Renters insurance is financial protection for your personal property and liability. It can cover everything from replacing your furniture and clothing after a house fire, to paying your neighbor’s medical bills if your dog bites them, to even covering the cost of a hotel room if your apartment is broken into and you need to stay somewhere else while it’s being repaired.

According to the Insurance Information Institute, the cost of renters insurance premiums went down in 2017 from 2016, but the majority of renters still do not have renters insurance. Despite being cheap, renters insurance can save you thousands of dollars if disaster does strike.

Renters insurance by the numbers

37% — The percentage of renters who had renters insurance in 2014, according to the Insurance Information Institute

2.7% — The percentage that the average renters insurance premium decreased in 2017 from the year before

$180 — The average cost of an annual renters insurance premium in the U.S. in 2017, according to 2019 data from the NAIC

$120 — The average cost of an annual renters insurance premium in North Dakota, the state with the lowest renters insurance premium rates in 2017

$500 — A common renters insurance deductible amount, according to the Insurance Information Institute

50% — The percentage of people in rental housing under the age of 30 in 2017, according to the National Multifamily Housing Council

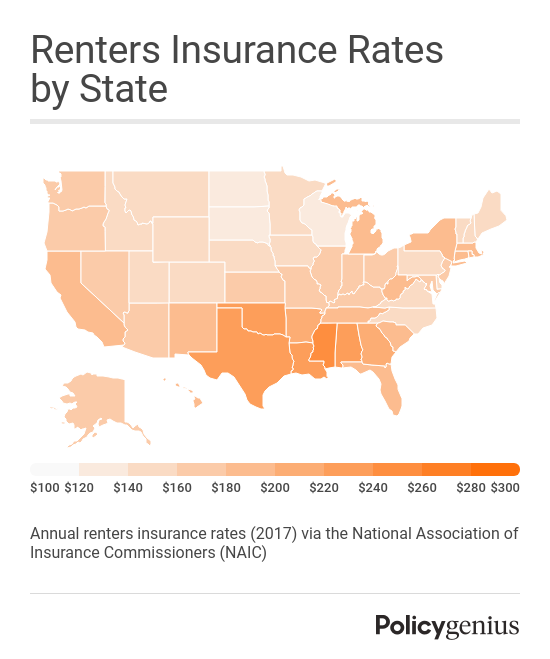

Average cost of renters insurance by state

The state and even the ZIP code you live in can affect the price of your renters insurance premium. States that experience severe weather will have a higher renters premium than states that typically have more mild weather. If you live in a crime-prone area, your renters insurance premium might be higher because you are considered more at-risk for perils like theft and vandalism.

With those caveats in mind, here are the average annual renters insurance premiums in each U.S. state as of 2017, per the NAIC:

Average annual premium by state, 2017

State | Avg Annual Premium |

|---|---|

Alabama | $235 |

Alaska | $166 |

Arizona | $178 |

Arkansas | $212 |

California | $182 |

Colorado | $159 |

Connecticut | $192 |

Delaware | $159 |

District of Columbia | $158 |

Florida | $188 |

Georgia | $219 |

Hawaii | $185 |

Idaho | $153 |

Illinois | $167 |

Indiana | $174 |

Iowa | $144 |

Kansas | $172 |

Kentucky | $168 |

Louisiana | $235 |

Maine | $149 |

Maryland | $161 |

Massachusetts | $194 |

Michigan | $182 |

Minnesota | $140 |

Mississippi | $258 |

Missouri | $173 |

Montana | $146 |

Nebraska | $143 |

Nevada | $178 |

New Hampshire | $149 |

New Jersey | $165 |

New Mexico | $187 |

New York | $194 |

North Carolina | $157 |

North Dakota | $120 |

Ohio | $175 |

Oklahoma | $236 |

Oregon | $163 |

Pennsylvania | $158 |

Rhode Island | $182 |

South Carolina | $188 |

South Dakota | $123 |

Tennessee | $199 |

Texas | $232 |

Utah | $151 |

Vermont | $155 |

Virginia | $152 |

Washington | $163 |

West Virginia | $188 |

Wisconsin | $134 |

Wyoming | $147 |

United States | $180 |

Average coverage amounts of renters insurance

A typical renters insurance policy is made up of three components: personal property coverage, liability coverage, and loss-of-use coverage.

Each category offers different types of coverage and protection.

Personal property coverage: Covers your personal property if it is stolen, damaged, or destroyed by a covered peril.

Liability coverage: Covers your personal liability if you cause damage to someone’s property or if someone gets hurt in your home. For example, if your friend gets injured in your apartment and needs medical expenses, your renters liability coverage can help pay for their medical fees.

Loss-of-use coverage: If your home becomes uninhabitable due to a covered peril, the loss-of-use provision of your renters policy will pay for you to stay elsewhere, like at a nearby hotel.

Here are common coverage amounts for each type of coverage in a renters insurance policy:

Type of coverage | Coverage amounts and ranges |

|---|---|

Personal property | $15,000 - $500,000 |

Liability and medical expenses | $100,000 or $300,000 or $500,000 |

Loss-of-use and additional living expenses | $3,000 - $5,000 or 40% of your personal property limit |

Biggest renters insurance companies

The NAIC ranks insurance companies by their total share of the market. This table shows the top renters insurance companies, their J.D. Power U.S. renters insurance rating, their A.M. Best Rating, and their total homeowners (which renters insurance falls under) share of the market as of 2017, according to National Association of Insurance Commissions.

RENTERS INSURANCE COMPANIES | J.D. POWER RENTERS INSURANCE RATING | A.M. BEST RATING | MARKET SHARE |

|---|---|---|---|

Allstate | About average | A+ | 8.44% |

American Family | Better than most | A | 3.23% |

Auto Club of Southern California Insurance Group (AAA) | About average | A+ | 0.95% |

CSAA Insurance Group | About average | A | 1.04% |

Erie Insurance | Winner | A+ | 1.69% |

Farmers Insurance | The rest | A | 5.96% |

Liberty Mutual | About average | A | 6.86% |

MetLife | The rest | A+ | 1.17% |

Nationwide | About average | A+ | 3.60% |

Safeco (a division of Liberty Mutual) | The rest | A | NA |

State Farm | About average | A++ | 18.63% |

The Hartford | About average | A+ | 1.10% |

Travelers | The rest | A++ | 3.76% |

USAA | Among the best* | A++ | 6.05% |

*USAA was given a designation, but not profiled, given that it didn’t meet J.D. Power’s study criteria.