Life insurance proceeds — the lump sum of money a beneficiary receives when a person covered by a life insurance policy, also called the insured, dies — are not typically subject to taxation. [1]

However, if a life insurance payout becomes part of a large estate, if you have a life insurance policy that comes with cash value — like most permanent life insurance policies — or you opt to receive the insurance payout in installments, those tax exemptions might not apply.

Your beneficiary may have to pay taxes if your death benefit is:

Paid as an annuity

Part of an estate valued higher than $13.61 million [2]

From a policy that’s owned by neither the beneficiary nor the deceased

It’s very unlikely you’ll pay taxes on your life insurance policy while you’re alive.

For example, if you activate an accelerated death benefit rider — a policy add-on that pays out some of your death benefit while you’re alive if you’re terminally ill — there are no tax implications.

You’ll pay taxes if you withdraw more from a permanent policy’s cash value than you’ve paid into it, fail to repay a loan taken from your policy’s cash value, or if you sell or surrender your life insurance policy, but most people don’t encounter these scenarios.

Term life insurance, which doesn’t have cash value and simply pays out a lump sum if you die while your policy is active, is usually not taxable.

Read more about how to understand your life insurance policy

When is your life insurance taxable?

Life insurance can be subject to taxes in these cases:

When you receive the payout in annual installments

The death benefit is most often paid as one lump sum of money. However, your beneficiaries can choose to receive it in incremental payouts, also known as an annuity. This more closely resembles an income stream and can be helpful for beneficiaries who might be overwhelmed by a large one-time payout while grieving.

However, if a beneficiary receives the death benefit payout as an annuity, the funds will accrue interest over the years.

The beneficiary won’t be taxed on the benefit, but can be taxed on any interest gained. This is an important extra cost to keep in mind and an argument for taking the death benefit as a lump sum.

Read more about how to file a life insurance death claim

When the life insurance payout becomes part of your estate

If the addition of the death benefit causes your assets to exceed the estate tax threshold — $13.61 million in 2024 — any assets above the threshold are subject to taxation. Similar limitations apply to any gifted assets that skip a generation (e.g., grandparents giving to their grandchildren) and state inheritance or estate taxes.

Some high-net-worth individuals buy life insurance specifically to offset their estate taxes. Others place the policy in an irrevocable trust, which keeps it from being counted as part of your estate.

When you have a cash value life insurance policy

Term life insurance policies are worthwhile and straightforward in that the policy guarantees your beneficiaries a death benefit, and nothing more. But permanent policies like whole life insurance come with an investment-like cash value component, which can complicate your tax situation.

The cash value of a policy can increase over the years (or decrease), above a guaranteed minimum interest rate. Cash value gains are tax-deferred, like the gains in a 401(k). Withdrawals less than or equal to what you’ve paid into the policy, known as the cash basis, are not taxable. However, withdrawals greater than the cash basis are taxable.

You can also take out a loan against your cash value amount. Any unpaid loans (for example, if your policy lapses before you pay back the balance) are taxable income.

Permanent policyholders can also surrender a policy for a cash amount. If you make a profit from the surrender or have an unpaid policy loan when you surrender your coverage, it’s taxed as income.

Read more about how to find the best life insurance policy for you

When there are three people involved in the policy

Most people buy a life insurance policy on themselves with the intention of protecting their beneficiaries. But you can buy life insurance on someone else (within limits).

However if, for example, a spouse buys life insurance on their partner and designates an adult child the beneficiary, the death benefit will be treated like a monetary gift from the parent to the child and subject to the gift tax.

The same applies to any cash value above the gift tax threshold if you transfer ownership of a permanent insurance policy to another person.

When you have group life insurance

Some employers offer group life insurance as a workplace benefit. If you get life insurance coverage through work and your employer subsidizes the cost, premiums for coverage over $50,000 are taxed as income to you.

This is especially important to keep in mind if you have voluntary supplemental life insurance through your employer, which could place you above that $50,000 limit.

When you sell a life insurance policy

It’s possible to sell the rights of a life insurance policy to a third party, usually a broker or life settlement company. Similar to surrendering a cash value policy, if you sell a policy and make a profit from the sale, that profit is taxed as earned income.

→ Average life insurance cost per month

Can you protect your life insurance from being taxed?

You can shield your life insurance death benefit from taxation by making the beneficiary of your life insurance policy an irrevocable life insurance trust (ILIT). This puts the policy and the disbursement of the death benefit under the trust’s control and excludes it from the value of your estate.

As a policyholder, you can also transfer ownership of a life insurance policy you already own to an irrevocable trust, but you should do it while you’re in good health. If the policy hasn’t been part of the ILIT for more than three years when you die, the death benefit will still be included in your estate’s valuation.

You don’t want to take risks with your estate planning, so work with a financial advisor to implement your ILIT properly.

