What are the cheapest car insurance companies for new drivers?

The cheapest car insurance for new drivers depends on whether they’re being added to an existing policy or buying their own coverage. On average, GEICO is the best cheap company for new drivers who are added to their family’s policy. State Farm is the best option for new drivers who decide to get their own coverage.

Auto insurance for new drivers can cost thousands of dollars more per year than insurance for more experienced drivers. But new drivers can still get cheap insurance by comparing quotes from multiple companies, and by considering per-mile or usage-based insurance.

Who do insurance companies consider new drivers?

There’s not necessarily one definition for who insurance companies consider new drivers. For insurance purposes, teenage drivers aren’t the only member of this group. Instead, “new drivers” can be anyone who:

Recently got their license, no matter their age

Has never had car insurance or been a part of a policy

Just moved to the United States from another country

Despite their inexperience, newly licensed drivers don’t need to get a separate type of new-driver car insurance to meet their state’s insurance requirements. The only difference for new drivers is that their insurance coverage will be more expensive since they don’t have a driving record yet.

Where to get auto insurance for new drivers

If you��’re someone insurance companies consider a new driver, the process of buying car insurance will be the same for you as for experienced drivers. You can still get coverage from well known companies.

New teen drivers will have the best luck if they’re added to an existing family policy, while newly-licensed adults may have to shop for their own coverage.

But it might be hard for some new drivers to find their own car insurance. It’s more expensive, and insurance companies don’t always let newly licensed drivers fill out an online quote form to get their own insurance. Also, if you’re a minor and you want your own car insurance, you’ll have to get approval from a parent or guardian.

