Cheapest car insurance companies for liability-only insurance

We found that GEICO has the cheapest liability-only car insurance for most drivers who want minimum coverage (meaning the least amount of insurance required by law). Auto-Owners has the cheapest liability insurance overall, but it’s not available in every state.

A liability-only insurance policy refers to a policy that does not include comprehensive or collision coverage. With liability-only insurance, you’d only be covered for damage you cause to others in an accident, not for damage to your own car.

What is the cheapest liability car insurance?

Liability-only car insurance costs an average of $51 per month (or $617 per year), but there are some companies with cheaper-than-average rates.

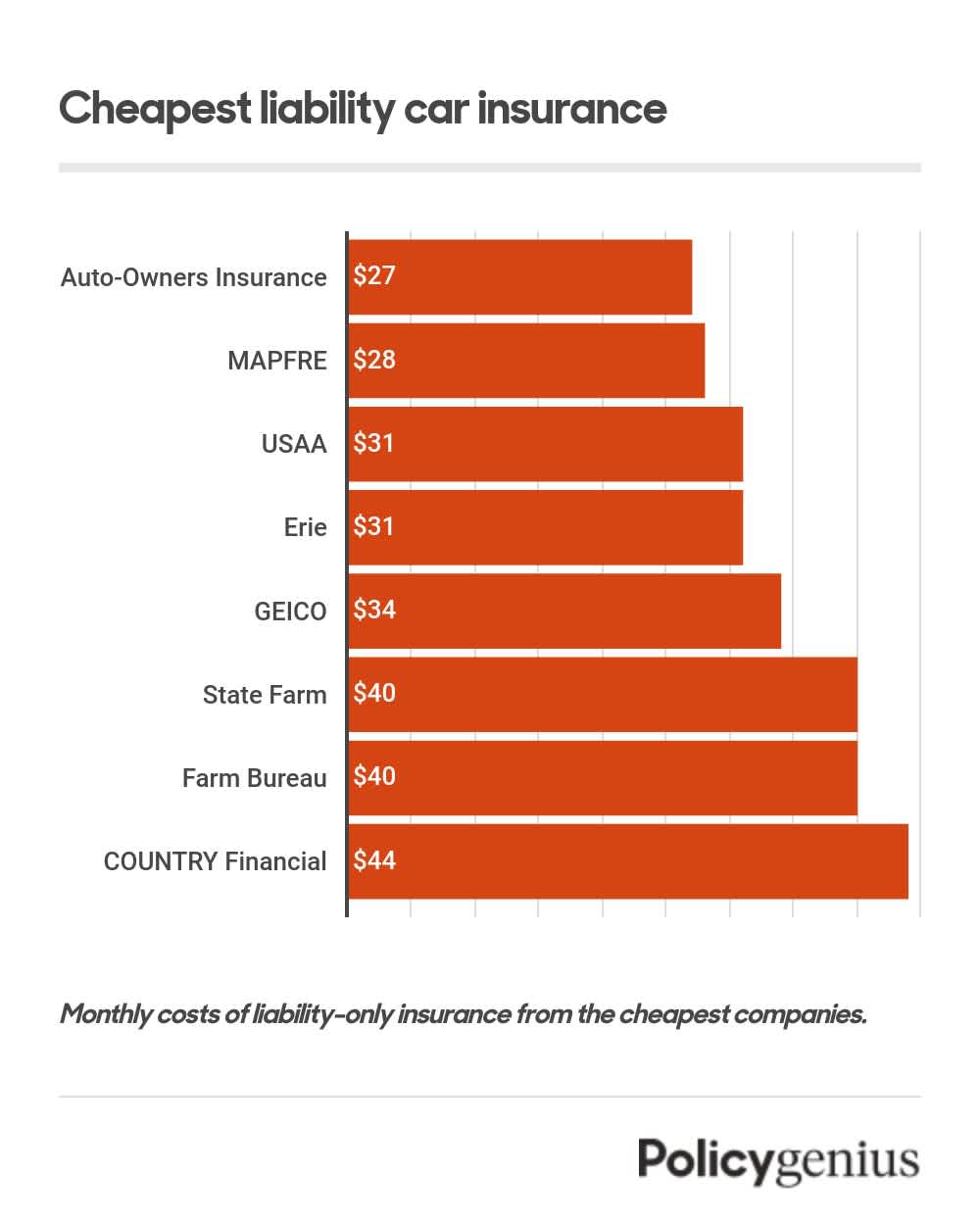

We found that the cheapest liability-only car insurance is Auto-Owners Insurance. On average, the cost of a liability car insurance policy from Auto-Owners is $27 per month, or $327 per year.

