What do your life insurance calculator results mean for you?

Our term life insurance calculator offers you an estimate of how much coverage you need, and a suggestion of how long your policy should last.

You’ll have two options to consider based on your budget and coverage needs.

Optimal coverage. This option recommends a policy long enough and a coverage amount large enough to pay for your family’s main expenses as well as your present and future financial needs — whether that’s paying off a mortgage or getting your children through college.

Coverage on a budget. This option recommends a policy that you can comfortably pay for year after year — even if it doesn’t offer all the coverage you need. You can opt for a shorter term to lower your premium, and speak with an agent who can walk you through different options to make sure you’re getting the best coverage for your budget.

Keep in mind that this calculator will only offer you an instant estimate of how much coverage you need. If you want to know the cost of your premiums, we’ve got you covered, too. Once you know how much coverage you’ll need, click on Get my quotes to continue your life insurance shopping journey and connect with an agent, or use our life insurance cost calculator further below on this page.

At Policygenius, our experts are licensed in all 50 states and can walk you through the entire life insurance buying process while offering transparent, unbiased advice.

How can you manually calculate how much life insurance you need?

One common rule of thumb is to multiply your annual income by 10 to 15, especially if you have dependents, to get an estimate for how much coverage you need.

For example, if you make $100,000 per year, you likely need around $1 million in life insurance coverage.

Some people choose to add an extra $100,000 per child to account for each child’s education.

So for instance, if you make $100,000 per year and you have two children you’re intending to put through college, you may want closer to $1.2 million in life insurance.

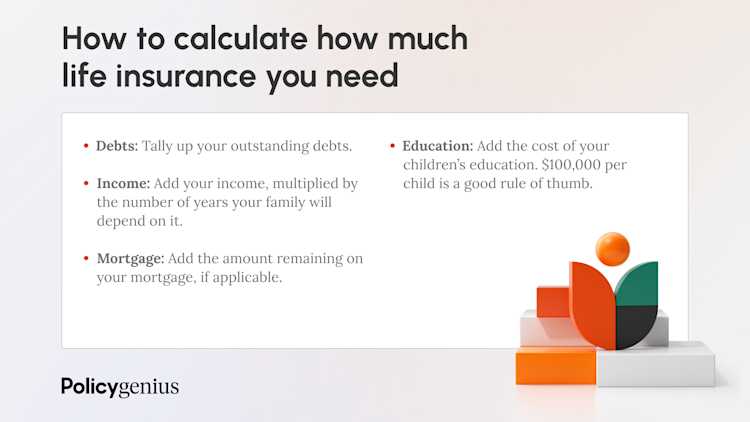

You can also use the DIME formula, which stands for Debts, Income, Mortgage, and Education. To calculate your life insurance needs using this method, you tally up the following:

Outstanding debts

Your income multiplied by the number of years your family will depend on it

The amount left on your mortgage

The cost of your children’s education

Your tally of your outstanding debts, separate from your mortgage, should include co-signed debt like car loans and student loans that your co-signer would become responsible for when you die. You can also include personal debt that might be taken out of your savings, like credit card debt.

You should also factor in income growth and the number of working years you have left. People who are early on in their career usually have to account for more years worth of coverage than people who are approaching retirement.

Learn more about how long your life insurance coverage should last

How much does the life insurance you need cost?

According to the Life Insurance Marketing and Research Association (LIMRA), over half the population thinks term life insurance is three or more times more expensive than it actually is. [1] To determine your rates, life insurance companies estimate your risk based on your personal profile, including your age, gender, health, and other lifestyle factors.

Use our cost calculator below to get an estimate of your monthly premiums.

Learn more about how much life insurance costs