insurance, but they don’t all have to. Car insurance for college students is $1,744 cheaper per year for drivers who stay on their family’s existing policy instead of getting their own.

You can stay on your parents’ policy while you’re away at school as long as their home is still your primary residence. You can even stay on your family’s car insurance if you bring your own vehicle to college. But when you fully move out of your parents’ home and have a new permanent address, you’ll have to get your own car insurance.

Best for college students who stay on their family’s car insurance: GEICO

The best cheap auto insurance for most college students who remain on their family’s policy is GEICO. On average, the cost of car insurance for a college student on a family plan with GEICO is $116 per month. That’s $873 cheaper than average.

In addition to having low car insurance rates for young drivers, GEICO also has a solid reputation for high-quality customer service. According to the National Association of Insurance Commissioners, GEICO receives about one quarter fewer complaints for its service, price, and claims process than expected. [1]

While GEICO has the cheapest student car insurance quotes of any national carrier, NJM has the cheapest overall rates — but it’s only available to drivers who live in Connecticut, Maryland, New Jersey, Ohio, and Pennsylvania. It’s still one of the best companies in the country, so it’s worth considering if you’re in NJM’s coverage area.

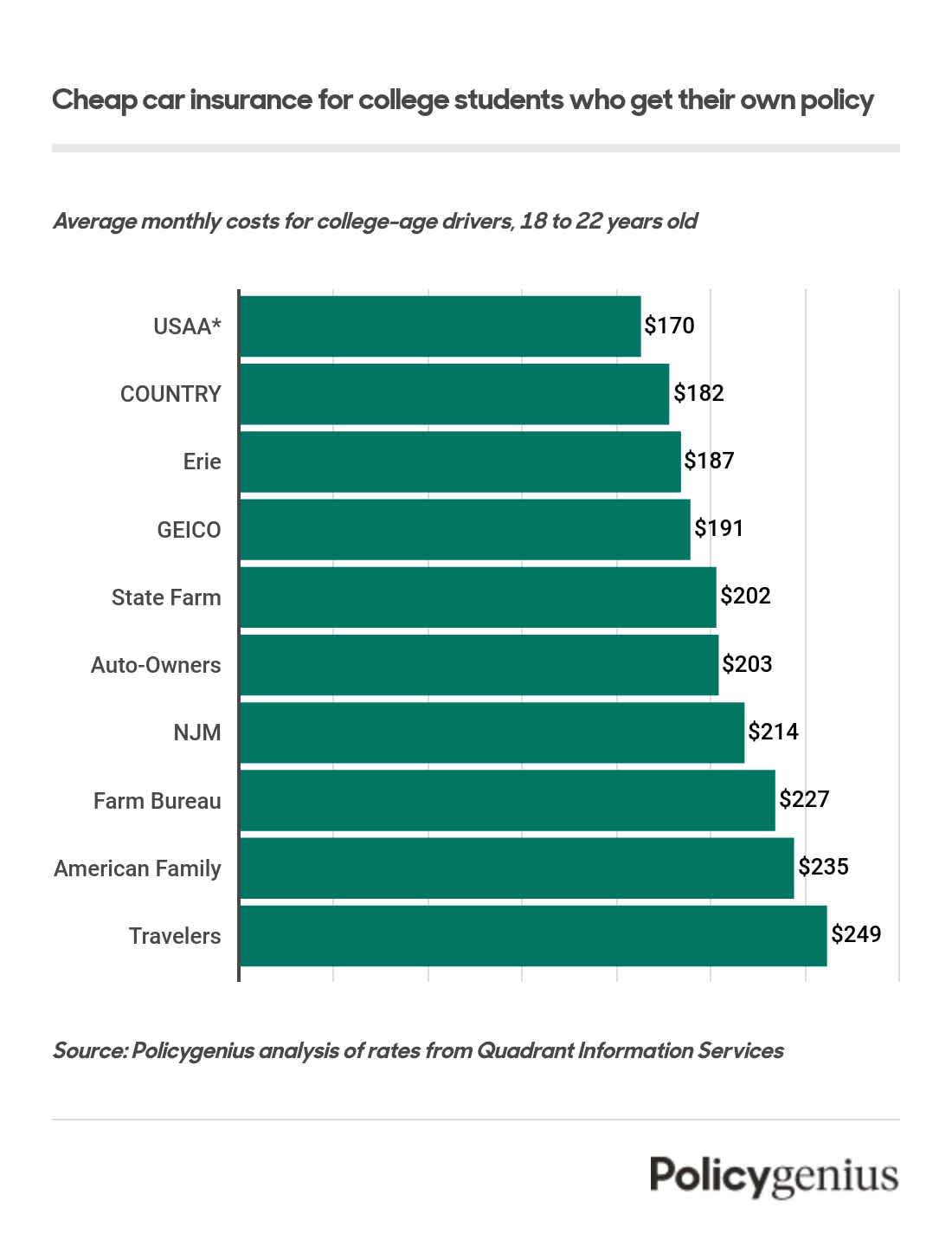

Best for college students who get their own car insurance: COUNTRY Financial

College students who don’t (or can’t) remain on their family’s plan while they’re in school will pay more for car insurance, but COUNTRY’s low rates can help keep costs down. We found that car insurance from COUNTRY Financial costs college students $1,212 less than average each year.

One of the most useful add-ons COUNTRY offers is up to $800 of personal belongings coverage. This covers any property that’s stolen from your car, including laptops, cellphones, or luggage.

COUNTRY also offers up to $1,000 of roadside assistance coverage for lockout service, fuel delivery, repairs, and towing. College students can also get up to $800 for a rental car, transportation, and lodging if they’re stranded.

Best for college students who don’t drive often: Nationwide

College students may be able to get cheap car insurance with Nationwide’s SmartMiles. Since SmartMiles is a per-mile program, your rates are based on how often you drive each month instead of a flat rate.

If you have to get your own car insurance at college, it’s worth looking into SmartMiles, especially if you only drive your car a few times a month.

Drivers who sign up for SmartMiles also save up to 10% on car insurance when they renew their policy — as long as they weren’t in any accidents during the last policy term. Plus, SmartMiles drivers can also get a road-trip exception and avoid paying extra for trips longer than 250 miles.

