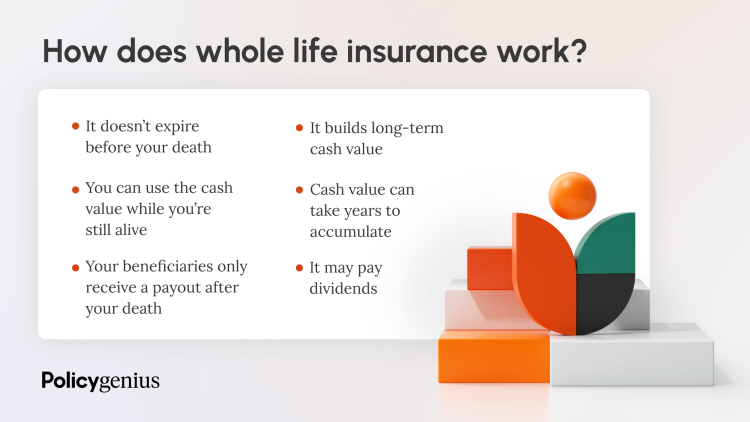

Whole life insurance is a type of permanent life insurance that doesn’t expire. No matter when you die, your loved ones will receive a guaranteed tax-free payout in exchange for your premium payments. Whole life also includes cash value, a tax-deferred savings account you can use to withdraw or borrow funds. The cash value earns interest at a fixed rate set by the insurer.

How does whole life insurance work?

Whole life insurance doesn’t expire and offers a guaranteed death benefit, in addition to the cash value. These features make whole life policies significantly more expensive than a comparable term life policy, which doesn’t grow cash value and expires after a set term — usually, between 10 and 30 years.

What is the whole life insurance death benefit?

The death benefit is the money your loved ones can claim when you die — whole life insurance policies are permanent coverage, so you can guarantee your loved ones can claim the money no matter when you die. In most cases, the death benefit is also tax-free.

To keep your coverage active, you’ll make payments — usually monthly or annually. For most whole life insurance policies, the cost of your premiums stays the same throughout the duration of your policy.

What is the whole life insurance cash value?

In addition to the payout, whole life has a savings component called the cash value account, that earns interest at a fixed rate over time. The interest rate is set by the insurer. A portion of your premiums is used to pay for the cost of maintaining policy, and the rest goes toward building your cash value.

Once you’ve accumulated enough cash value, you can withdraw from or borrow against it. Although you can take out a tax-free loan, any outstanding loans you haven’t paid back by the time of your death are deducted from the death benefit your beneficiaries will receive.

It can take five to 10 years or even longer for a whole life policy to build significant cash value, depending on the type of whole life insurance you buy. When you die, your beneficiaries only receive the death benefit. The cash value is reverted back to the insurance company.

Who should consider buying whole life insurance?

A traditional whole life policy can be a good fit for high-net-worth individuals and people who have long-term financial obligations.

High-net-worth individuals: High earners can use whole life insurance as an additional investment vehicle, especially if you’re already maximizing contributions to traditional investment accounts like a 401(k) or IRA. Whole life can also be used as a buffer against estate tax, as long as your estate is valued at less than $13.61 million. [1]

People with long-term financial obligations: If you have financial obligations that will last longer than 20 to 30 years — for example, lifelong dependent children, or if you expect to care for aging parents — whole life can ensure they’ll be cared for in the event of your death, no matter when it occurs.

Advantages & disadvantages of whole life insurance

Pros

Whole life insurance doesn’t expire. This can be especially helpful if you have dependents that require lifelong care, you have long-term financial obligations, or you want to provide an inheritance for your loved ones. According to LIMRA, 38% of Americans cite that being able to transfer wealth was an important motivator for buying life insurance. [2]

Whole life earns tax-deferred interest through its cash value component. This can be a good option if you’re already maximizing your contributions to tax-advantaged accounts like a Roth IRA or a 401(k) and are seeking another low-risk investment option.

You can use your policy’s cash value while you’re alive. You can take out a tax-free loan from your cash value, which can be easier than taking out a personal loan. You can also choose to withdraw money while you’re still alive.

Cons

Whole life is significantly more expensive than term life. If you take out a whole life policy and then find you can’t afford to keep it, you risk losing out on the tax benefits and leaving your family without financial protection.

Penalties can apply if you cancel your policy during the surrender period — but there’s no penalty for canceling term life insurance.

Whole life offers lower rates of return as an investment vehicle when compared to using a brokerage account or other investment options.

Whole life premiums offer no flexibility. Tax-advantaged accounts like Roth IRAs, for example, don’t require you to fund them every year, so you have more flexibility. Whole life policies require you to commit to expensive premiums indefinitely in order for your cash value to accumulate.

