Even though renters insurance is the best way to protect your personal belongings if they are damaged or stolen, only 51% of renters in Seattle have renters insurance according to data from the U.S. Census Bureau. Are you one of them?

If you’re a Seattleite renter who doesn’t have renters insurance, find out how easy and affordable it can be to get covered by the country’s top insurers today.

Best renters insurance companies in Seattle

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | $10.42 | $10.42 |

Allstate | $14.27 | $14.24 |

Travelers | $15.00 | $13.00 |

Stillwater | $12.92 | $12.92 |

Lemonade | N/A | N/A |

Note: Lemonade is not available in Seattle Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000.00 | $1,000 | $1,000 | $2,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance coverage is more than just protecting your personal property. Here’s a rundown of the basic components of a policy when you’re comparing renters insurance rates.

Property coverage: Reimbursement for destroyed, damaged, lost or stolen property.

Liability coverage: Covers legal costs in the event that you’re sued if someone is injured in your home.

Medical payments to others: Covers medical costs in the event that you’re sued if someone is injured in your home.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Seattle?

Renters insurance is not legally mandatory in Seattle. However, landlords can retire it as a condition of renting out a house or apartment. You should check with your potential landlord and get renters insurance quotes before you sign your lease to ensure a smooth process in becoming a tenant.

Reasons to buy renters insurance in Seattle

Seattle is known for its overcast weather. And while the Emerald City might not be gloomy, its reputation for rain isn’t unfounded. According to the NOAA, Seattle averages over 5 inches of rain three months out of the year (January, November, and December).† It also annually averages 150 rain days (days with at least 0.01 inches of precipitation). This can be a big deal when it comes to renters insurance: a leaky roof can damage a lot of your stuff — maybe even an entire room — and a good renters policy can ensure that you’re not left footing the entire bill.

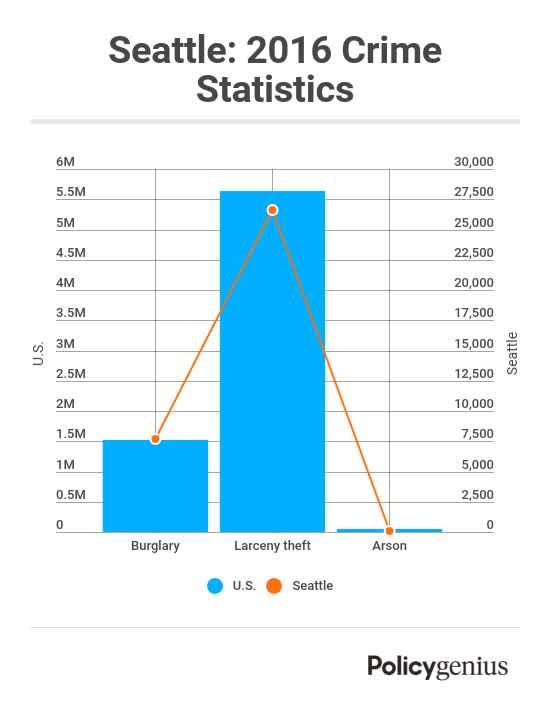

Renters insurance also protects against theft. In 2016 there were over 26,600 reported cases of larceny theft and over 7,600 reported cases of burglary.‡ Just like with damaged items, renters insurance helps with stolen items because once you pay the deductible, the insurance company will help pay to replace your items.

Plus, with the cost of renters insurance averaging under $13 a month in Seattle, there’s really no reason to not buy it. You can get $20,000 worth of property coverage for under $150 a year; that’s valuable (and affordable) peace of mind.

Helpful resources

The Average Cost of Renters Insurance : Find out what really determines your renters insurance price — and how that price calculated

Tenants Union: On a mission to “create housing justice through empowerment-based education, outreach, leadership development, organizing, and advocacy”

Dispute Resolution Center of King County: Helps mediate disputes between landlords and tenants

Know the Law - Housing: Renter and landlord responsibilities outlined by the Seattle Office of Housing

† NOAA

‡ FBI CDE