Drivers can also get some of the cheapest insurance from smaller companies like MAPFRE and Erie, as well from USAA, which only offers policies to drivers who are affiliated with the military. But since these companies aren’t available to everyone, GEICO is the cheapest liability-only insurance for most people.

Cheapest liability-only insurance for most people: GEICO

GEICO is the cheapest liability-only insurance company of any nationally available company. It’s the only company in our top picks that’s available in every state.

On average, liability-only car insurance from GEICO costs $34 per month ($402 per year). That’s $215 cheaper per year than average. That’s also just $35 more expensive per year than the company with the cheapest liability-only insurance.

Company | Monthly cost | Annual cost |

|---|---|---|

USAA* | $31 | $369 |

GEICO | $34 | $370 |

State Farm | $40 | $402 |

Nationwide | $52 | $475 |

Travelers | $57 | $526 |

Five major car insurance companies with the cheapest liability insurance.

GEICO also has a range of discounts that drivers can use to get even cheaper rates. You can save on your GEICO policy if you:

Own a car with safety and anti-theft tech

Stay accident-free for at least five years

Take a defensive driving or driver’s education class

Keep your grades high if you’re a student

Are a federal employee or a member of the military

Bundle more than one policy with GEICO

Insure more than one vehicle on the same policy

Are a part of one of GEICO’s affiliate organizations

Cheapest liability-only insurance from a smaller company: Auto-Owners

Auto-Owners has the cheapest liability-only car insurance of any company on our list. On average, the cost of a minimum-coverage liability-only policy from Auto-Owners is $27 per month ($327 per year). That’s $290 less per year than the national average.

Company | Monthly cost | Annual cost |

|---|---|---|

Auto-Owners Insurance | $27 | $327 |

MAPFRE | $28 | $335 |

USAA | $31 | $369 |

Erie | $31 | $370 |

GEICO | $34 | $402 |

Cost of liability car insurance from the five cheapest companies.

Drivers can get even cheaper liability-only auto insurance with discounts. Auto-Owners offers discounts for drivers who:

Bundle multiple policies with Auto-Owners

Insure more than one car on the same policy

Make on-time payments for three consecutive years

Pay their entire annual premium at once

Enroll in paperless billing

Switch to make online payments

Request a quote before their policy’s start date

Own a car with safety and anti-theft tech

While Auto-Owners has cheap liability insurance, it isn’t available everywhere. Auto-Owners only offers car insurance in 26 states, and doesn’t offer coverage in California, New York, or Texas.

Cheapest liability-only insurance for people in the military: USAA

Drivers in the military (and their families) can get cheap liability car insurance from USAA. We found that the average cost of a liability-only insurance policy from USAA is $31 per month ($369 per year). That’s $248 less per year than the national average.

Besides having excellent rates for liability insurance for military families, USAA has a few discounts that drivers can use to lower their costs. You can get qualify for discounts from USAA if you:

Keep your garage on a military base

Maintain high grades if you’re a student

Bundle your home and auto policies with USAA

Own a new car or one with anti-theft tech

Drive less than average

USAA also has great customer service. It ranks near or at the top of J.D. Power’s Auto Claims Satisfaction Survey year after year, which means customers feel good about the claims process with USAA. [1]

Cheapest liability-only car insurance after an accident: State Farm

State Farm has the cheapest liability-only car insurance for people with a recent accident on their driving record. On average, we found that liability-only insurance from State Farm costs $49 per month ($585 per year) after you’re in an at-fault accident.

We found that the cost of liability-only insurance from State Farm is still $331 less per year than the average after an accident. There are a few companies that have slightly lower rates for higher-risk drivers, but none are as widely available as State Farm.