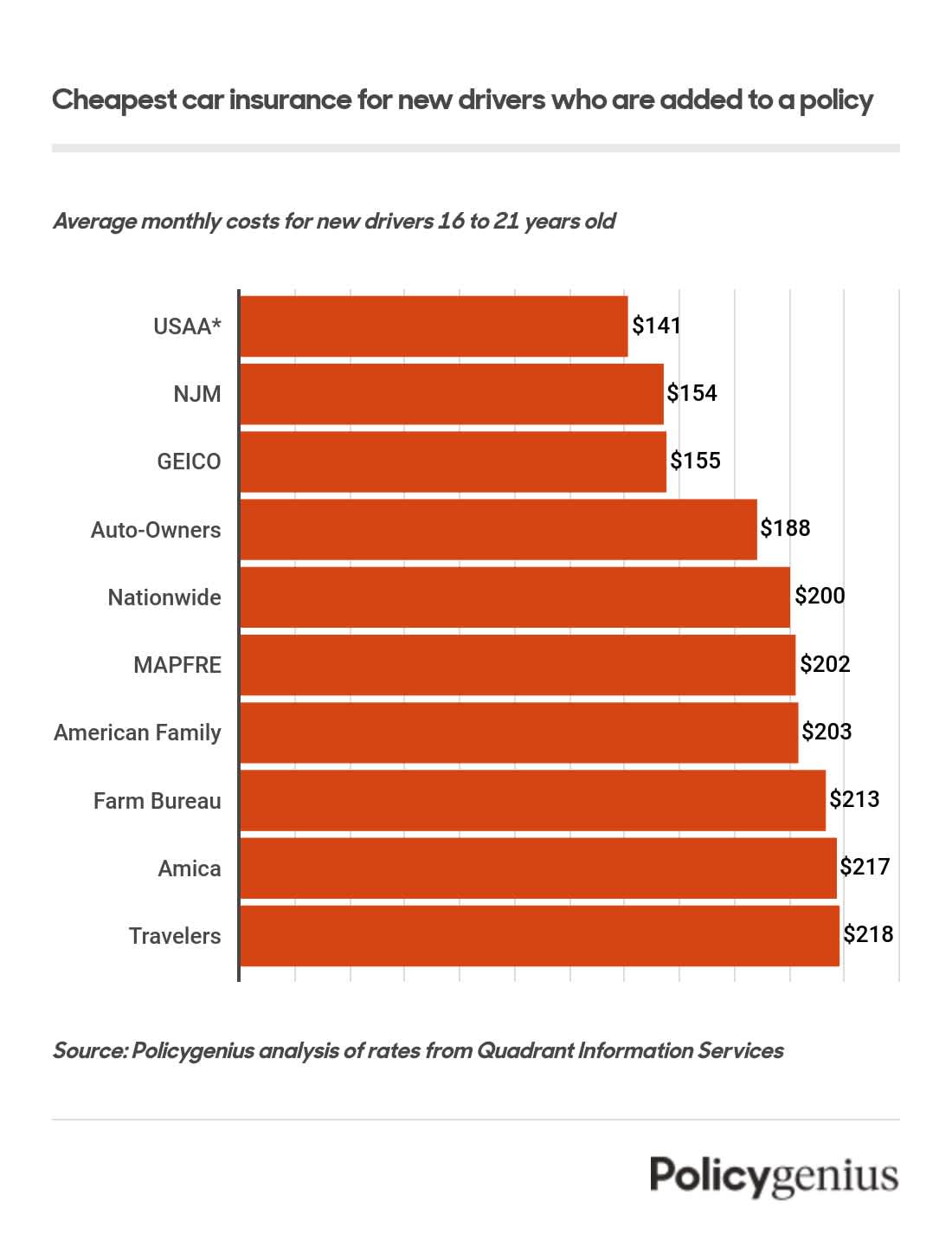

Cheapest car insurance for adding a new driver

GEICO is the best and cheapest car insurance for families adding a new driver to an existing car insurance policy. GEICO isn’t the cheapest overall, but it’s still an affordable choice that’s available in every state. We found that at $240 per month, GEICO cost $907 less per year than the average rates for new drivers.

NJM is the absolute cheapest car insurance for new drivers but it’s only available in Connecticut, Maryland, New Jersey, Ohio, or Pennsylvania. But new driver insurance from NJM is only slightly cheaper than GEICO — $6 per year on average.

Members of the military, both active-duty and retired vets (and their families) can also get cheap car insurance for new drivers from USAA, where coverage for new drivers costs $141 a month ($1,076 cheaper per year than average). But unlike GEICO and NJM, USAA isn’t available to the general public.

Company name | Average monthly cost | Average annual cost |

|---|---|---|

USAA* | $141 | $1,687 |

NJM | $154 | $1,853 |

GEICO | $155 | $1,856 |

Auto-Owners | $188 | $2,260 |

Nationwide | $200 | $2,400 |

MAPFRE | $202 | $2,420 |

American Family | $203 | $2,440 |

Farm Bureau | $213 | $2,551 |

Amica | $217 | $2,608 |

Travelers | $218 | $2,612 |

State Farm | $223 | $2,678 |

Progressive | $229 | $2,751 |

COUNTRY | $230 | $2,756 |

Shelter | $237 | $2,846 |

AVG | $230 | $2,763 |

Farmers | $244 | $2,931 |

AAA | $254 | $3,053 |

Erie | $259 | $3,112 |

Allstate | $260 | $3,125 |

National General | $269 | $3,226 |

Kemper | $311 | $3,737 |

Hartford | $336 | $4,032 |

CSAA | $362 | $4,350 |

Mercury | $385 | $4,618 |

Sentry | $411 | $4,929 |

Hanover | $528 | $6,333 |

Full-coverage car insurance rates for new drivers at the 20 cheapest companies.

How to add a new driver to an existing policy

Most insurance companies require that every licensed driver in your household be included on your car insurance policy. Fortunately, it’s easy to add a new driver to an existing policy.

You can usually add a new driver to an existing policy over the phone or online, through your insurance company’s website or mobile app.

