If you’re shopping for auto and motorcycle insurance, you should consider getting both policies from the same company, or “bundling” coverage. Most major car insurance companies offer motorcycle insurance and bundles, and buying both policies together can earn you bundling discounts of up to 20% off your premiums.

Bundling your car and motorcycle insurance means purchasing each policy from the same insurance company. You’ll still get two separate car and motorcycle policies, with their own limits, deductibles, and exclusions, but bundling the policies together will save you money on your premiums.

Can I bundle car and motorcycle insurance?

Yes, not only can you bundle car and motorcycle insurance, but most companies offer discounts for bundling. If you’re already happy with your car insurance company’s rates and customer service, you could save by bundling your motorcycle insurance with the same provider.

Bundling discounts are very common, most car insurance companies offer them. All of the largest car insurance companies offer discounts for bundling, though many smaller companies also offer similar discounts.

When you sign up for car insurance, most insurance companies offer the option to insure more than one type of property, like your motorcycle, boat, ATV, or RV in addition to your vehicles. You can also bundle a renters insurance policy or a home insurance policy on top of that for even more savings.

→ Read more about how to save money on your car insurance

Best car and motorcycle bundles

Not every company offers bundling discounts, but most insurance providers do. You can bundle car and motorcycle insurance, as well as coverage for other property types, with the following major car insurance companies:

Not only do you get a discount for bundling your car and motorcycle insurance with Acuity, but you can also add coverage for watercraft, snowmobiles, ATVs, and RVs which will unlock even more chances to save. Of the 700+ reviews on Trustpilot, 87% of policyowners rated the company “Great” or Excellent,” making Acuity a leading company when it comes to customer satisfaction.

You can get a discount by bundling two or more property insurance policies at Allstate, and you can also save by switching your motorcycle insurance to Allstate from another carrier. Allstate also offers discounts for insuring more than one motorcycle or for passing a motorcycle safe driving program in the past 36 months.

American Family offers an impressive list of discounts, including an opportunity to save when you bundle your insurance. Policyholders who bundle auto and motorcycle insurance, in particular, are also entitled to a collision deductible waiver that will excuse the less expensive deductible when your car and motorcycle are damaged in the same incident.

In addition to a discount for auto and motorcycle insurance bundles, Amica also offers discounts for every additional motorcycle you insure with them. According to the company, you can also save up to 25% by insuring two or more vehicles.

You’re eligible for a number of discounts when you switch to GEICO insurance, including 10% off when you transfer your motorcycle insurance from another insurer, 20% off for active Motorcycle Safety Foundation instructors, and an extra 5% for bundling auto and motorcycle insurance policies.

You can save money by bundling your car and motorcycle insurance with Nationwide — and you can also get great coverage for your bike. Nationwide has a couple high-quality endorsements that you can add to a regular policy. These include up to $30,000 of coverage for custom parts and original parts coverage if your bike is less than 10 years old.

Progressive’s car insurance rates are 7% more expensive than average, but the company’s complete protections for motorcycles makes it a top pick for bundling. With Progressive, you can get full replacement coverage for your motorcycle, as well as $30,000 of accessories and custom parts coverage and coverage for your bike’s original parts.

A child company of Liberty Mutual insurance, Safeco offers a host of unique discounts and a customer service experience that compares to major companies like GEICO. For remaining claim-free, you can decrease your deductible for collision coverage by $100 when it’s time to renew your policy, and safe motorcycle drivers earn $1,000 (per person, per incident) on motorcycle gear replacements at no extra cost with no deductible.

Should I bundle auto and motorcycle insurance?

If you own a car and a motorcycle, then bundling your car and motorcycle insurance is usually a great idea. You need to insure both vehicles anyway, and insurance companies will typically make it worth your while to purchase more than one policy from them.

1. Bundling saves you money

Many insurance companies offer multi-policy discounts when you bundle your car and motorcycle insurance with them (or any other property insurance for that matter). Customers can save up to 20% or more on their insurance premiums by bundling.