Best for top-rated customer service: State Farm

State Farm has the best customer service of any of our cheapest companies for college students. The NAIC shows that State Farm has received about 30% fewer complaints than average every year since 2019. J.D. Power’s annual claims satisfaction survey also rates State Farm’s claims process higher than its competitors. [2]

State Farm also has some of the cheapest car insurance for college students. We found that it costs $202 per month for college students to get their own policy with State Farm — that’s $967 less than average per year. Coverage costs about average for students who stay on a family policy, at $185 per month.

Cheapest car insurance for college students in every state

Along with your age, your location is one of the most important factors in determining your car insurance rates. The cheapest insurance company for college students varies by state (and even ZIP code).

State | Cheapest for adding a driver | Cheapest for their own policy |

|---|---|---|

USAA | COUNTRY | |

USAA | USAA | |

GEICO | GEICO | |

Farm Bureau | USAA | |

Wawanesa | Wawanesa | |

National General | American National | |

General Electric Insurance | GEICO | |

USAA | State Farm | |

GEICO | Erie | |

UAIC | GEICO | |

USAA | Auto-Owners | |

USAA | GEICO | |

American National | American National | |

Pekin | Pekin | |

Allstate | USAA | |

IMT | State Farm | |

USAA | USAA | |

GEICO | GEICO | |

Farm Bureau | USAA | |

Auto-Owners | Auto-Owners | |

USAA | USAA | |

USAA | USAA | |

Farm Bureau | GEICO | |

Farm Bureau | Farm Bureau | |

USAA | USAA | |

USAA | USAA | |

USAA | State Farm | |

Farm Bureau | Farmers Mutual of Nebraska | |

GEICO | COUNTRY | |

MMG | Auto-Owners | |

GEICO | GEICO | |

USAA | USAA | |

GEICO | American Family | |

State Farm | GEICO | |

USAA | American Family | |

Grange | USAA | |

American Farmers and Ranchers | American Farmers and Ranchers | |

USAA | COUNTRY | |

Nationwide | GEICO | |

GEICO | USAA | |

State Auto | American National | |

USAA | State Farm | |

USAA | State Farm | |

Redpoint | Farm Bureau | |

Farm Bureau | GEICO | |

Auto-Owners | Auto-Owners | |

USAA | GEICO | |

PEMCO | State Farm | |

GEICO | State Farm | |

West Bend | USAA | |

USAA | USAA |

Cost of full-coverage car insurance for college students, ages 18 to 22.

The best way to ensure that you’re finding your cheapest rates is by comparing quotes from more than one company. This way, you’ll be able to easily see who has the lowest rates for drivers like you — and you won’t have to worry about overpaying for coverage.

How much is car insurance for college students?

The average cost of college student car insurance for drivers who stay on their family’s car insurance policy is $189 per month, or $2,264 per year.