You’ll need a few key pieces of information on hand to add a driver to a car insurance policy, including their:

Name and birthday

Social Security Number

Drivers license number

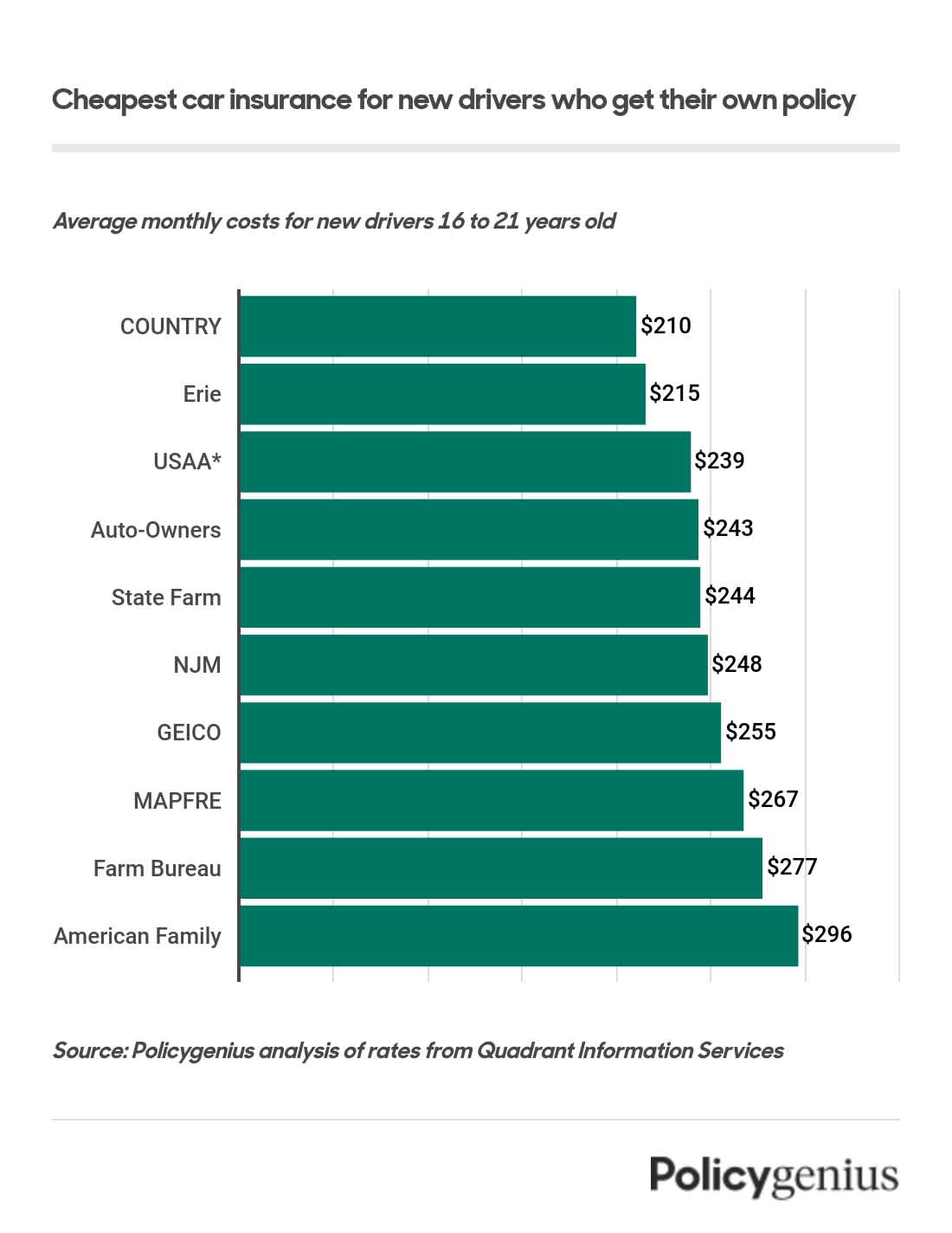

Cheapest car insurance for new drivers who get their own policy

State Farm has the best and cheapest car insurance for new drivers who are buying their own policy. On average, new-driver insurance costs $380 per month with State Farm, which is $1,632 cheaper per year than average for new drivers.

