Cheapest SR-22 insurance in Pennsylvania

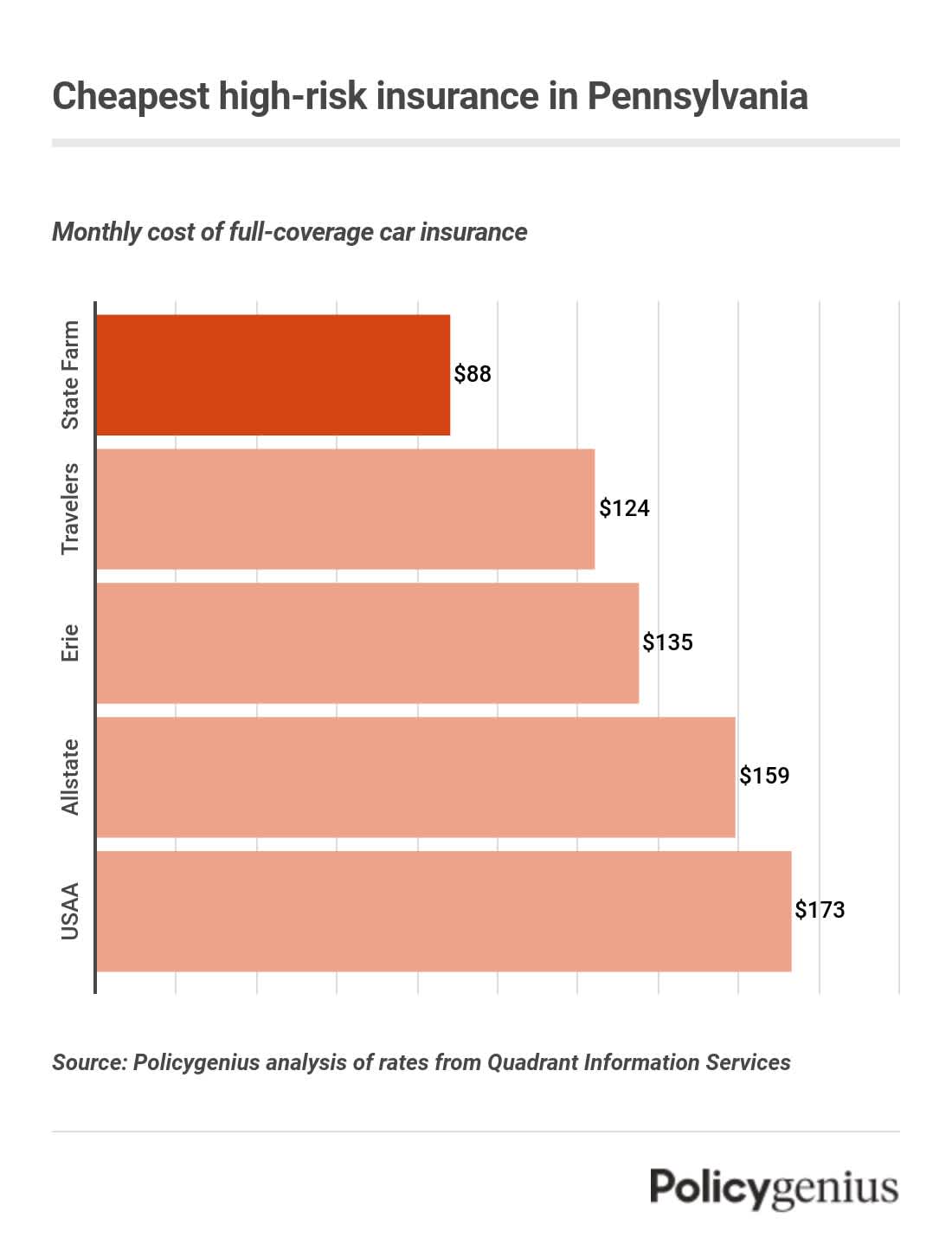

Pennsylvania doesn't require SR-22 forms, but all Pennsylvania drivers still need car insurance. We found that State Farm has the cheapest car insurance in Pennsylvania for high-risk drivers with a DUI, suspended license, or reckless driving citation. On average, State Farm costs $88 per month or $1,937 a year.

