Houston is one of the nation’s largest metros — and the most populated city in Texas, a large and crowded state. If you’re one of the 2.3 million Houstonians and you’re renting, it’s important to carry the right renters insurance.

Best renters insurance rates in Houston

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | $26.50 | $24.67 |

Allstate | $32.50 | $29.83 |

Travelers | N/A | N/A |

Stillwater | $14.67 | $16.75 |

Lemonade | $8.34 | $6.92 |

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable. N/A denotes quotes were not available online.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000.00 | $1,000 | $1,000 | $1,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance covers more than just your stuff. Here’s a rundown of the basic components of a renters policy.

Property coverage: Reimbursement for destroyed, damaged, lost or stolen property.

Liability coverage: Covers legal costs in the event that you’re sued if someone is injured in your home.

Medical payments to others: Covers medical costs in the event that you’re sued if someone is injured in your home.

For a deep dive on what renters insurance covers, head here.

Is renters insurance legally required in Houston?

You are not legally required to have renters insurance by the city of Houston. However, a Houston landlord has the right to require renters insurance of tenants. Check if your prospective landlord requires renters insurance before signing a lease. If they don’t, renters insurance is still a good idea. Otherwise, you’re on the hook for the full cost of replacing your belongings if an accident happens or disaster strikes.

Reasons to buy renters insurance in Houston

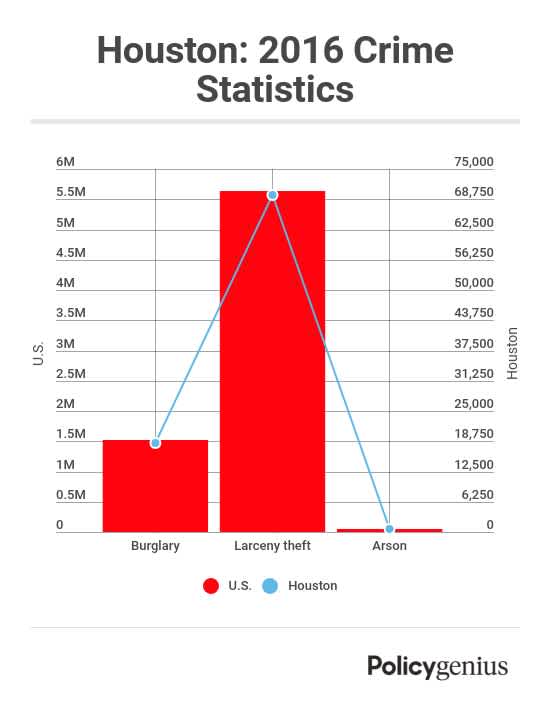

Renters insurance covers the cost of replacing your stuff if it’s destroyed, damaged or stolen — and Houston, like every city in the U.S., isn’t insulated from these crimes. In 2016, Houstonians reported 18,488 burglaries, 69,630 thefts and 668 instances of arson, according to data from the Houston Police Department compiled by the FBI’s Crime Data Explorer.

Houston was also among the cities hit hardest by Hurricane Harvey in 2017. The city received 32 to 46 inches of rain during the ordeal, per the National Centers for Environmental Information. Standard renters insurance doesn’t cover flooding. It might cover some damage associated with hurricanes. For instance, you could have coverage for damage caused by heavy winds. But if you’re a renter in Houston, you might also want to add flood insurance to your financial protection plan.

Helpful resources

Houston tenants looking for more resources on renting and their rights should visit the following:

The Average Cost of Renters Insurance: Find out how your renters insurance rates specifically are determined.

City of Houston Intro to Housing and Tenant Law: A guide to renters’ rights in the city, courtesy of its Housing and Development Department.

Renting after Harvey: What you need to know to protect yourself: Some tips for renters in the wake of Hurricane Harvey via its KPRC 2, a local television station.

Texas Hurricane Harvey Recovery Guide: This pamphlet released by the Federal Emergency Management Agency (FEMA) can help Houston residents protect themselves from future damages.

Texas Tenant Rights: An outline of the state’s broader guidelines, courtesy of its Attorney General.