Car insurance from State Farm is available in every state except Massachusetts and Rhode Island, but depending on where you live a smaller company might be a cheaper option. We found that COUNTRY, followed by Erie and Auto-Owners all have cheap auto insurance for new drivers.

Company | Average monthly cost | Average annual cost |

|---|---|---|

COUNTRY | $210 | $2,515 |

Erie | $215 | $2,578 |

USAA* | $239 | $2,871 |

Auto-Owners | $243 | $2,913 |

State Farm | $244 | $2,930 |

NJM | $248 | $2,981 |

GEICO | $255 | $3,059 |

MAPFRE | $267 | $3,199 |

Farm Bureau | $277 | $3,322 |

American Family | $296 | $3,546 |

Travelers | $358 | $4,298 |

Nationwide | $360 | $4,314 |

Shelter | $371 | $4,447 |

Kemper | $415 | $4,975 |

Allstate | $459 | $5,513 |

CSAA | $486 | $5,836 |

National General | $494 | $5,926 |

Hartford | $520 | $6,242 |

Progressive | $559 | $6,708 |

Amica | $571 | $6,855 |

Farmers | $578 | $6,935 |

Sentry | $637 | $7,648 |

AAA | $654 | $7,849 |

Mercury | $793 | $9,514 |

Hanover | $957 | $11,487 |

Cost of full-coverage car insurance for new drivers at the 20 cheapest companies.

Cheapest new driver car insurance in every state

The cheapest auto insurance for new drivers depends on lots of other factors too — especially location.

Here are the cheapest car insurance companies for new drivers in every state — whether you’re adding a newly-licensed driver to your family policy or you’re a new driver shopping on your own.

State | Cheapest for adding a driver | Cheapest for their own policy |

|---|---|---|

USAA | COUNTRY | |

USAA | USAA | |

GEICO | GEICO | |

Farm Bureau | Farm Bureau | |

Wawanesa | Wawanesa | |

National General | American National | |

General Electric | State Farm | |

USAA | State Farm | |

GEICO | Erie | |

UAIC | GEICO | |

USAA | Auto-Owners | |

USAA | GEICO | |

State Farm | American National | |

Pekin | Pekin | |

Allstate | USAA | |

IMT | State Farm | |

USAA | American Family | |

GEICO | GEICO | |

Farm Bureau | USAA | |

Auto-Owners | Auto-Owners | |

USAA | USAA | |

USAA | USAA | |

Farm Bureau | GEICO | |

Farm Bureau | Farm Bureau | |

USAA | USAA | |

USAA | USAA | |

USAA | State Farm | |

Farm Bureau | Farmers Mutual of Nebraska | |

GEICO | COUNTRY | |

MMG | Auto-Owners | |

GEICO | GEICO | |

USAA | USAA | |

Progressive | American Family | |

State Farm | State Farm | |

North Star | American Family | |

GEICO | USAA | |

American Farmers and Ranchers | American Farmers and Ranchers | |

COUNTRY | COUNTRY | |

Nationwide | GEICO | |

GEICO | USAA | |

State Auto | American National | |

Farm Bureau | State Farm | |

USAA | State Farm | |

Redpoint | Farm Bureau | |

Farm Bureau | GEICO | |

Auto-Owners | Auto-Owners | |

USAA | GEICO | |

PEMCO | State Farm | |

GEICO | State Farm | |

GEICO | USAA | |

USAA | USAA |

Cost of full-coverage car insurance for new drivers in every state.

Car insurance for new drivers who just moved to the U.S.

No matter their age or experience behind the wheel, anyone who moves to the United States is considered a new driver. Because these drivers don’t have an insurance history with U.S. companies, it’s hard to evaluate their chances of making a future claim.

While the cost of insurance for international drivers who were just licensed will be more expensive, regardless of their experience in their home country, their rates will still go down with time as long as they avoid accidents and tickets.

In the meantime, foreign drivers who move to the United States can get the best rates from the same companies that are cheapest for new drivers, including GEICO and State Farm.