You can also find cheap high-risk insurance in Pennsylvania from Travelers and Erie. Since the cost of car insurance coverage depends on the driver, it’s a good idea to compare rates from different companies before you pick a policy.

Your data security is our priority.

Company | Average monthly cost | Average yearly cost |

|---|

State Farm | $88 | $1,059 |

Travelers | $124 | $1,491 |

Erie | $135 | $1,620 |

Allstate | $159 | $1,911 |

USAA | $173 | $2,077 |

Methodology: Why you can trust our picks for the cheapest insurance in Pennsylvania

We found the cheapest companies in Pennsylvania for drivers with a suspended license, DUI, or a reckless driving citation by analyzing rates from every ZIP code in the state.

Our sample driver was a 30-year-old male driver of a 2017 Toyota Camry LE with average credit who had a policy with the following limits:

Bodily injury liability: $50,000 per person, $100,000 per accident

Property damage liability: $50,000 per accident

Uninsured/underinsured motorist: $50,000 per person, $100,000 per accident

Comprehensive: $500 deductible

Collision: $500 deductible

Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of insurance costs. Your actual quotes may differ.

What is SR-22 insurance in Pennsylvania?

Pennsylvania doesn’t require SR-22s, which is a form that proves to the state you’re insured. SR-22s are required in many states for drivers with suspended licenses or who’ve committed serious driving violations, like a DUI.

Pennsylvania doesn’t have an SR-22 requirement, but you still need to have car insurance. The minimum car insurance requirements in Pennsylvania are:

Bodily injury liability (BIL): $15,000 per person, $30,000 per accident

Property damage liability (PDL): $5,000 per accident

States that don’t require SR-22 insurance

There are 12 states that don’t have SR-22 requirements:

Delaware

Kentucky

Maryland

Minnesota

New Jersey

New Mexico

New York

North Carolina

Oklahoma

Pennsylvania

Rhode Island

West Virginia

What you need instead of SR-22 insurance in Pennsylvania

There is no SR-22 requirement in Pennsylvania, but that doesn’t mean there aren’t penalties for high-risk driving.

After a serious driving violation or a license suspension, the Department of Transportation (PennDOT) will let individual drivers know what the process is for reinstating their license.

The penalties vary by incident, but you may be required to sign up for a probationary or temporary license, install an ignition interlock system in your vehicle (basically a breathalyzer that’s connected to your car), take a driving safety class, pay fines, and more.

Your data security is our priority.

Frequently asked questions

Who needs SR-22 insurance in Pennsylvania?

There is no SR-22 requirement in Pennsylvania. In other states, high-risk drivers and people caught driving without car insurance might have to get an SR-22 to prove they’re covered.

Do you need car insurance in Pennsylvania?

Yes, you need to have car insurance in Pennsylvania. If you’re caught driving without insurance you’ll be fined and your license will be suspended.

Is SR-22 insurance the same as no-fault insurance?

No, SR-22 insurance and no-fault insurance aren’t the same thing. Although Pennsylvania doesn’t require SR-22 insurance, it does require no-fault insurance — also called personal injury protection or PIP.

No corrections since publication.

Author

Andrew Hurst is a former senior editor at Policygenius who has spent his entire career writing about life, disability, home, auto, and health insurance. His work has been featured in The New York Times, The Wall Street Journal, the Washington Post, Forbes, USA Today, NPR, Mic, Insurance Business Magazine, and Property Casualty 360.

Editor

Anna Swartz is a senior managing editor who specializes in home, auto, renters, and disability insurance at Policygenius. Previously, she was a senior staff writer at Mic and a writer at The Dodo. Her work has also appeared in Salon, HuffPost, MSN, AOL, and Heeb.

Questions about this page? Email us at editorial@policygenius.com.