You might reduce the death benefit your beneficiaries will receive if you don’t pay back any loans you took against your policy’s cash value.

Types of whole life insurance

The types of whole life insurance mainly differ by how you pay for them. These include:

Level payments. You pay set premiums on a monthly, quarterly, semi-annual, or annual basis for the rest of your life. Most policies include an age you’ll reach when your policy is considered fully paid for, such as age 99 or 100. This is the most common type of whole life insurance payment schedule.

Single premium. You pay the full cost of the policy in one lump-sum payment up front. This option is rare, as it’s very expensive and not convenient for most shoppers.

Limited pay. Instead of paying premiums for the rest of your life, you cover the full price of your policy on a limited payment schedule — for example, over the course of 10 years. Single pay, 10 pay, and 20 pay are all examples of limited pay whole life policies.

Paid up at age 65. You pay premiums on your policy until you reach age 65.

Modified whole life insurance. It offers lower premiums for a short time, usually the first two or three years of the policy, and higher premiums for the rest of your life. Modified whole life policies don’t cost less than a traditional whole life policy — you eventually make up for the initial lower payments with pricier premiums down the road.

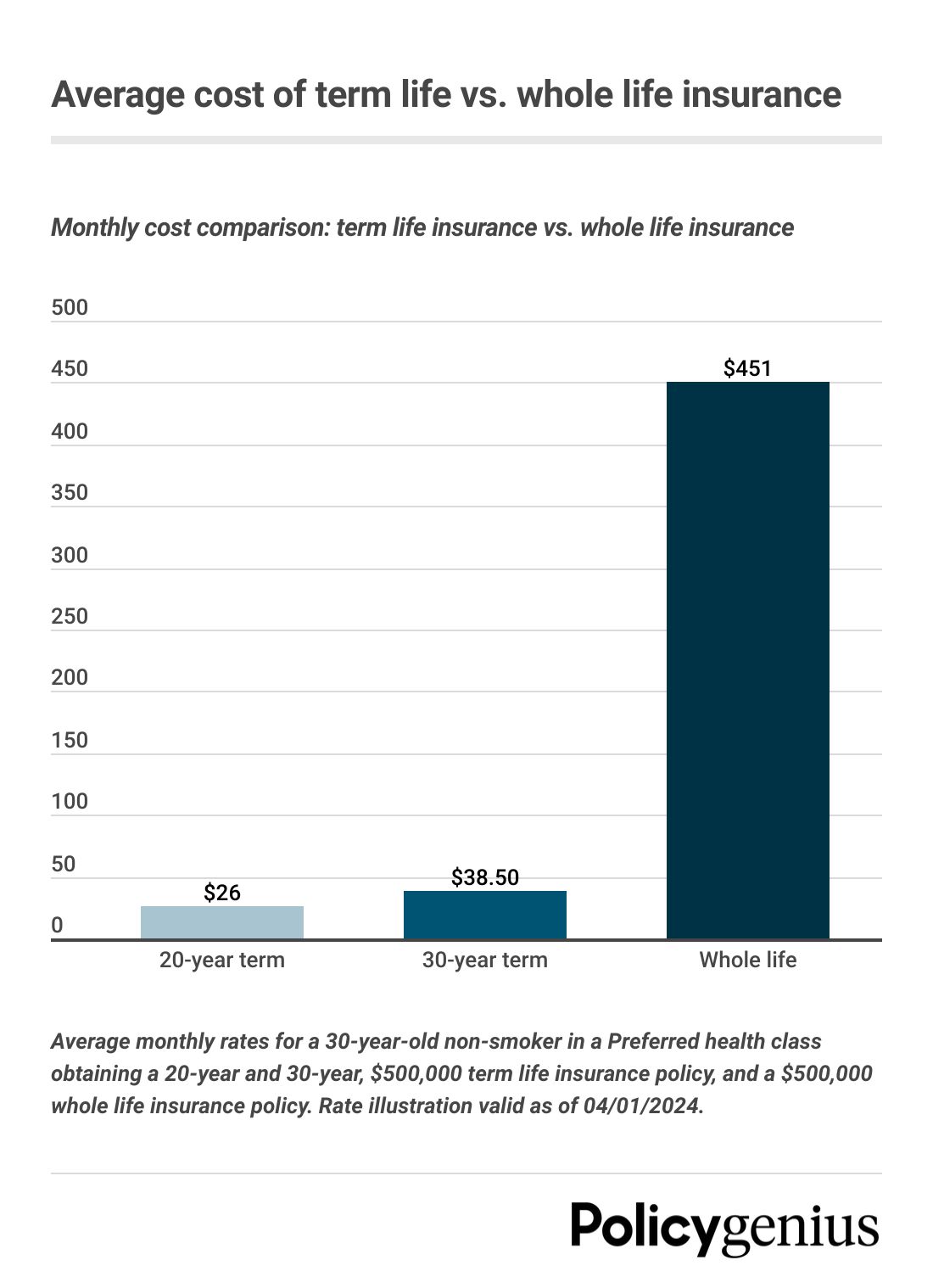

How much does whole life insurance cost?

