Philadelphia residents have a lot to feel good about — the Eagles won the Super Bowl and are positioned to compete for years to come, and rent prices have remained at reasonable levels even as they’ve skyrocketed in other East Coast cities.^ As the number of renters increases in the City of Brotherly Love, so should the number of people purchasing renters insurance.

Renters insurance ensures that your personal belongings are protected. There are countless reasons you should consider renters insurance if you live in Philadelphia, from rate affordability to the high risk of weather-related damage to break-ins. Read on to learn more about why renters insurance makes sense for Philadelphia residents.

Best renters insurance companies in Philadelphia

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | $15.67 | $14.92 |

Allstate | $25.00 | $23.00 |

Travelers | $19.00 | $17.00 |

Stillwater | $12.08 | $12.08 |

Lemonade | $12.67 | $11.09 |

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000.00 | $1,000 | $1,000 | $2,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance is about far more than just protecting your personal property. Here’s a rundown of the components you should look for in a policy when comparing renters insurance rates.

Property coverage: reimbursement for lost, stolen, or damaged property.

Liability coverage: covers legal expenses in the event someone is injured in your residence and they sue you.

Loss of use: covers temporary living expenses if your residence becomes uninhabitable.

Medical payments to others: covers medical costs in the event someone is injured in your residence and requires medical treatment.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Philadelphia?

No, renters insurance isn’t a legal requirement in Philadelphia or the state of Pennsylvania, but landlords and management companies may include a provision in the lease that requires renters insurance as a condition for signing, and this is completely legal.

In fact, considering Philadelphia’s susceptibility to harsh snowstorms, and recently, hurricanes, landlords may be doing Philadelphians a favor by requiring renters insurance.

Reasons to buy renters insurance in Philadelphia

Renters insurance is among some of the most affordable insurance types to buy, and considering your most cherished personal belongings are typically stored in your residence or storage units, it should be a no-brainer in any city.

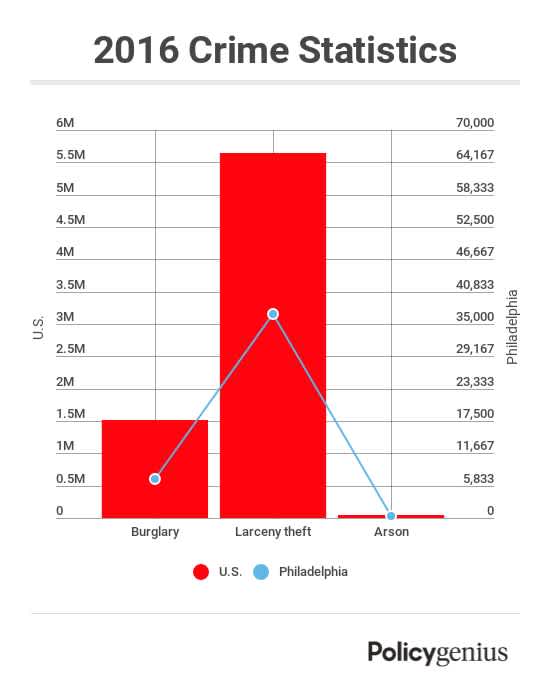

And while instances of burglary have decreased by almost half over the past decade in Philadelphia, property crime as a whole (arson, larceny, burglary) remains about 22% higher than the national average.† Renters insurance is a nice safeguard to have, given the high theft potential of urban areas.

As for weather, Philadelphia experiences just about every element, though nothing in hazardous amounts.‡ But the storm potential and unpredictability of East Coast cities is ever-present in Philadelphia, and the recent trend of tropical storms drifting north is particularly unsettling.

Thankfully, renters insurance protects personal belongings against perils like wind, hail, and fire. However it won’t cover other hurricane-related perils like flood-damage, which is something to keep in mind when you select a policy.

Helpful resources

Philadelphia residents looking for more information on renters rights and resources should check out the following:

Philadelphia Fair Housing Commision: resources for Philadelphia residents to learn more and take action against unfair rental practices, domestic abuse, rental safety, and anti-discrimination rights

Tenant Union Representative Network: Renters union whose mission is ensuring tenant safety, legality in rental practices, and landlord transparency

Subsidized Housing: Legal representation and advice for low-income tenants

Philadelphia Tenants Union: Union dedicated defending tenants against landlord and property owner impropriety such as building neglect, withholding of security deposits, and eviction threats

^ 1. City of Philadelphia

† 2. FBI CDE

‡ 3. NOAA