Can new drivers get car insurance if they’re undocumented?

New drivers can still get car insurance if they’re undocumented immigrants, but it depends on where they live. Not every state allows undocumented new drivers to get a license — which you need to get car insurance.

But the following states do allow undocumented new drivers to get a license — and car insurance — even without proof of citizenship. These states are:

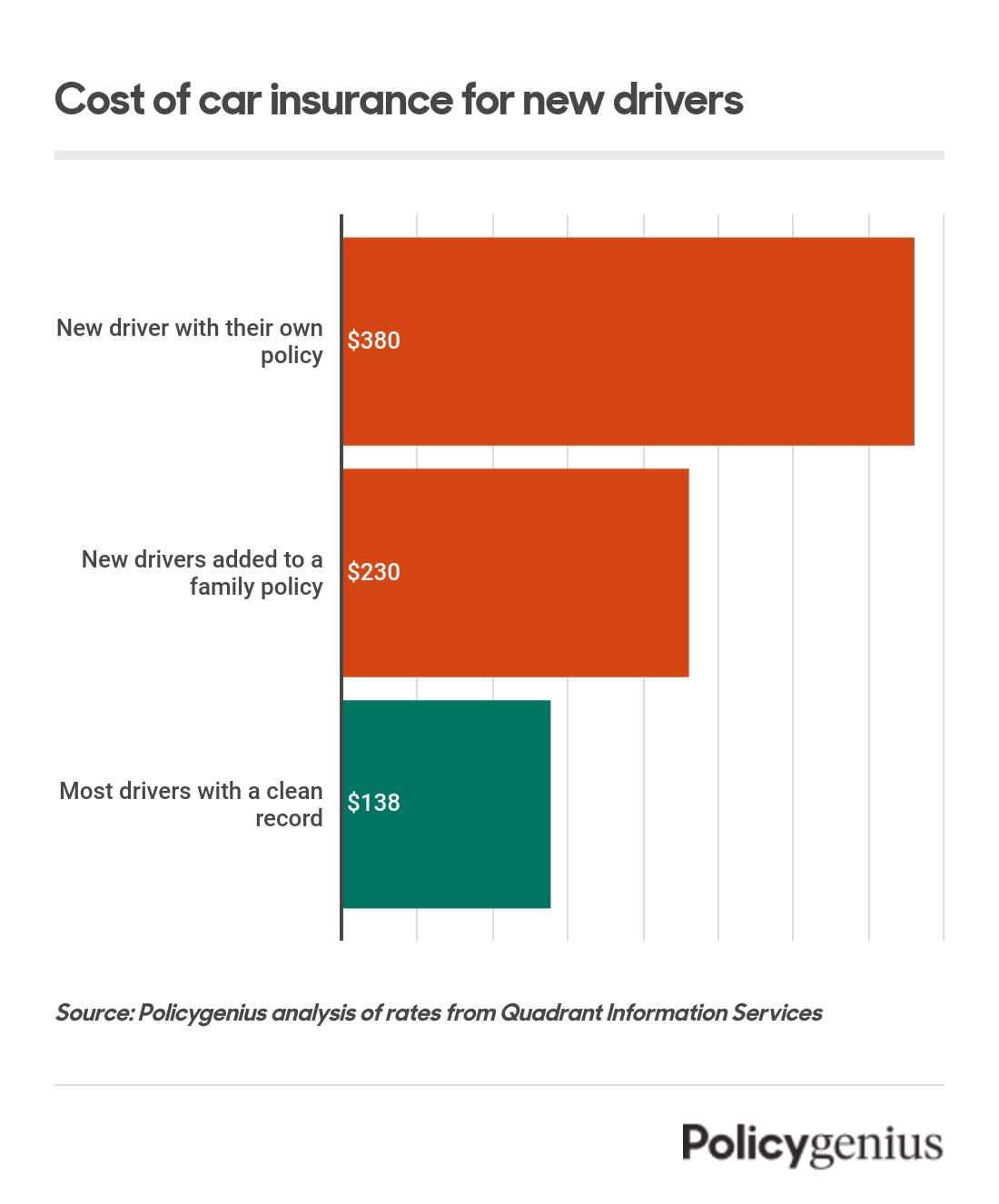

What does new driver insurance cost?

