Health insurance was a big news item in 2023, as consumers contended with rising costs and narrower restrictions on what their plans covered. We looked back on five of the biggest stories Policygenius covered in 2023 and how they’re predicted to progress in 2024.

1. Health insurance premiums keep rising

On paper, total compensation for workers increased by 20% from 2000 to 2021. But when you subtract employee contributions to health insurance, family household income increased by only 7%, adjusting for inflation, meaning most of the raises workers have received over the past 20 years has gone toward health insurance, according to an opinion piece published in JAMA Health Forum in March.

Kevin Schulman, a professor of medicine at Stanford University and a co-author of the JAMA piece with Adita Narayan, expects these trends to continue into 2024.

“If anything, we’re likely to see a continued acceleration of health insurance premiums,” he says. “Hospitals have consolidated in most markets, and are now facing higher labor costs.”

Hospitals are passing these costs onto commercial insurance companies. Premiums increased by 7% in 2023.

2. Many families can’t afford deductibles

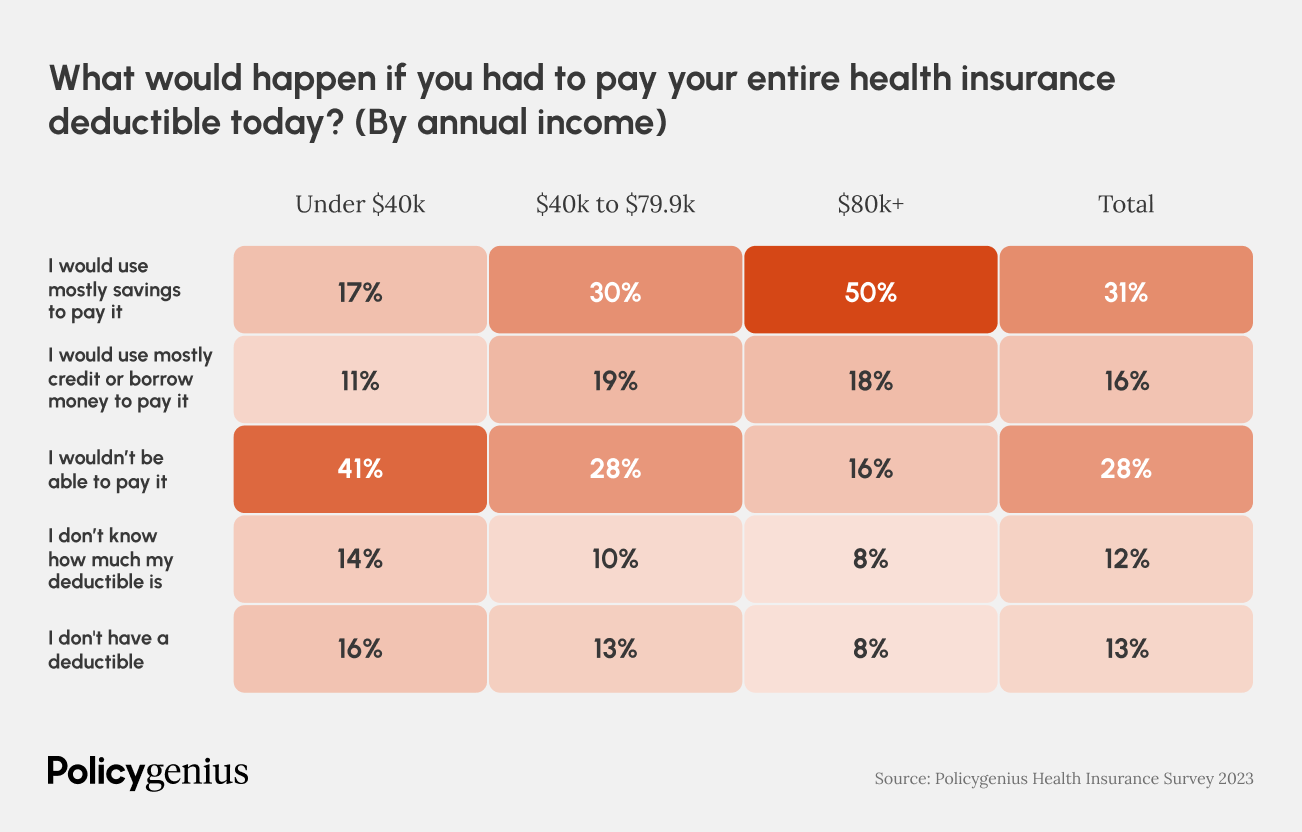

Even among Americans with health insurance, health care is still unaffordable. The Policygenius 2023 Health Insurance Survey found that 28% of Americans with health insurance wouldn’t be able to pay their deductible immediately, while another 16% said they’d have to borrow money or use credit. These families would have to choose between going into debt or paying for medical care.

“After we pay so much for commercial health insurance, the value of the benefit continues to decline,” Schulman says. “For lower-income employees, (or for mid-level employees), high premiums, deductibles, and cost-sharing price health care services out of reach.”

3. Access to mental health care remains a struggle

Self-reported mental health reached a new low in the wake of the pandemic. In response, the Biden administration has proposed a rule aimed at lowering barriers to getting mental health and substance abuse treatment by requiring health insurers to demonstrate that they’re providing equal access to medical and mental health care.

Comments on the proposed rule closed in October.

“But it typically takes many months — sometimes years — for government agencies to review and respond to public comments, and to finalize proposed rules,” says Dr. Paul Appelbaum, a professor of psychiatry at Columbia University. “That may happen at some point in 2024.”

But, Appelbaum says, whether the rules actually improve access depends on how assertively they’re enforced.

“No enforcement, no change,” he says.

4. Consumers face aggressive sales for junk health insurance

Millions of people lost their Medicaid coverage this year, and a secret shopper study conducted by researchers at Georgetown University finds that many of them may be sold “limited benefit” health plans, or what President Joe Biden calls “junk insurance.”

These plans cover fewer services than traditional Obamacare plans, and have more restrictions.

As with mental health care, the Biden administration is finalizing a rule to address the issue. It would limit short-term plans to a maximum duration of four months and require clearer disclosure that they aren’t the same as comprehensive health plans.

5. The definition of ‘medically necessary’ is getting more strict

Research published in the Iowa Law Review documented how many health insurers are adopting more black-and-white, technical rules for what they’ll cover, with the end result being that your coverage is less generous.

ProPublica in 2023 documented other ways health insurance companies have made it easier for themselves to say no to patients, sometimes breaking the law to do so.

Image: Catherine Falls Commercial / Getty Images