Insurance is an information business: Your home insurance company needs to know how likely you are to file a claim to decide how much to charge you, or whether to cover you at all. That information can now come from above, based on reports in California that homeowners insurance companies are canceling policies based on information from aerial photography.

In a report from KGO-TV, an ABC affiliate in San Francisco, several homeowners said their insurance companies were dropping their policies based on aerial photography that found things like a cluttered yard and a drained swimming pool. The nonrenewals were all from the same insurance company, CSAA Insurance Group, which said in a statement that it “evaluates many sources of information to assess the condition of properties we insure, including third-party proprietary aerial imagery captured by fixed-wing aircraft and satellites.”

Can insurance companies drop you based on aerial photography?

Homeowners insurance companies can decide not to renew your policy for a number of reasons. Probably the most common is that you filed too many claims. But your homeowners insurance company can also cancel or not renew your policy because it stops offering coverage where you live, you’re late on payments, you experience an increase in natural disasters in your area, you added a high-risk item to your home like a trampoline or pool, or your credit score dropped.

All these factors can signal to your home insurance company that your risk of filing a claim has gone up. Aerial photography is one way of evaluating that risk. But is it an invasion of privacy?

The California civil code says a person can be held responsible for invading someone's privacy by physically entering their property or the airspace above it without permission. This invasion is done with the intention of capturing pictures, recordings, or any physical evidence of the person engaging in private, personal, or family-related activities. The invasion is considered offensive if it would upset a reasonable person.

So where does an insurance company’s use of aerial photography fall on that scale?

“Although the law in this area is evolving along with the technology, insurers have been able to obtain information from public sources that view the insured’s property from above without the insured’s permission,” says Joseph Lavitt, who teaches torts and insurance law at Berkeley Law. “As long as the effort to obtain this information doesn’t invade a person’s reasonable expectation of privacy, or work in a way that a reasonable person would find offensive, it would be difficult to conclude, at present, that such efforts are forbidden. This conclusion may change, however, as standards of offensiveness can and do evolve.”

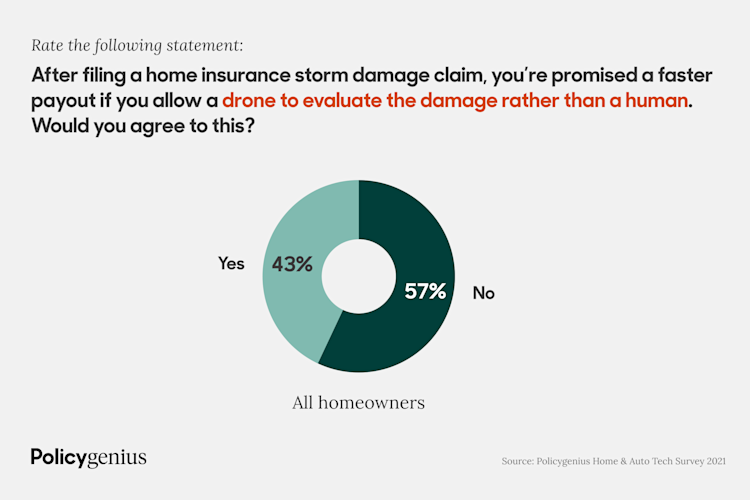

At least in the area of storm damage claims, many homeowners say they’re uncomfortable with the idea of a drone evaluating their property rather than a human during a home insurance storm damage claim, even if it led to a faster payout.

California’s evolving insurance landscape

These canceled policies are part of a broader withdrawal from California by home insurance companies. Many have decided to no longer insure homes in certain parts of the state, or have left the market altogether, leaving many residents with few options for coverage. It’s not because of drone footage — it’s because of wildfires, which have destroyed 39,000 homes in California over the past five years.

If your policy is canceled or nonrenewed, contact your insurance company to see if there are any property upgrades or other steps you can take to keep your policy. If not, you will need to shop for a new policy. In a state like California where coverage may be hard to get, you may have to work with a local insurance agent who can connect you with a company willing to cover your home. If all else fails, some states, including California, have last-resort insurance programs that provide coverage to homeowners who can’t find coverage on the private market.

Image: Andrew Merry / Getty