Car insurance for new drivers is always more expensive than the average rates for older, more experienced ones. But it’s even harder to find cheap car insurance when you’re a new driver shopping for your own policy instead of being added to an existing one.

On average, the cost of standalone new-driver insurance is $380 per month, or $4,562 per year. That’s nearly $2,000 more expensive per year than adding a new driver to an existing policy, which costs $230 per month, or $2,763 per year.

Among the largest companies, the cost of car insurance for new drivers is $280 more expensive per month than it is for most older drivers (ages 30 to 45) who have a comparable standalone policy.

Company | New drivers | Experienced drivers |

|---|---|---|

COUNTRY | $210 | $115 |

Erie | $215 | $94 |

USAA* | $239 | $87 |

Auto-Owners | $243 | $99 |

State Farm | $244 | $98 |

NJM | $248 | $123 |

GEICO | $255 | $99 |

MAPFRE | $267 | $87 |

Farm Bureau | $277 | $123 |

American Family | $296 | $118 |

Travelers | $358 | $125 |

Nationwide | $360 | $123 |

Shelter | $371 | $146 |

Kemper | $415 | $138 |

Allstate | $459 | $165 |

CSAA | $486 | $201 |

National General | $494 | $143 |

Hartford | $520 | $162 |

Progressive | $559 | $148 |

Amica | $571 | $141 |

Farmers | $578 | $162 |

Sentry | $637 | $270 |

AAA | $654 | $215 |

Mercury | $793 | $217 |

Hanover | $957 | $308 |

Monthly costs of full-coverage insurance.

Why is insurance so expensive for young drivers?

There are a couple of reasons why car insurance costs new drivers more than older drivers. Because of their inexperience, newly-licensed drivers are more likely to be involved in a serious accident than their more seasoned counterparts.

Companies also look at your driving record to predict how likely you are to get in an accident. But since new drivers don't have a record yet, companies charge them higher rates until they've proven they're safe drivers.

How to get cheap car insurance for first-time drivers

The best way to find insurance for new drivers that’s not too expensive is by shopping around and comparing quotes, but you should also:

Add a new driver to an existing policy: If you’re a newly-licensed teen or young adult who lives at home, you can save money by staying on your parents’ car insurance instead of buying your own.

Be ready to switch companies: Since you can switch insurance carriers at any time, shop around at least once a year and get quotes from other places if adding a new driver to a policy makes it too expensive.

Make sure you’re getting every available discount: Most discounts are automatically applied when you shop for coverage, but you might qualify for more over the course of your policy. If you’re a new driver and you have a life-changing event, like getting married, you could end up being eligible for more discounts.

Consider usage-based or per-mile car insurance: Signing up for a usage-based program like Drivewise or Rightrack, your rates will be set based partly on your driving behavior. That means you’ll save for being a good driver or drive infrequently.

Methodology

Policygenius found the cost of car insurance for new drivers using rates provided by Quadrant Information Services. These rates corresponded to every ZIP code in all 50 states by the District of Columbia. Our sample insured vehicle was a 2017 Toyota Camry LE driven 10,000 miles per year.

We calculated the cost of adding a driver to an existing policy by finding the average yearly rate of decay for drivers aged 17 through 21. Then we applied these rates of change to the one-year-younger driver’s average rate for each company, starting with the cost of adding a 16-year-old to an existing policy.

Our sample policies used the following rates:

Bodily injury liability: $50,000 per person, $100,000 per accident

Property damage liability: $50,000 per accident

Uninsured/underinsured motorist: $50,000 per person, $100,000 per accident

Comprehensive: $500 deductible

Collision: $500 deductible

Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of costs. Your actual quotes may differ.