You can cancel your life insurance policy by contacting your insurance provider. For term life insurance policies, you can also simply stop making payments and the coverage will lapse. When you cancel a permanent policy, you’ll be able to collect any cash value that’s accumulated, but you may also have to pay surrender fees, so it’s best to speak with your insurer or a licensed agent about the cancellation process.

In some cases, if you find you no longer have a need for coverage — like dependents or debts — it might make sense for you to cancel your policy. If your main reason for canceling coverage is affordability, there are ways to lower your premiums without losing your insurance protection. You can speak with a Policygenius expert to find the best option for your circumstances.

How to cancel a term life insurance policy

Canceling term life insurance is easy and free, and you can end your coverage at any time. You won’t pay any fees or penalties when you cancel a term life policy.

To do so, you can simply stop making payments and your coverage will end. If you prefer, you can call or send a letter to your insurance company notifying them of the cancellation.

Stop paying premiums

When you stop making your premium payments, you’ll trigger the grace period on your insurance policy — this normally lasts 30 days. During the grace period, you’ll have the chance to make up any payments you missed and keep your policy active.

If you let the grace period expire without making any more payments, your insurance coverage will end.

Write a letter

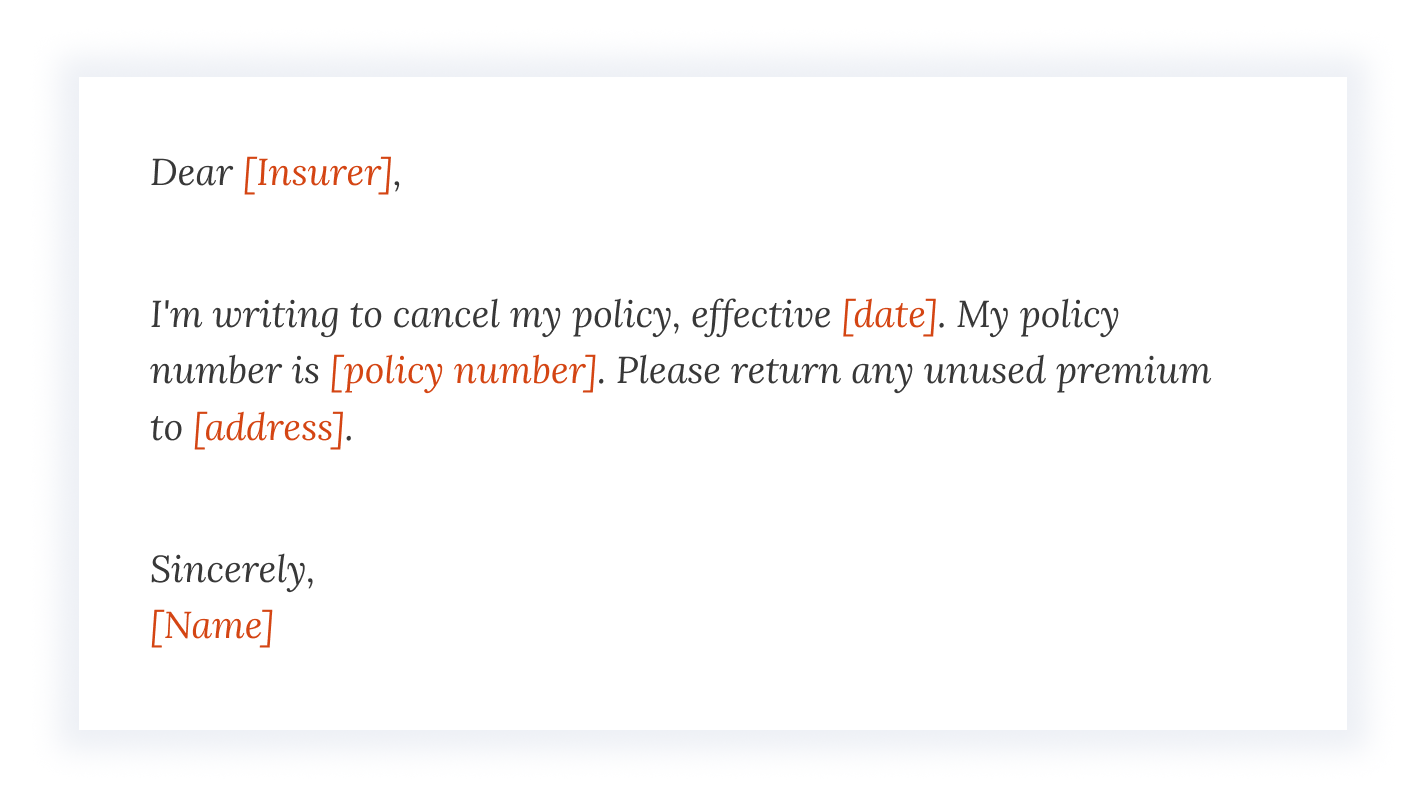

Alternatively, you can provide written notice to your insurer that you’d like to cancel your policy. Even though not required, for many people a formal written notice can give them peace of mind when canceling a policy.

Here’s an example of a term life insurance policy cancellation letter:

Sample insurance cancellation letter

Check your provider’s website, too, since some insurers offer a way to submit your notice online.

Call your life insurance provider

Most insurers can cancel your policy over the phone, or at least start the process for you. If you decide to call your insurance provider, have your policy number handy so an agent can pull up your policy and guide you through the steps.

