News

Latest

Homeowners insurance

Will home insurance prices keep rising in 2024?

Read more

Health insurance

The 5 biggest health insurance trends of 2023

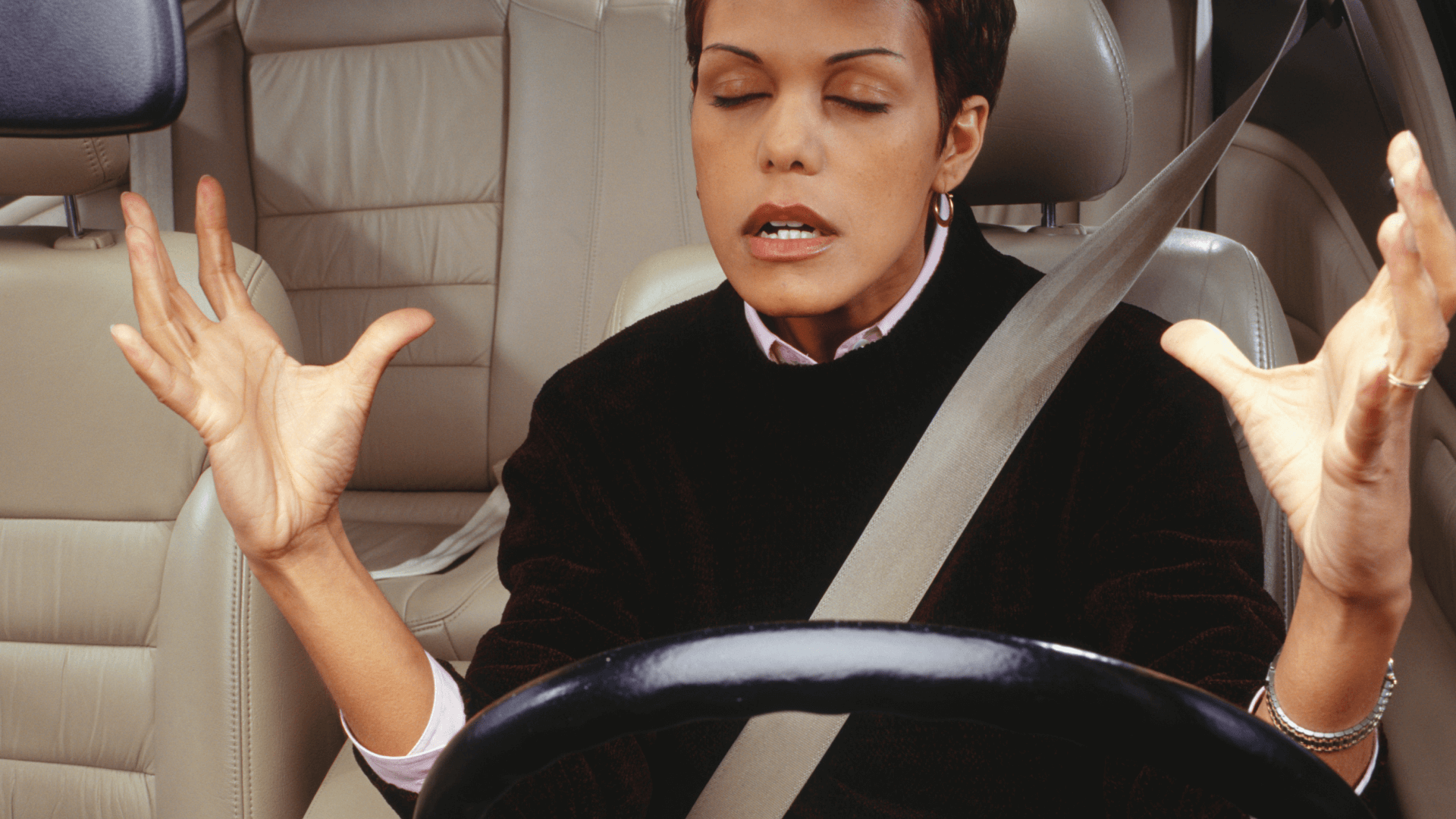

Auto insurance

How more 'fair' car insurance pricing can backfire - Policygenius

Life insurance

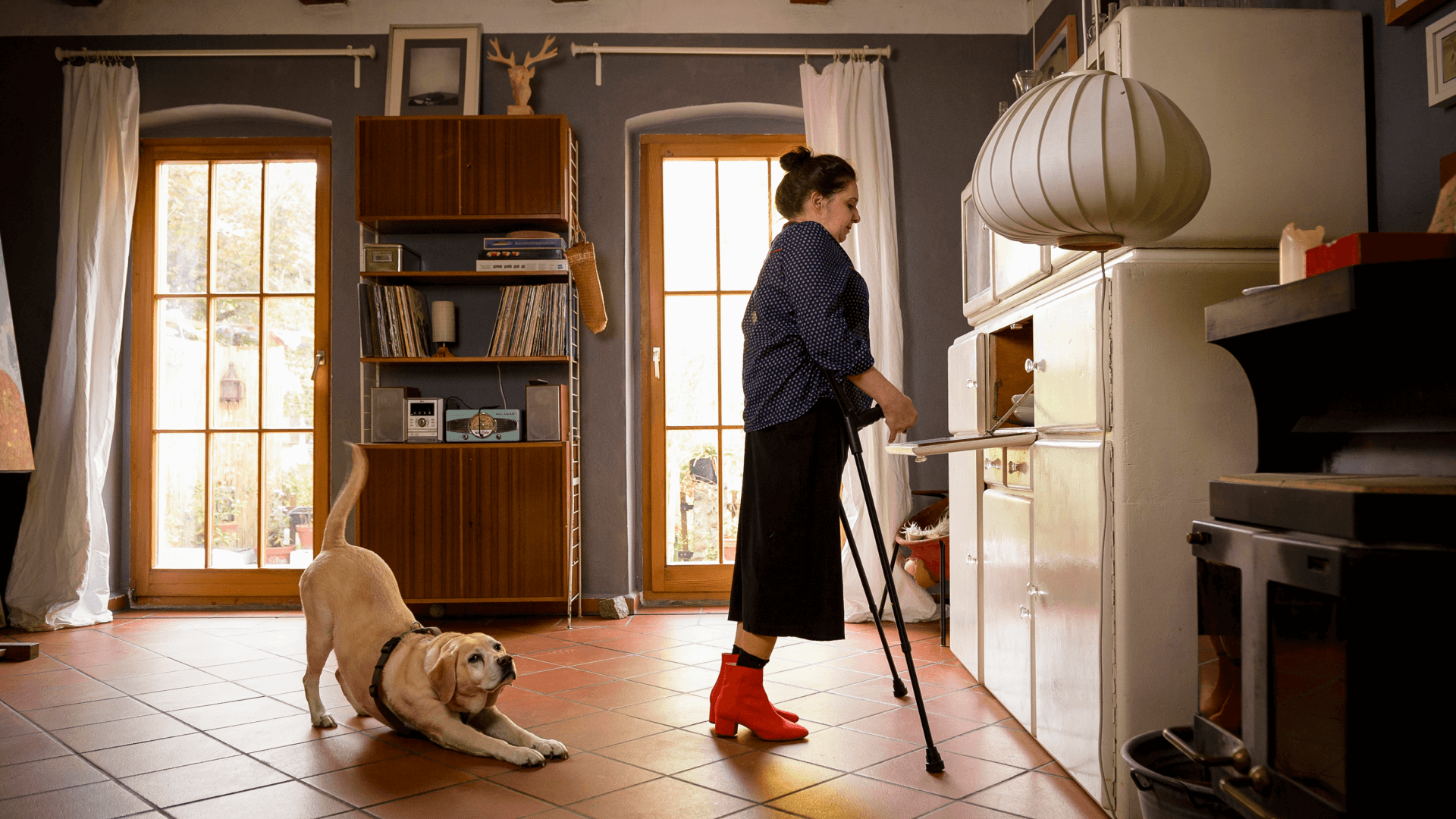

Don't know about long-term care insurance? It could cost you

More news

Health insurance

Are immigrants too costly to insure? New study challenges the myth

Homeowners insurance

How the home insurance crisis added fuel to the housing crisis fire

Health insurance

One surprising way natural disasters impact health insurance coverage

Homeowners insurance

Is the insurance crisis spreading to North Carolina?

Homeowners insurance

Why people go without home & auto insurance

Homeowners insurance

Why Florida residents may soon pay a 'hurricane tax'

Life insurance

Can DNA test results make life insurance more expensive?

Health insurance

Consumers face aggressive sales tactics for ‘junk’ health plans

Homeowners insurance

The hidden impact of hurricanes: higher insurance premiums

Homeowners insurance

If you want to keep your home insurance, watch for prying eyes in the sky

Health insurance

Here’s how Biden plans to make mental health care easier to access

Homeowners insurance

Climate change will make extreme precipitation in the Northeast 'the new normal'

View full archive

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017