In the event that both your car and motorcycle are damaged, say they are keyed and defaced overnight, you may only need to pay a single deductible when you go to file a claim rather than two separate ones, saving you money.

2. Bundling is convenient

Bundling your car and motorcycle insurance also means you can access both your policies whenever you contact your insurance company. With access to both your policies, you can review your coverages, make payments, and file a claim all in the same place.

You’ll also never have to worry about which insurance company to call when it’s time to file a claim for your car or motorcycle. This can make the claims process less stressful than it would be if you had two different insurance providers.

3. You may miss out on better deals

Bundling your car and motorcycle insurance can usually save you money on your premiums, but it’s not always the best deal. Every now and then, you should shop around for better bundles or better coverage for both vehicles with separate providers.

Even just switching insurance companies can help you save, but occasionally you’ll find it’s cheaper to insure your car and motorcycle with separate policies from two different companies.

How to shop for a car and motorcycle insurance bundle

Fortunately, most companies make it easy to shop for bundling discounts if you want to insure your car and motorcycle. No matter how you shop, you should:

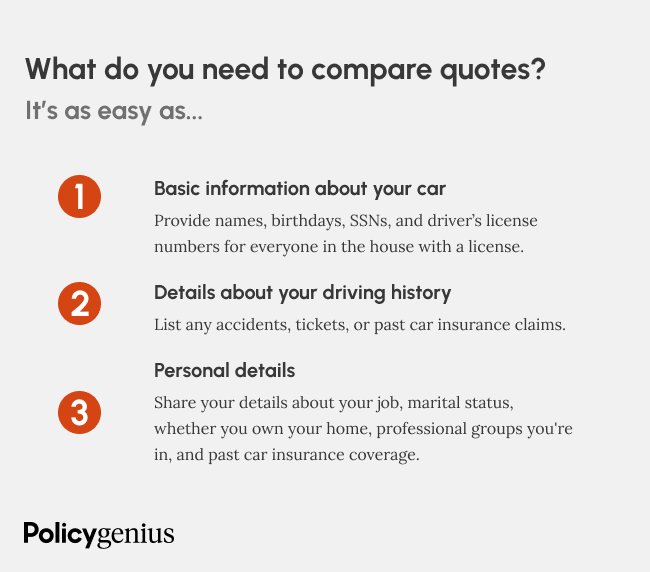

Collect information about your vehicles: Make sure you know details about your car and motorcycle, like each vehicle’s VIN, age, and annual mileage, since these factors will all influence your rates.

Know your vehicle’s drivers: Insurance companies require the names, driver’s license numbers, and ages of the people who live in your house who drive your car and motorcycle.

Understand the policy: Companies may offer car and motorcycle insurance in 6- or 12-month policies, and some automatically include coverages that may cost extra somewhere else. Understanding the length of your policy and what’s included can help you budget for coverage.

Compare quotes and get covered: As you collect quotes from multiple companies, you’ll be able to see which offers the best deal for bundling your motorcycle and auto insurance. Then you just need to choose a start date and finalize your coverage.

Methodology

To find the best companies for auto and motorcycle insurance bundles, Policygenius compared discounts for bundling, costs, and motorcycle insurance coverage offerings from different car insurance companies.

The costs that we found were sourced from public rate files and supplied by Quadrant Information Services for a full-coverage policy. We gathered quotes from every ZIP code in all 50 states and the District of Columbia. These rates reflect the cost of a full-coverage policy with the following limits:

Bodily injury liability: 50/100

Property damage liability: $50,000

Uninsured/underinsured motorist: 50/100

Comprehensive: $500 deductible

Collision: $500 deductible

Our sample driver was a 30-year-old male driver, driving a 2017 Toyota Camry LE driven 10,000 miles/year. Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of costs. Your actual quotes may differ.