Chicago is a huge city with over 1.3 million people who live in rental units.^ If you’re one of them, ask yourself: Do you have renters insurance?

There are a lot of ways your possessions can get damaged or stolen in the Windy City, and it’s important to make sure you’re protected. Renters insurance is the best way to cover the cost of replacing your stuff, and can often do it on the cheap by finding the best insurance company.

Best renters insurance companies in Chicago

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deducible |

|---|---|---|

State Farm | $14.08 | $13.17 |

Allstate | $21.00 | $19.00 |

Travelers | $32.00 | $29.00 |

Stillwater | $23.33 | $19.25 |

Lemonade | $5.92 | $5.17 |

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000 | $20,000.00 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000.00 | $100,000.00 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000.00 | $1,000.00 | $1,000 | $2,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance coverage is more than just protecting your personal property. Here’s a rundown of the basic components of a policy when you're comparing renters insurance rates.

Property coverage: Reimbursement for destroyed, damaged, lost or stolen property.

Liability coverage: Covers legal costs in the event that you’re sued if someone is injured in your home.

Loss of use: Covers temporary living expenses if your residence becomes uninhabitable.

Medical payments to others: Covers medical costs in the event that you’re sued if someone is injured in your home.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Chicago?

Renters insurance is not required by the state of Illinois or the city of Chicago. However, individual landlords or condominium/homeowners associations can require renters insurance as a term of leasing. When applying to rent an apartment, be sure to check with the landlord to find out if he or she requires renters insurance.

However, even if a landlord doesn’t require renters insurance, it’s still worth buying. A policy with $500 deductible has an average cost of under $20 a month in Chicago, and a policy with a $1,000 deductible averages only $17.50. Plus, there are many other reasons to apply.

Reasons to buy renters insurance in Chicago

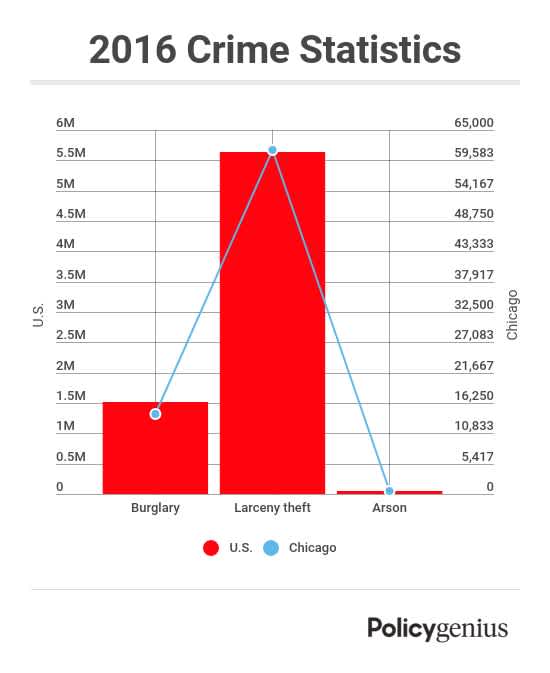

Renters insurance provides valuable peace of mind by protecting your personal belongings inside and outside your home. In 2016, Chicagoans experienced over 14,200 burglaries and over 62,400 thefts, according to data provided by the Chicago Police Department and compiled by the FBI’s Crime Data Explorer.†

Chicago’s extreme weather is another good reason to buy renters insurance. The average low temperature in Chicago in January is just 21 degrees, and the city averages 10 inches of snow in February.‡ Heavy snowfall, frigid weather, and high winds can all cause damage to your stuff. (Think frozen pipes exploding.) And although your landlord’s insurance will cover damage to the building itself, you’ll be responsible for any damage to your possessions.

Helpful resources

Chicago tenants looking for more resources on renting and their rights should visit the following:

The Average Cost of Renters Insurance: Find out what really determines your renters insurance price — and how that price calculated

Lawyers’ Committee for Better Housing: Understanding legal remedies available under the Chicago Residential Landlord and Tenant Ordinance

City of Chicago Rents Right: Education on rental rights

Center for Renters Rights: Provide counsel and legal referrals to tenants and residential property owners

Metropolitan Tenants Organization: Education and organization around affordable and safe housing

^ U.S. Census Bureau, 2016 American Community Survey 1-Year Estimates

† FBI CDE

‡ NOAA