How to cancel a whole life insurance policy

Canceling a whole life insurance policy involves a few more steps than just stopping payments. Each policy has slightly different rules around cancellation, so if you want to cancel your policy, it’s best to start with a call to your insurer.

Your options will depend on how long you’ve owned the policy and your insurance company’s guidelines, but here are some common outcomes.

Cash out the policy

Whole life insurance has a cash value account, which earns interest over time. If you cancel your policy, you’ll likely pay financial penalties. You’ll also have to pay taxes on any interest you earn from the cash value of the policy.

Opt for reduced paid-up insurance

This option comes with the fewest fees. A reduced paid-up option allows you to stop paying premiums in exchange for a lower death benefit. The reduced payout is based on the premiums you’ve already paid, and coverage lasts for life.

Even though the coverage amount is much smaller, a reduced paid-up option doesn’t come with penalties and maintains some amount of insurance protection, but also allows you to stop making payments.

Tax-free exchange

You may be able to exchange your insurance policy for either another life insurance policy or an annuity. This option allows you to transfer any investment gains to the new policy without paying taxes on them at the time of the exchange.

Because this process can be complicated, it’s best to consult a tax professional if you’re considering this option.

Sell your policy

You may be able to sell your life insurance policy using a life settlement company. You’ll have to pay commissions and fees for the service, so depending on the value of your policy, you may not walk away with much money. On the flip side, if you make a profit on your policy, the payout you receive is subject to income tax.

This process doesn’t make financial sense for most people, so it’s best to consult a trusted financial advisor if you're considering selling your policy.

Read more about how to transfer your life insurance policy

How to cancel life insurance with popular providers

The quickest way to cancel life insurance is to contact your insurer. If you purchased a policy through Policygenius, you can contact us, too, and we’ll help you cancel.

Here are a few popular providers and their contact information.

Canceling a State Farm life insurance policy

You can contact State Farm at:

800-782-8332

One State Farm Plaza Bloomington, IL 61710

Canceling a Northwestern Mutual life insurance policy

You can contact Northwestern Mutual at:

866-950-4644

720 East Wisconsin Ave. Milwaukee, WI 53202

Canceling a New York Life life insurance policy

You can contact New York life at:

800-225-5695

PO Box 768 New York, New York 10159

Canceling a Transamerica life insurance policy

You can contact Transamerica at:

800-797-2643

PO Box 189 Cedar Rapids, IA 52406

Canceling a Lincoln Financial life insurance policy

You can contact Lincoln Financial at:

800-487-1485

10 N Greene St. Greensboro, NC 27401

When to cancel your life insurance policy

If you no longer have a need for insurance, you can cancel your life insurance policy at any time — this can apply to both term and whole life insurance. Canceling a policy might make sense for you if you’ve reached retirement and have saved enough money to fulfill your remaining financial obligations, if you’ve paid off a mortgage or other debt, or if you have adult children who are financially independent.

If you’re considering canceling because you can no longer afford your premiums, it’s best to connect with your agent or insurance company first, since you can oftentimes lower coverage or take other measures to adjust your premiums first.

Canceling during the free look period

Life insurance policies typically have a free look period of 10 to 30 days after your policy goes into effect. During this time, if you decide you no longer want the policy, there’s no penalty for canceling.

Canceling after the surrender period

If you cancel your whole life policy after the surrender period, you won’t have to pay surrender fees. At this point, you’ll receive your remaining cash value, and your coverage will be canceled.

Things to consider before canceling life insurance

Check with your beneficiaries

If you’re thinking you no longer need coverage, it’s important to check with your spouse, children, or other beneficiaries to update them and confirm they wouldn’t struggle financially in your absence.

Consider any health conditions

Have you developed any health conditions or experienced lifestyle changes that would make it more expensive for you to buy a new policy? If so, it might be worth keeping your existing policy or reducing coverage before canceling.

On the flip side, if you’ve improved lifestyle habits or gone through positive health changes since purchasing your policy, you may be able to get more competitive rates with a new one. This will depend on your age and how long you’ve had your policy. A Policygenius expert can help you compare quotes for free.

Consider surrender fees

Make sure to understand your policy’s guidelines regarding the surrender period and surrender fees before canceling whole life insurance. If you have a term life insurance policy, you won’t have to worry about surrender fees.

Alternatives to canceling life insurance

Canceling your life insurance policy isn't advisable if anyone still counts on your financial support. Ending your coverage not only leaves your loved ones unprotected — it also forfeits your current rates. If you decide you need a policy in the future, your premiums will be higher.

If your policy no longer fits your needs or budget, there are ways to lower your premiums or adjust your coverage without completely losing life insurance protection.

Use your cash value to cover your premiums. If you have a permanent policy, you may be able to use the cash value to cover your premiums until you can afford to pay them out-of-pocket.

Ask for a new medical exam. If you’ve lost weight, quit smoking, or made another significant lifestyle change, you could qualify for lower premiums. Most insurers offer reconsideration once you’ve had your policy and maintained positive lifestyle changes for at least a year.

Lower your coverage amount. Most insurers let you decrease your coverage amount at least once, which can make your premiums more affordable and help you customize your coverage to your current financial obligations.

Shop for a new policy. It's possible that your current policy needs or health improvements could earn you lower rates with a different insurance company. Work with an independent broker to compare quotes and replace your existing policy.

A life insurance agent can walk you through the best option for your circumstances and help you make any necessary adjustments.