State Farm doesn’t have as many discounts as competitors, but it does offer some opportunities to save, including for drivers who:

Bundle home and auto insurance with State Farm

Drive a newer car

Own a vehicle with safety and anti-theft tech

Insure more than one car on the same policy

Cheapest liability car insurance in every state

The cost of liability-only car insurance depends heavily on where you live. In some states, the difference between the cheapest company and the average cost of insurance can be hundreds, or even thousands, of dollars per year.

We found that the cheapest companies at the statewide level are GEICO and USAA, which have the best rates for liability-only insurance in a combined 32 states.

Since the cheapest company for liability car insurance varies so much depending on where you live, it’s even more important to compare quotes from the best companies before you get insurance.

State | Cheapest company | Average monthly cost | Minimum liability required |

|---|---|---|---|

GEICO | $68 | $25,000/$50,000/$25,000 | |

State Farm | $66 | $50,000/$100,000/$25,000 | |

GEICO | $62 | $25,000/$50,000/$15,000 | |

USAA | $70 | $25,000/$50,000/$25,000 | |

Wawanesa | $81 | $15,000/$30,000/$5,000 | |

American National | $61 | $25,000/$50,000/$15,000 | |

GEICO | $55 | $25,000/$50,000/$25,000 | |

Travelers | $93 | $25,000/$50,000/$10,000 | |

GEICO | $69 | $25,000/$50,000/$10,000 | |

GEICO | $107 | $10,000 property damage | |

Auto-Owners | $68 | $25,000/$50,000/$25,000 | |

GEICO | $51 | $20,000/$40,000/$10,000 | |

American National | $37 | $25,000/$50,000/$15,000 | |

Pekin | $51 | $25,000/$50,000/$20,000 | |

USAA | $50 | $25,000/$50,000/$25,000 | |

West Bend | $53 | $20,000/$40,000/$15,000 | |

USAA | $66 | $25,000/$50,000/$25,000 | |

GEICO | $74 | $25,000/$50,000/$25,000 | |

USAA | $115 | $15,000/$30,000/$25,000 | |

GEICO | $41 | $50,000/$100,000/$25,000 | |

USAA | $63 | $30,000/$60,000/$15,000 | |

USAA | $77 | $20,000/$40,000/$5,000 | |

GEICO | $76 | $20,000/$40,000/$10,000 | |

Farm Bureau | $60 | $30,000/$60,000/$10,000 | |

USAA | $65 | $25,000/$50,000/$25,000 | |

USAA | $54 | $25,000/$50,000/$10,000 | |

USAA | $62 | $25,000/$50,000/$20,000 | |

Auto-Owners | $65 | $25,000/$50,000/$25,000 | |

GEICO | $72 | $25,000/$50,000/$20,000 | |

State Farm | $51 | Optional | |

GEICO | $74 | $25,000/$50,000/$25,000 | |

State Farm | $65 | $25,000/$50,000/$10,000 | |

American Family | $80 | $25,000/$50,000/$10,000 | |

GEICO | $45 | $30,000/$60,000/$25,000 | |

USAA | $55 | $25,000/$50,000/$25,000 | |

Erie | $43 | $25,000/$50,000/$25,000 | |

USAA | $69 | $25,000/$50,000/$25,000 | |

State Farm | $74 | $25,000/$50,000/$20,000 | |

Erie | $56 | $15,000/$30,000/$5,000 | |

State Farm | $71 | $25,000/$50,000/$25,000 | |

American National | $49 | $25,000/$50,000/$25,000 | |

Kemper | $65 | $25,000/$50,000/$25,000 | |

USAA | $62 | $25,000/$50,000/$25,000 | |

Farm Bureau | $76 | $30,000/$60,000/$25,000 | |

GEICO | $58 | $25,000/$65,000/$15,000 | |

USAA | $53 | $25,000/$50,000/$10,000 | |

USAA | $58 | $30,000/$60,000/$20,000 | |

USAA | $71 | $25,000/$50,000/$10,000 | |

USAA | $65 | $25,000/$50,000/$25,000 | |

USAA | $50 | $25,000/$50,000/$10,000 | |

American National | $52 | $25,000/$50,000/$20,000 |

Rates for the minimum amounts of insurance required in every state.

How to get cheaper liability-only insurance

A liability-only policy will usually be cheaper than a full-coverage policy (which includes comprehensive and collision), but it’s still possible to find even cheaper liability insurance.

