Pittsburg has 300,000 residents — and nearly 70,000 of them live in rental units.^ If you’re one of those 70,000 renters, you probably need renters insurance. Do you have it?

Life is good in the Steel City, but if your belongings get damaged, destroyed or stolen, your landlord’s insurance won’t help you — only renters insurance will. Renters insurance helps you cover the cost of replacing your stuff, and finding the best renters insurance company in Pittsburgh can help you do it for about the cost of a french-fry-laden burger (or two).

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | $12.58 | $11.92 |

Allstate | $16.95 | $15.92 |

Travelers | $13.00 | $12.00 |

Stillwater | $12.08 | $12.08 |

Lemonade | $9.34 | $8.25 |

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000.00 | $1,000 | $1,000 | $2,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance policies offer you three kinds of coverage, each with its own coverage limits. The basic renters insurance policy coverage types are:

Property coverage: Reimburses your for property that is destroyed, damaged, or stolen.

Liability coverage: Covers legal costs if a guest is injured in your home and sues you.

Medical payments to others: Covers the medical expenses if a guest is injured in your home.

Read more about what renters insurance covers.

Is renters insurance legally required in Pittsburgh?

There is no ordinance in the city of Pittsburgh or the state of Pennsylvania that requires a renter to purchase renters insurance. In fact, there is no city or state in the U.S. that requires it. So no, you are not legally required to purchase renters insurance. However, your landlord can require you purchase renters insurance as a condition of your lease, and that requirement is perfectly legal.

But even if your landlord doesn’t require purchasing renters insurance, it makes sense to buy it anyway. It’s easy to buy and affordable insurance that protects the things you own! Nothing could make more sense.

Reasons to buy renters insurance in Pittsburgh

Renters insurance provides peace of mind and protection from some of life’s worst-case scenarios — including break-ins and fires.

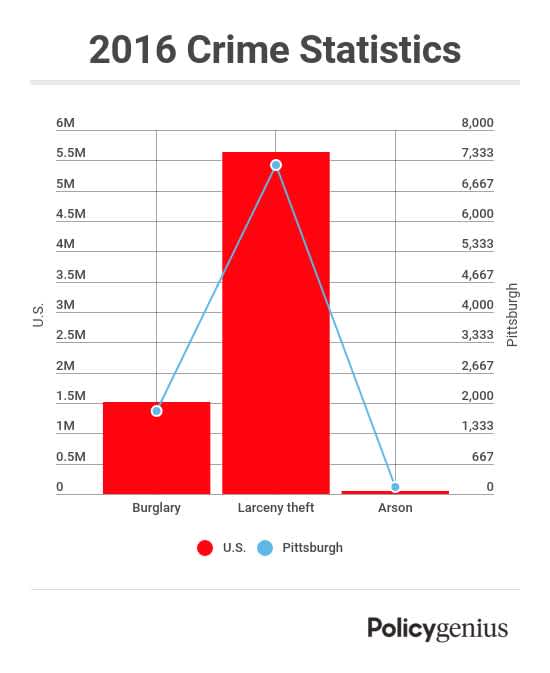

In 2016, Pittsburgh experienced nearly 2,000 burglaries and over 7,000 thefts, according to data provided by the Pittsburgh Bureau of Police and compiled by the FBI’s Crime Data Explorer.† The property crime rates in Pittsburgh exceed national rates, which make it especially prudent for Pittsburgh residents to protect themselves.

Pittsburgh epic weather is another good reason to buy renters insurance. The average low temperature in Pittsburgh in January is just 20 degrees, and the city averages over nine inches of snow in January.‡ Heavy snowfall, frigid weather, and high winds can all cause damage to your stuff. (Think frozen pipes exploding.) And although your landlord’s insurance will cover damage to the building itself, you’ll be responsible for any damage to your possessions, and for the cost of staying in a hotel if a burst pipe makes your apartment uninhabitable until it gets repaired.

Pennsylvania is also one of the areas in the U.S. that is prone to sinkholes, so if you’re worried about that, you can add an extra rider, or addendum, to your renters insurance policy to cover you in case of big holes in the ground.

Helpful resources

Pittsburg tenants looking for more resources on renting, renters insurance, and their rights should visit the following:

The Average Cost of Renters Insurance Find out what factors determine your renters insurance price — and how that price is calculated.

Pittsburgh Fair Housing Partnership: Read the Pennsylvania Landlord Tenant Act.

Housing Equality Center of Pennsylvania: Learn all about your rights as a tenant in Pittsburgh.

Allegheny County Bar Association: Questions and answers about renters rights.

Neighborhood Legal Services Association: More information about housing rights and regulations in Alleghaney County.

^ 1. City of Pittsburgh Housing Needs Assessment

† 2. FBI CDE

‡ 3. NOAA