A 30-year-old non-smoking female in good health can expect to pay $408 per month for a whole life insurance policy with a $500,000 payout. A 30-year-old non-smoking male with a similar health profile can expect to pay $472 per month for a policy with the same coverage.

Average monthly whole life insurance rates

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $146 | $287 | $545 |

Male | $169 | $334 | $639 | |

30 | Female | $206 | $408 | $801 |

Male | $238 | $472 | $920 | |

40 | Female | $296 | $588 | $1,161 |

Male | $355 | $706 | $1,372 | |

50 | Female | $462 | $920 | $1,826 |

Male | $543 | $1,081 | $2,117 | |

60 | Female | $772 | $1,540 | $3,065 |

Male | $903 | $1,802 | $3,556 |

Methodology: Whole life insurance rates are calculated for male and female non-smokers in a Preferred Plus health classification obtaining a $250,000, $500,000, or $1,000,000 whole life insurance policy fully paid up at age 100 offered by Policygenius through MassMutual. Individual rates will vary as specific circumstances will affect each customer’s rate. Rate illustration valid as of 10/01/24.

What factors affect your whole life insurance rates?

Whole life insurance rates are determined by your age, gender, health, and coverage amount.

Each insurance company has its own guidelines to assess risk and assign your rates.

Generally speaking, the younger you are and fewer health conditions you have, the cheaper your rates will be.

The higher your coverage amount, the more expensive your rates will be.

Learn more about the best whole life insurance companies of 2024

Whole life insurance vs. term life insurance

If you’re shopping for life insurance, you may be wondering whether whole life insurance is better than term life insurance. The answer will depend on your coverage needs — and your budget.

If you’re looking for an affordable, temporary way to provide your family with a financial safety net in your absence, term life insurance can be a good fit.

If you have dependents that require lifelong coverage or long-term financial obligations, or you have a high net worth and are looking for life insurance options to diversify your investment strategy or complement your estate planning strategy, then whole life insurance can be a better option for you.

Comparing whole life vs. term life

Features | Term life insurance | Whole life insurance |

|---|---|---|

Permanent coverage | No — maximum of 40 years | Yes |

Cost* ($500,000 coverage amount) | $26/month for a 20-year term | $451/month |

Guaranteed death benefit payout | Yes | Yes |

Guaranteed cash value | No | Yes |

Premium cost stays fixed | Yes, in most cases | Yes, in most cases |

Pays annual dividends | No | Yes, in some cases |

*Methodology: Average monthly term life insurance rate is for male and female non-smokers with a Preferred health classification obtaining a 20-year, $500,000 policy. Term life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Average monthly whole life insurance rate is calculated for non-smokers in a Preferred health classification, obtaining a whole life insurance policy paid up at age 100 offered by Policygenius from MassMutual. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 10/01/2024.

Whole life vs. universal life insurance

Universal life insurance (UL) is another type of permanent life insurance.

Similar to whole life insurance, universal life policies don’t expire and come with a cash value component.

But unlike whole life, where both the death benefit and premiums are set, UL allows you to increase or decrease how much you pay toward premiums.

Universal life policies also allow you to adjust the death benefit on your policy.

If you’re looking for permanent coverage with a guaranteed death benefit and cash value, whole life insurance can work for you. If you desire flexibility and are able to be involved in monitoring your policy’s cash value, UL can be a good fit for you.

Comparing whole life vs. universal life insurance

Features | Universal life insurance | Whole life insurance |

Coverage length | Permanent | Permanent |

Cash value | Flexible, not always guaranteed growth | Fixed, guaranteed growth |

Guaranteed death benefit amount | Depends on the policy | Yes |

Cost | Flexible payments, but more expensive than term | Much more expensive than term, more expensive than UL |

Premium cost stays fixed | No | Yes |

Pays annual dividends | No | Yes, in some cases |

How & where can you buy whole life insurance?

You can buy life insurance from an independent broker that works with multiple companies, or directly from an individual insurance company. At Policygenius, our agents can help you compare quotes from different insurance companies to find the right coverage at a price that works for you.

Fill out an application, have a phone call with an agent, and then, in most cases, take a medical exam.

Wait for the insurance company to review your application and give you your final rate.

Once you sign the policy paperwork and pay your first premium, you’re covered.

Call us at 1-800-608-2192 to connect with a Policygenius agent and get started on your application, or follow the link below.