Jersey City is a popular city because it provides a short commute to New York City but with (relatively) cheaper rent. But only 25% of Jersey City renters have renters insurance.^

But with policies as low as $5 a month in Jersey City, there’s no good reason to not have renters insurance. Here are the best companies and resources for renters in JC.

Best renters insurance companies in Jersey City

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | $10.50 | $10.50 |

Allstate* | N/A | N/A |

Travelers | N/A** | $15.00 |

Stillwater*** | $15.50 | N/A |

Lemonade | $5.00 | $5.00 |

*Quotes unavailable **$500 deductible not available ***Price based on $250 deductible. Other deductibles unavailable Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000.00 | $1,000 | $1,000 | $2,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance coverage is more than just protecting your personal property. Here’s a rundown of the basic components of a policy when you're comparing renters insurance rates.

Property coverage: Reimbursement for destroyed, damaged, lost or stolen property.

Liability coverage: Covers legal costs in the event that you’re sued if someone is injured in your home.

Loss of use: Covers temporary living expenses if your residence becomes uninhabitable.

Medical payments to others: Covers medical costs in the event that you’re sued if someone is injured in your home.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Jersey City?

Renters insurance is not legally required for renters in Jersey City. However, landlords can make it mandatory for signing a lease. Always be sure to check with a potential landlord so you don’t risk being in violation of your lease.

Even if a landlord doesn’t require renters insurance, it’s a good idea to have anyway because of the affordable protection it provides.

Reasons to buy renters insurance in Jersey City

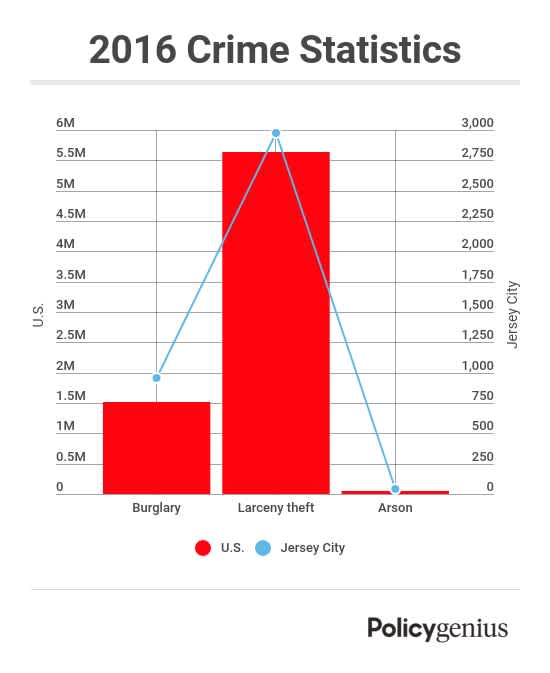

Only a quarter of renters in Jersey City have renters insurance, but many more should. Why? According to Jersey City Police Department information compiled by the FBI Crime Data Explorer, there were 953 burglaries reported in 2016 in Jersey City, along with 2,979 cases of larceny theft and 40 cases of arson.†

Plus, Jersey City isn’t exempt from Mother Nature. The city averages around 4 inches of rain nine months out of the year and over 26 inches of snow a year.‡ Renters insurance helps protect your possessions in the event of a leaky roof from excessive rain or snow, which can easily add up to thousands of dollars

Helpful resources

Jersey City tenants looking for more resources on renting, and their rights as renters, should visit the following:

The Average Cost of Renters Insurance: Find out what really determines your renters insurance price — and how that price calculated

Jersey City Tenant Resources: Information on rent control, tenant rights, and more in Jersey City.

Tenant Rights, Laws and Protections: New Jersey: Resources for tenant rights and legal assistance from the Department of Housing and Urban Development

^ Based on American Housing Survey compiled by Policygenius

† FBI CDE