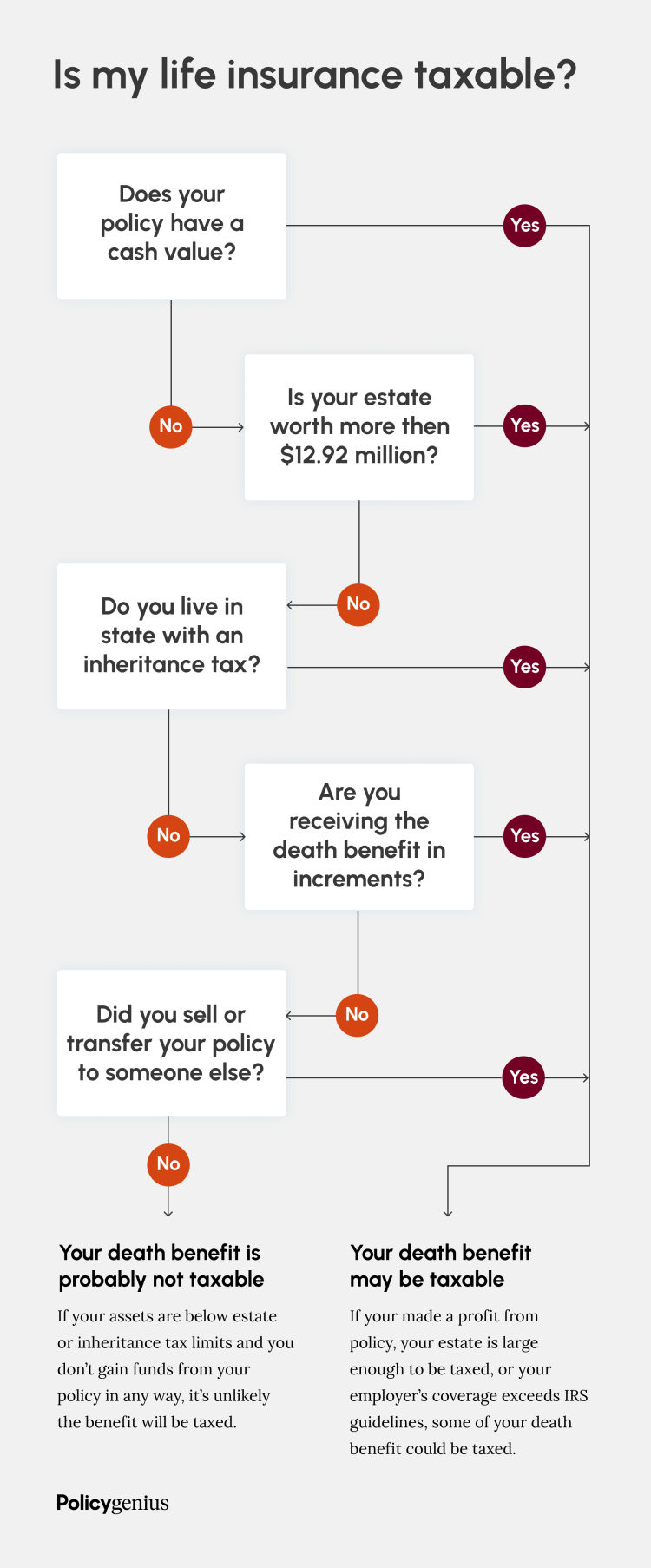

Still not sure if your policy could be taxed or if it’s tax-deductible? Take a look at this flowchart and see where you fall:

Life insurance & the tax code

Whether your life insurance is taxable is determined by specific sections of the U.S. tax code. Together, these codes create guidelines for which policy items fall under life insurance tax rules and which don’t.

Types of taxes that can make life insurance taxable

Because a life insurance death benefit isn’t considered taxable income for most people, income tax usually doesn’t apply. However, you or your beneficiary might be subject to estate taxes, inheritance taxes, gift taxes, or the generation-skipping transfer tax.

Estate tax: The federal estate tax applies to high-value estates. Any amount of your estate over the current estate tax threshold is subject to taxation.

Generation-skipping transfer tax: This applies to assets that skip a generation. It has the same exemption limits as the estate tax.

Inheritance tax: A tax levied on inherited money, property, investments, or other assets. It’s only collected by six states and ranges from 10% to 20%. [3]

Gift tax: A federal tax on assets given as gifts. The gift tax is in place to prevent people from avoiding taxes by “gifting” money rather than including it in an estate, like if you transfer ownership of a life insurance policy to a beneficiary while you’re still alive. There’s a lifetime exemption amount, which is the same as the estate tax limit, as well as an annual exemption amount ($17,000 in 2023). [4]

Some states also apply their own tax laws to some of these scenarios. For example, 12 states and the District of Columbia also have their own estate tax laws, [5] and others have their own inheritance tax laws. Be sure to check the guidelines and limits for your state. These taxes won’t apply in every situation, and most people are exempt from them due to their high limits, but they’re important to keep in mind as you put together a comprehensive estate plan.

Read more about how to transfer a life insurance policy

Generally, life insurance isn’t taxable — your beneficiaries receive the entire death benefit. However, some circumstances could put the death benefit at risk of taxation. When you pass away, it’s not you who will bear responsibility for taxes on your death benefit, but your loved ones.

Since every financial situation is different and life insurance needs will vary, consider speaking with a certified financial planner about your estate plans to get answers to your questions, ensure you have the life insurance coverage you need, and guarantee your beneficiaries aren’t saddled with any undue burdens.