The best way to find the cheapest liability-only car insurance is by comparing quotes from multiple companies before you buy. That way, you can see right away which one offers the cheapest liability insurance. You can also get cheap liability-only auto insurance by:

Signing up for usage-based insurance: When you sign up for usage-based insurance, your insurance company monitors your driving for a few weeks and awards lower rates for safe driving.

Enrolling in a defensive driving course: You could get cheaper liability-only insurance by taking a defensive driving course (or a driver’s education course if you’re a young driver).

Switching companies if your rates go up: When your policy is up for renewal, it’s a good idea to compare rates again and switch if there’s a company that offers cheaper liability-only car insurance.

Getting a broad form policy: A broad form policy is cheaper than even a minimum liability policy, but only one driver is allowed to use the insured vehicle and you can’t add comprehensive or collision coverage.

How does liability-only insurance work?

Liability-only insurance only covers the cost of the other driver’s medical expenses and repair bills after an at-fault accident. Your policy will cover you up to its limits, which are usually shown per person and per accident.

For instance, let’s say that you have liability-only car insurance with these limits:

Bodily injury liability insurance: $25,000 per person, $50,000 per accident

Property damage liability insurance: $25,000 per accident

This means that your bodily injury liability insurance would cover up to $25,000 in injuries for the other drivers and their passengers. But you’ll only be covered for up to $50,000 for the entire accident.

Your liability-only insurance does not cover damage to your own vehicle after a crash that you cause. That’s where a full-coverage policy would come in. Without collision and comprehensive coverage, you’d be stuck paying to replace your car yourself if you damage it in a crash.

Should you get liability-only insurance?

It’s tempting to get liability-only insurance instead of full-coverage. Liability-only insurance is, on average, $1,035 per year less than the cost of a full-coverage policy. But most drivers need the protection of a full-coverage policy.

Liability-only insurance won’t cover damage to your own car after an accident that you cause. While the other person’s injuries and property damage would be covered up to your policy’s limits, you would have to repair (or replace) your car yourself.

There are some cases when it makes sense to get liability-only insurance, so you may want to drop full-coverage if:

Your car is an old clunker that wouldn’t cost much to replace

Your car is worth less than your collision or comprehensive deductible amount

If you do get liability-only insurance, you should still get more than the minimum amounts required in your state. It’s not very expensive to add more liability insurance, so you should get as much as you can afford even if you don’t get full-coverage.

It can be easy for the cost of someone else’s damage or injuries to exceed your state’s minimum liability limits after a crash. With only enough insurance to drive, you could easily be stuck paying tens of thousands of dollars out of pocket.

If you choose to buy liability-only car insurance, it is important to choose the highest level of coverage you can afford. If you don't have enough liability insurance to cover the damage caused in an at-fault accident, you will be held responsible for any costs that go beyond your coverage limits. We recommend a minimum of 100/300/100 levels of liability coverage but, if that is too expensive, you should buy the highest level of liability coverage you can afford.

How much is liability-only insurance compared to full-coverage?

According to the National Association of Insurance Commissioners, the cost to go from liability-only policy insurance to a full-coverage policy is $518 per year. But the cost for you to upgrade your liability-only insurance depends on how much insurance you have. [2]

For example, if you had liability-only insurance with higher limits it will be closer in price to a full-coverage policy. But let’s say you have the legal minimum amounts of liability insurance, and you want to add more liability insurance and full-coverage. Then it would cost an average of $1,035 to upgrade your policy.

The cost of liability-only insurance compared to full-coverage also depends on your insurance carrier. Among our cheapest companies for liability-only car insurance, we found that the cost to upgrade to full-coverage is lowest at MAPFRE, USAA, and State Farm.

Company | Cost difference | Liability-only coverage | Full-coverage |

|---|---|---|---|

Auto-Owners Insurance | $888 | $324 | $1,212 |

MAPFRE | $732 | $336 | $1,068 |

USAA | $756 | $372 | $1,128 |

Erie | $780 | $372 | $1,152 |

GEICO | $768 | $408 | $1,176 |

State Farm | $756 | $480 | $1,236 |

Farm Bureau | $1,044 | $480 | $1,524 |

COUNTRY Financial | $984 | $528 | $1,512 |