Car Insurance is more expensive for students who get their own policy. We found that the cost of a separate car insurance policy for a college student with a clean driving record is $283 per month, or $3,396 per year.

Car insurance for college-aged drivers tends to get cheaper as they age — as long as they avoid accidents and tickets. We found that average rates for college students on a family policy decreased by 19% as age increased year over year, while rates for young drivers who got their own policy go down by 17% each year.

Age range of college student | Cost when staying on a family policy | Cost when getting a separate policy |

|---|---|---|

18 to 19 | $239 | $365 |

19 to 20 | $212 | $296 |

20 to 21 | $171 | $249 |

21 to 22 | $134 | $207 |

Cost of full-coverage car insurance for college students, ages 18 to 22.

The reason that auto insurance for college students is so much more expensive than average is because of their relative lack of experience behind the wheel. Since students have been licensed for less time, they’re more likely to get into an accident and make a claim than older drivers.

Car insurance for college-aged drivers tends to cost less and less over time until age 25, which is when young drivers age out of the highest-risk (and most expensive) age group and start seeing normal auto insurance rates.

Car insurance discounts for college students

The best way for college students to save on car insurance is by joining their parents’ existing policies, but most companies offer at least a few discounts specifically for full time students (which you can get whether you’re on a family policy or have your own).

Some of the most common discounts for college students include:

Good student discount

Most car insurance companies offer this discount, and full time students can usually save on car insurance as long as they keep at least a “B” average, earn a spot on the honor roll, or score well on standardized tests. We found that college students pay $475 less per year if they qualify for a good student discount.

Companies that offer good student discounts include:

Allstate

American Family

COUNTRY

Farmers

GEICO

Liberty Mutual

Nationwide

Progressive

Travelers

USAA

Discounts for completing a defensive driving course

College students might be able to get a discount on their car insurance by completing a defensive driving course. To get this discount, drivers just usually have to take a course that’s sanctioned by their state’s DMV.

Companies that offer defensive driving course discounts include:

Allstate

American Family

Erie

GEICO

Liberty Mutual

Progressive

State Farm

Travelers

USAA

Usage-based discount

Most insurance companies offer significant discounts through usage-based or telematics programs (also called UBI). Usage based programs track your driving behavior for a few weeks, then award discounts for safe driving habits. College students who are cautious behind the wheel may be able to earn significant savings by opting-in to a usage based car insurance program.

Companies that offer usage-based discounts include:

Allstate: Drivewise

American Family: KnowYourDrive

Farmers: Signal

GEICO: DriveEasy

Liberty Mutual: RightTrack

Nationwide: SmartRide

Progressive: Snapshot

State Farm: Drive Safe and Save

Travelers: IntelliDrive

USAA: SafePilot

Bundling discount

If you have your own place off-campus and you have your own car insurance policy, consider bundling it with your renters insurance to save on both.

Companies that offer bundling discounts include:

Allstate

American Family

COUNTRY

Erie

Farmers

GEICO

Liberty Mutual

Nationwide

Progressive

State Farm

Travelers

USAA

Students away-from-home discount

If there’s a college student on your policy who attends school that’s at least 100 miles away and doesn’t have a car with them, you could earn a special discount since they’ll be driving less.

Companies that offer student away-from-home or distant student discounts include:

American Family

Erie

Farmers

Liberty Mutual

Progressive

Travelers

Car insurance for college graduates

Car insurance for college graduates is basically the same as car insurance for any adult — but it will probably be cheaper than car insurance for college students simply because of age, since drivers under 25 pay much higher rates.

When you sign up for car insurance, you may have to enter your education level or highest degree (along with all the other information you share).

But things like your education and employment won’t have much of an effect on your car insurance rates, and a handful of states actually ban companies from considering drivers’ education level when setting prices.

College graduates may qualify for some discounts that can mean cheaper car insurance, including:

Having a college degree: A few companies, including COUNTRY Financial, offer discounts for graduating college and holding either bachelor’s or associate’s degree.

Having a graduate degree: Drivers who hold a master’s degree or higher can sometimes qualify for even lower rates than someone with a two or four-year degree. It won’t affect your rates by much, though.

Being an alumni of certain schools: If you’re a part of an alumni network, you may be able to get an affinity discount on car insurance. There are a lot of different schools that qualify for these discounts, so there’s a good chance yours will be included.

Being a member of a Greek organization: Graduates who were a part of a fraternity or sorority during their college years may qualify for affinity discounts from some insurance companies.

Being part of a professional organization: Being a member of certain professional groups, like the American Bar Association, can earn you affinity discounts with partnering insurance companies.